Galaxy Asset Management, the venture arm of Galaxy Digital, has announced the successful final close of its inaugural Galaxy Ventures Fund I (“GVF I”).

According to the official Press Release, the fund has received over $175 million in committed capital, surpassing its original $150 million target by more than 16 percent. The oversubscribed fund attracted a diverse roster of limited partners, including institutional investors, family offices, fund-of-funds, and strategic corporate investors though the specific names have not been disclosed.

With the funding, Galaxy Ventures Fund I aims to back around 30 startups over the next 18–24 months. This will also include follow-on reserves set aside to support portfolio companies through successive financing rounds.

The funding marks the first time Galaxy has brought in external investors for its venture activities, transitioning from a balance-sheet–only investment approach to a traditional limited-partner structure. This also comes as Mike Novogratz-led Galaxy Digital continues to be traded on the Nasdaq under the ticker GLXY since May 16, 2025.

What kind of startups will be supported by Galaxy’s GVF-I Fund

Galaxy’s GVF I is co-led by Will Nuelle and Mike Giampapa – serving as the General Partner at Galaxy Ventures. According to the official announcement, they both bring decades of combined expertise in early-stage investments related to institutional finance, blockchain protocol development, and on-chain market operations.

The fund’s investment trajectory will target early-stage startups building the foundational layers of the on-chain economy. It will span its investment strategy across “the categories of financialized applications, blockchain protocols, and software infrastructure.”

GVF I will also continue to allocate capital across three main verticals:

-

Stablecoin & Payments: Projects which are building next-generation payment rails and collateral frameworks.

-

DeFi Protocols: Supporting decentralized exchanges, lending platforms, and on-chain derivatives.

-

Infrastructure & Tools: Investing in developer tooling, cross-chain interoperability, and data analytics solutions that enable robust on-chain applications.

Interestingly, as the fund is backed by Galaxy’s broader platform, the fund will offer portfolio companies access to a global team of over 550 employees and deep industry relationships. In addition to capital, startups benefit from Galaxy’s in-house “Ventures Platform,” providing go-to-market assistance, compliance guidance, and technical expertise to accelerate product development and market entry.

Q2 2025 Fundraising Falls Short : Estimates

The investment in the Galaxy fund also comes as according to estimates, the about to be concluded Q2 2025 fails to keep pace with the Q1 2025 fundings. This is despite the burgeoning M&A and IPOs activities.

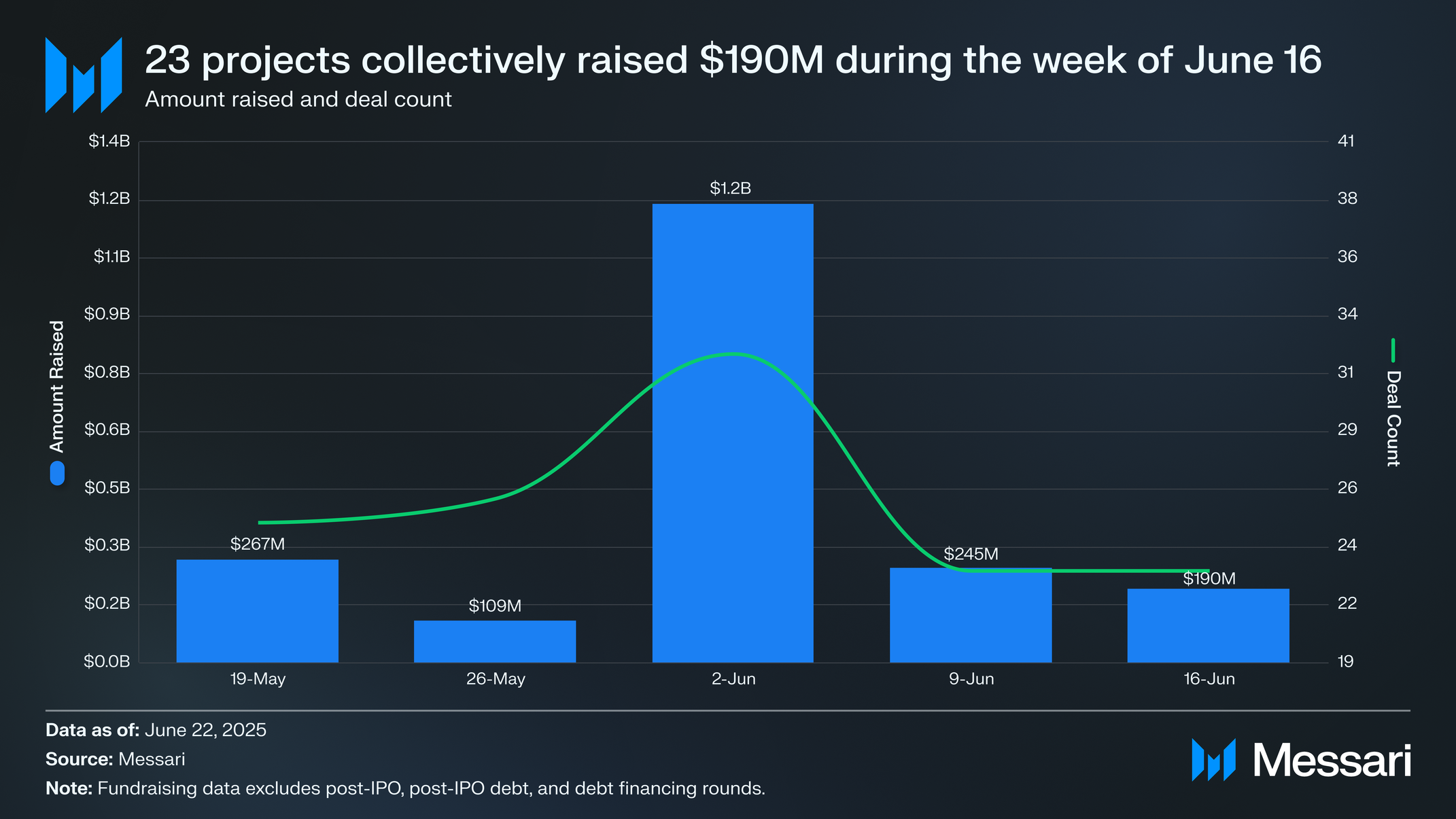

According to the data from Messari, in the week of June 16–22, 23 projects raised about $190 million, led by EigenLabs ($70 M) and PrismaX ($11 M). Further, earlier in Q2, during May 26–31, 25 projects secured $109 million, headlined by Conduit’s $36 million Series A.

Thus, this investment round closing hints at better Q3 2025 landscape for web3 startups. Since its preliminary close, Galaxy Ventures has already deployed approximately $50 million across several high-potential companies.

Notable investments include Monad, a blockchain designed for low-latency trading applications; Ethena, a yield-bearing stablecoin protocol among others.

Thus, as regulatory clarity improves and on-chain use cases evolve, GVF I is positioned to capitalize on the maturation of blockchain technology into mainstream financial and enterprise applications.

Also Read: Aptos Launches Cloud Storage Protocol Shelby

Why trust CoinGape: CoinGape has covered the cryptocurrency industry since 2017, aiming to provide informative insights to our readers. Our journalists and analysts bring years of experience in market analysis and blockchain technology to ensure factual accuracy and balanced reporting. By following our

Editorial Policy,

our writers verify every source, fact-check each story, rely on reputable sources, and attribute quotes

and media correctly. We also follow a rigorous

Review Methodology when evaluating exchanges and tools. From emerging blockchain projects and coin launches to industry events and technical developments, we cover all facets of the digital asset space with unwavering commitment to timely, relevant information.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Share