Gemini Expands:- The leading Winklevoss Bros’ led crypto Exchange Gemini has announced its expansion in Europe.

In the latest update, Mark Jennings, Head of Europe, has announced that the exchange has received regulatory license approval from Malta. With this, the exchange will be offering its crypto derivatives products across the EU.

The Investment Firm license that Gemini has received is Markets in Financial Instruments Ditector or MiFID II license.

Interestingly, this comes only 24 hours after Coinbase acquired the derivates platform Deribit in $2.9 billion deal – implying the ongoing race in derivates segment.

Gemini Expands in Europe

With the license from the Malta Financial Services Authority (MFSA), Gemini will be offering its perpetual futures and other derivates products in EU.

According to the announcement, the derivates services will be available to both retail and institutional users in the EU.

MiFIDII license, received by Gemini, governs how investment firms and trading venues operate across the EU and EEA. Coming into force on January 3, 2018, it isn’t a single “license” but a comprehensive EU regulatory framework.

Accorrding to the Eurosif website, once a firm holds a MiFID II license in one member state, it can “passport” its services into other EU/EEA jurisdictions. After this license, the firm doesn’t requires separate local authorizations.

Race Heating Up in Derivates

This latest move by Gemini in the derivatives segment signifies that competition in the crypto derivatives space is heating up.

This year, Coinbase also secured its MiFID II license by acquiring the Cypto arm of BUX and rebranding it as Coinbase Financial Services Europe Ltd. It enabled the exchange to passport its services across the EEA. EEA region brings all EU member states plus three of the EFTA countries (Iceland, Liechtenstein, and Norway) into a single market.

The recent acquisition of Deribit comes as another boost for the crypto exchange in the derivates segment.

Kraken has likewise pursued a license via the acquisition of leading U.S. retail futures trading platform NinjaTrader. Others like Crypto.com have also entered the Contracts for Difference (CFDs) market via regional brokerage purchases.

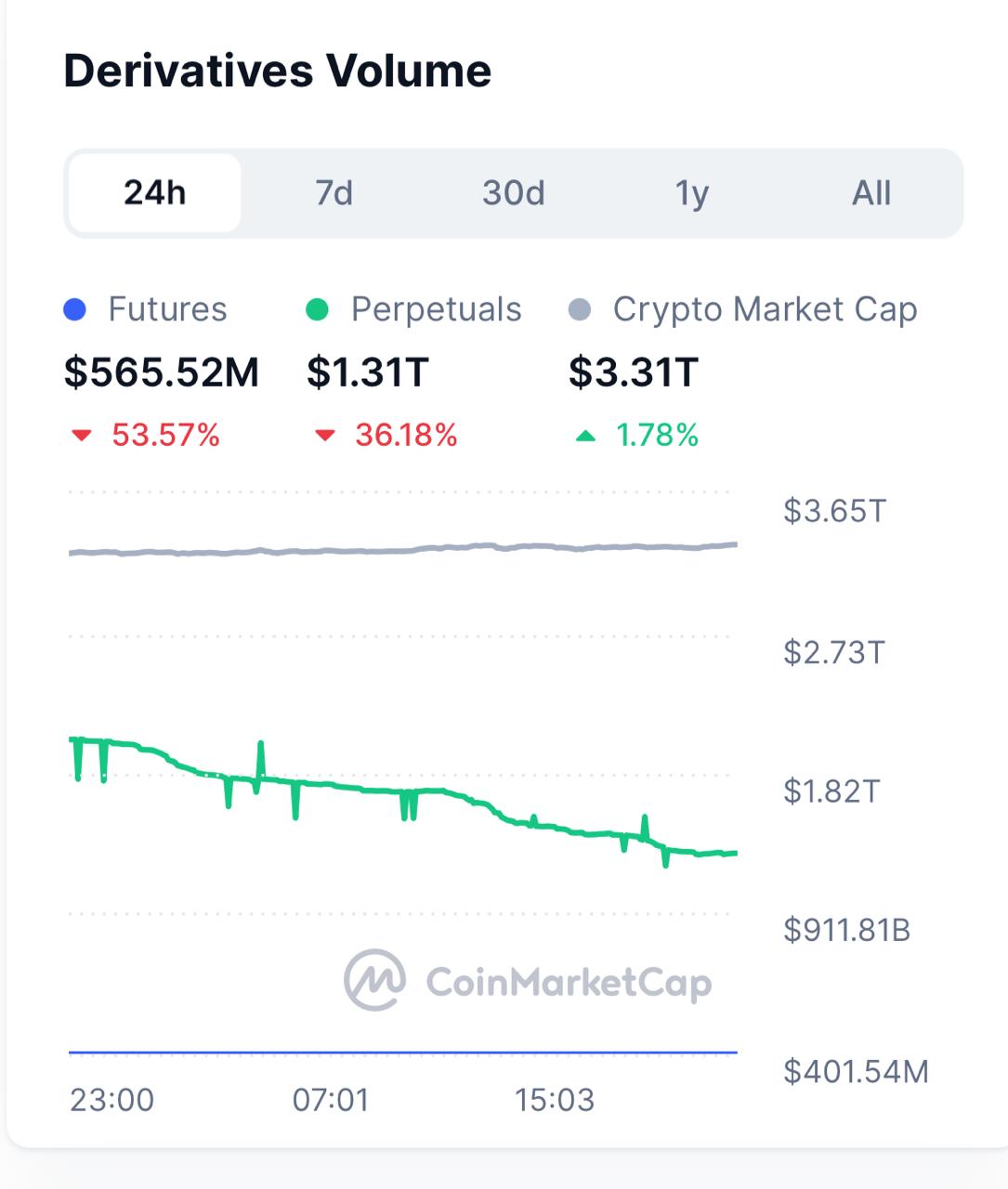

This comes as the trading volumes in crypto derivaties continue to gain. In the past 24 hours only, total trading volume across major derivatives venues have reached $240.2 billion. According to Coinglass Data, this is up by 4.16 % from the previous day.

From January 1 to March 31, cumulative derivatives volume totaled $21.0 trillion, with an average daily volume of $233 billion.

Also Read: Key Cardano Levels

Why trust CoinGape: CoinGape has covered the cryptocurrency industry since 2017, aiming to provide informative insights to our readers. Our journalists and analysts bring years of experience in market analysis and blockchain technology to ensure factual accuracy and balanced reporting. By following our

Editorial Policy,

our writers verify every source, fact-check each story, rely on reputable sources, and attribute quotes

and media correctly. We also follow a rigorous

Review Methodology when evaluating exchanges and tools. From emerging blockchain projects and coin launches to industry events and technical developments, we cover all facets of the digital asset space with unwavering commitment to timely, relevant information.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Share