Strike:- In a move towards accelerating its tech end development, Stripe and Paradigm backed payments chain Tempo has added one of Ethereum’s most visible researchers to its roster.

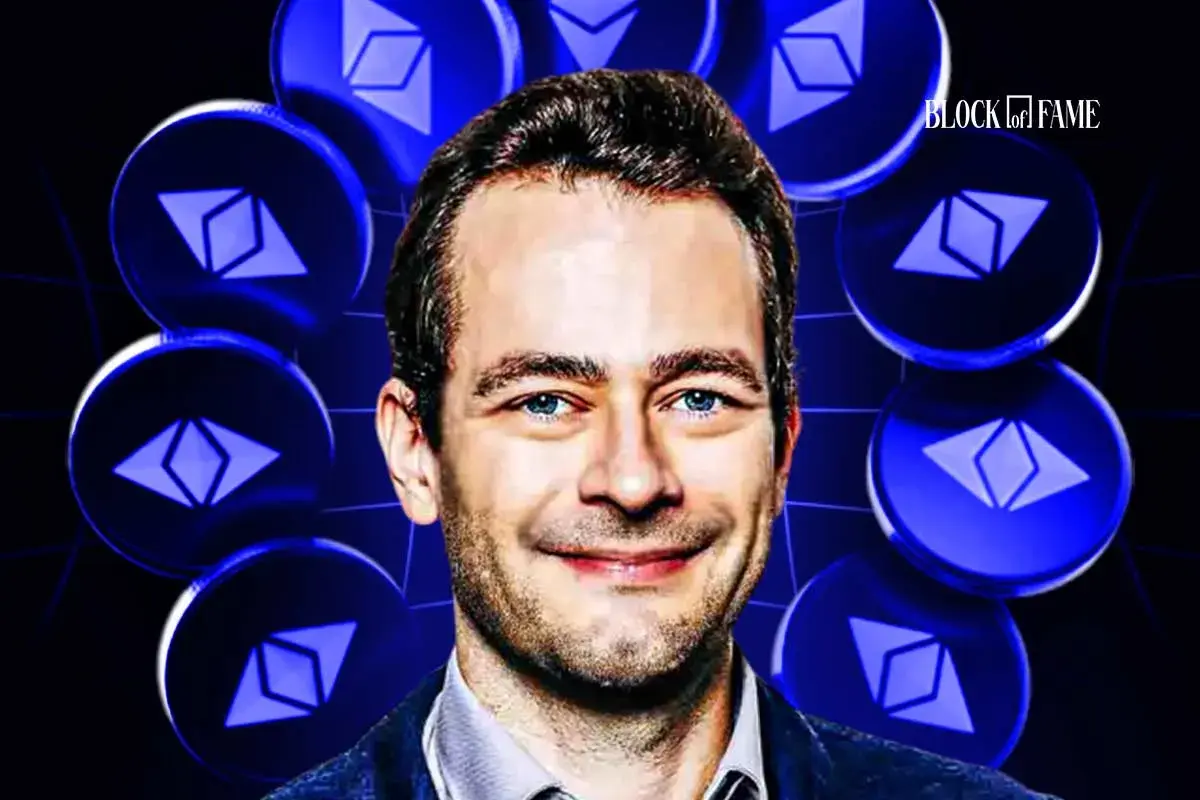

On Friday, Dankrad Feist, a longtime developer and researcher at the Ethereum Foundation, announced he will join the Tempo project while remaining an adviser to some Ethereum research efforts. The hire comes as Tempo Tempo raised $500 million in a Series A round led by Greenoaks and Thrive Capital, valuing the payments-focused network at $5 billion, according to Fortune report.

In a short announcement on X, Feist said he was “excited” to join Tempo and framed the move as a continuation of work to make high-scale, practical blockchains that preserve permissionless ideals. He also signalled he will keep a research advisory relationship with parts of the Ethereum ecosystem, including work on scaling features and UX improvements.

Also Read: After Solana Seeker, Ethereum Phone Launches

Ethereum Researcher Joins Tempo

Introduced by Strike founder Patrick Collison on September, Patrick describe the aim of developing Tempo clearly: make stablecoins and high-volume dollar rails fast, cheap and predictable for merchants and treasuries.

Ethereum Founder Vitalik Buterin after Feist’s Tempo joining news shared his work on scaling proposals. David Feist has most prominently worked on Danksharding and other pieces of the network’s long-term throughput roadmap. His research footprint and technical credibility make the appointment notable as Tempo, the permissionless-but-payments-first chain aims at reducing settlement friction for stablecoins and merchant flows.

Stripe-owned startup Bridge is also seeking a national bank trust charter to comply with the Genius Act. The company recently also compeleted adding its infrastructure partners as well – from MetaMask, Privy, Alchemy, Chaianalysis among others. Now, adding Feist is an explicit signal that Tempo wants deep protocol expertise to make it par with leading players like Solana and Ethereum.

Era of Stablecoin-focused Chains

As the faith in stablecoin-powered global payment mechanism grows, Tempo isn’t the only chain oriented around stablecoins and payments. Patrick and his chain Tempo is directly bidding in the space along with big issuers – with Circle working on Arc and Tether rapidly developing its Plasma and Stable chain projects.

Circle unveiled Arc 1 month before Stripe’s announcement of Tempo. It introduced the idea of Arc as an open Layer-1 engineered for stablecoin finance (USDC as native gas, dollar-denominated fees). Currently, it is running alliance/webinar outreach and testnet activity as it staffs up for production.

On the other hand, Tether’s Plasma has already pushed into mainnet beta in September 2025. It launched with an aggressive liquidity bootstrap – with more than $2 billion of stablecoin liquidity and a native token (XPL) at launch. In terms of product moves, it has also introduced Plasma One aimed at instant, near-zero-fee USDT transfers. The emphasis across the three stablecoin-focused chains remains same: making stablecoin transfers instant and with low fees.

Also Read: How big is the Indian Crypto Market?

Why trust CoinGape: CoinGape has covered the cryptocurrency industry since 2017, aiming to provide informative insights to our readers. Our journalists and analysts bring years of experience in market analysis and blockchain technology to ensure factual accuracy and balanced reporting. By following our

Editorial Policy,

our writers verify every source, fact-check each story, rely on reputable sources, and attribute quotes

and media correctly. We also follow a rigorous

Review Methodology when evaluating exchanges and tools. From emerging blockchain projects and coin launches to industry events and technical developments, we cover all facets of the digital asset space with unwavering commitment to timely, relevant information.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Share