Bybit Earn:- In a bold move to bridge the gap between centralized finance (CeFi) and decentralized finance (DeFi), Bybit, one of the leading cryptocurrency exchanges, has integrated Avalon Lab’s BTC lending protocol into its platform.

This strategic integration will allow Bybit Earn users to access high-yield Bitcoin lending. It will ensure an innovative approach of CeDeFi for users seeking to earn passive income in the crypto space.

Unlike traditional crypto lending platforms that usually offer variable interest rates based on market conditions, Avalon provides a fixed borrowing rate model — starting at 8% for Bitcoin.

Avalon Labs claims to be the first fixed-borrow rate lending model in crypto. Its institution lending layer launched on April 10 provides On-chain credit facility for BTC-holding institutions.

The CeFi-DeFi Bridge: A New Era in Crypto Lending?

This Bybit-Avalon integration aims to combine the best features of both worlds: the security and reliability of CeFi and the flexibility and high-yield opportunities presented by DeFi.

Bybit users via its lending product, Bybit Earn, can now leverage Avalon’s CeFi-to-DeFi bridge to lend Bitcoin at a fixed rate. This will be made possible by the protocol’s use of FBTC tokens. Avalon’s platform ensures that these loans are managed in a manner that maximizes returns while maintaining security.

By integrating Avalon’s lending protocol, Bybit aims to offer users a hybrid model — using Avalon’s CeFi features while tapping into the efficiency and yield-generation possibilities of DeFi.

Notably, BlockFi, Nexo, and others have offered fixed or semi-fixed interest rates, but they’re centralized custodians, not on-chain, and typically don’t blend DeFi strategies or offer full transparency.

Further, other DeFi platforms like Aave or Compound also offer variable rates. Some protocols like Notional and Yield Protocol do support fixed rates. But these are often complex for average users and don’t focus on institutional-grade simplicity or a BTC-focused model like Avalon.

What Does This Mean for Bybit Users?

Bybit’s partnership with Avalon brings several significant benefits to users of the platform.

First and foremost, the yield-generating opportunities for Bitcoin holders have increased dramatically. Bybit’s collaboration with Avalon allows users to earn a fixed 8% yield on Bitcoin by borrowing, which is facilitated by Avalon’s institutional-grade lending system.

Users can access the yield generation system directly through the Bybit Earn platform. This will simplify the process of earning passive income from Bitcoin holdings.

Additionally, this collaboration offers enhanced security and simplified access to high-yield strategies. It doesn’t require users to deeply engage with the complexities of DeFi protocols themselves.

The Role of FBTC Tokens

At the heart of this integration is the use of FBTC tokens, which play a crucial role in how the yield is generated.

These tokenized Bitcoin represent the value of Bitcoin in a form that can be utilized within Avalon’s DeFi ecosystem to generate higher returns.

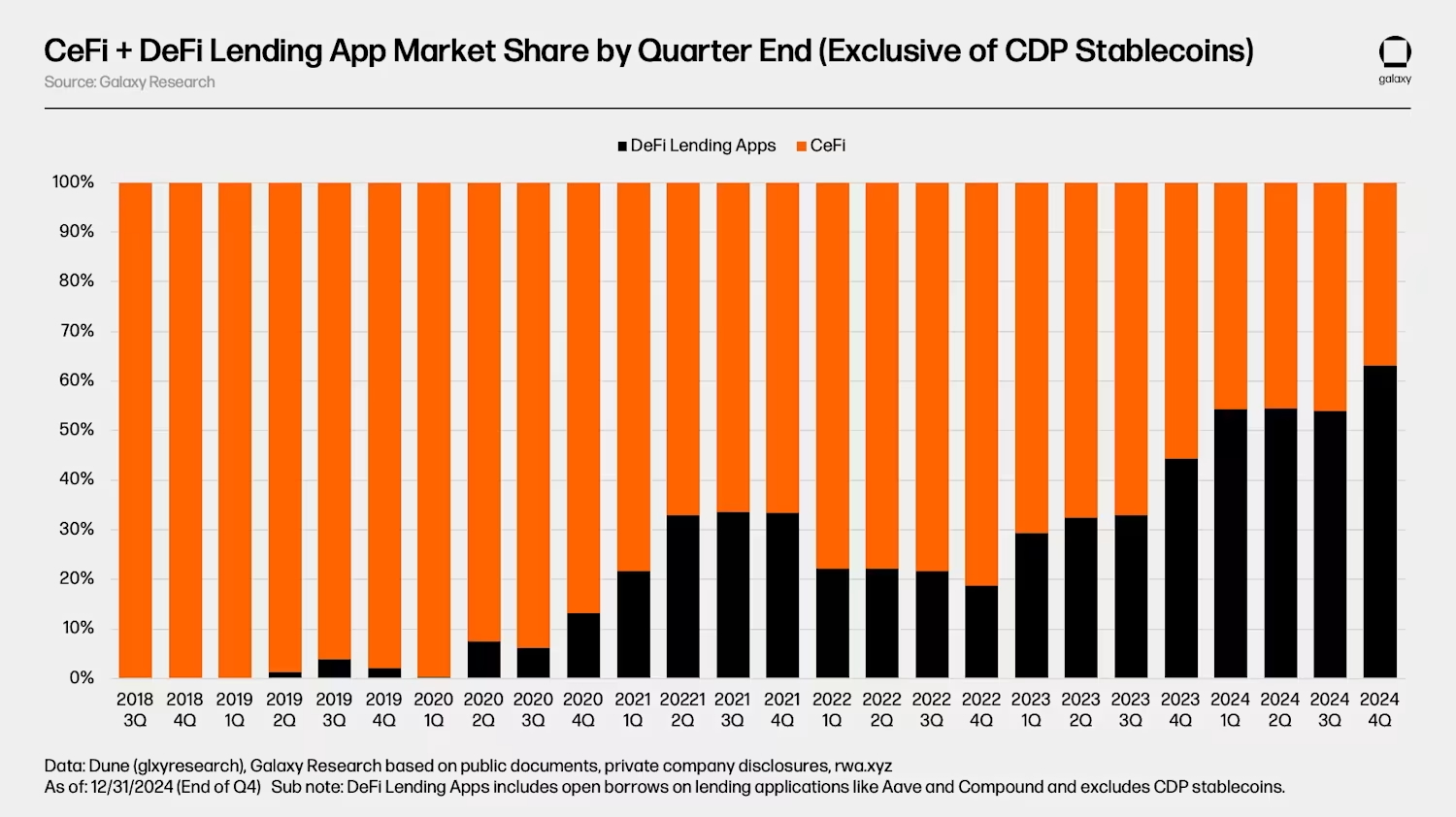

Further, there is also a boom in DeFi lending volume. According to the recently released Galaxy Data, at the end of Q4 2024, Defi’s share of total borrow volume at $11.2 billion has nearly doubled – from 34% to 63% since the bull cycle.

Moreover, this partnership highlights how centralized exchanges are beginning to embrace decentralized finance.

This is ultimately providing a comprehensive and integrated solution for users looking for high-yield opportunities, secure transactions, and the convenience of centralized services.

Will This Model Become the Future of Finance?

The integration of Avalon’s BTC lending protocol by Bybit raises a larger question: Are CeFi and DeFi truly bridging the gap in the world of cryptocurrency?

This partnership does highlights how centralized exchanges are beginning to embrace decentralized finance. Thus, can set the precedent for other players.

For now, Bybit users can enjoy the best of both worlds, with access to secure, yield-generating Bitcoin lending strategies.

Why trust CoinGape: CoinGape has covered the cryptocurrency industry since 2017, aiming to provide informative insights to our readers. Our journalists and analysts bring years of experience in market analysis and blockchain technology to ensure factual accuracy and balanced reporting. By following our

Editorial Policy,

our writers verify every source, fact-check each story, rely on reputable sources, and attribute quotes

and media correctly. We also follow a rigorous

Review Methodology when evaluating exchanges and tools. From emerging blockchain projects and coin launches to industry events and technical developments, we cover all facets of the digital asset space with unwavering commitment to timely, relevant information.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Share