HYPE Jumps 10% as Hyperliquid Treasury Firm Sonnet Secures Merger Approval

Highlights

- HYPE is up 10% amid Sonnet's announcement of the shareholders approval to proceed with the Hyperliquid DAT.

- Sonnet will merge with Rorschach I LLC to launch the HYPE treasury.

- The company which will trade as Hyperliquid Strategies plans to raise up to $1 billion to buy HYPE.

Hyperliquid has received a major boost following Sonnet’s shareholders’ approval of the merger to establish a HYPE treasury company. This could bring about significant buy pressure for the altcoin as the company has already filed to raise up to $1 billion for the treasury.

Hyperliquid Rises Around 10% Amid Sonnet’s HYPE Treasury Approval

CoinMarketCap data shows that the HYPE price is up almost 10% today, rallying above $33 from an intraday low of around $30. This comes amid Sonnet BioTherapeutics’ announcement of the approval of its merger to form a HYPE treasury.

The company announced in a press release that its stockholders have approved the proposed business combination with Hyperliquid Strategies and Rorschach I LLC. This comes two weeks after the company had to delay the vote because it failed to meet the quorum.

Following this approval, the company now has the go-ahead to merge with the other companies and establish the HYPE treasury. As CoinGape earlier reported, Hyperliquid Strategies has already filed with the SEC to raise up to $1 billion, which it intends to use to accumulate the altcoin.

What Are The Implications Of The Sonnet DAT For HYPE?

Crypto research platform OAK Research noted that the implications of the approval are significant. One is the fact that the company could initially purchase up to 2.6 million HYPE for the treasury. The research firm stated that at least $265 million will be used to buy the altcoin following the closing of the transaction.

OAK noted that Hyprliquid’s buybacks currently average around $2.5 million per day. As such, injecting $265 million of additional structured demand would represent a major shift in scale.

Moreover, it could fill the vacuum created by the $314 million HYPE unlock on November 29. The research firm noted that there is debate over whether Sonnet’s purchases would be over-the-counter, especially after the recent unlocks.

OAK stated that buying directly on the open market would mechanically increase the value of the tokens being committed to the Hyperliquid DAT. This would, in turn, improve the company’s ATM issuance capacity, although the research admitted that the incentives are not straightforward.

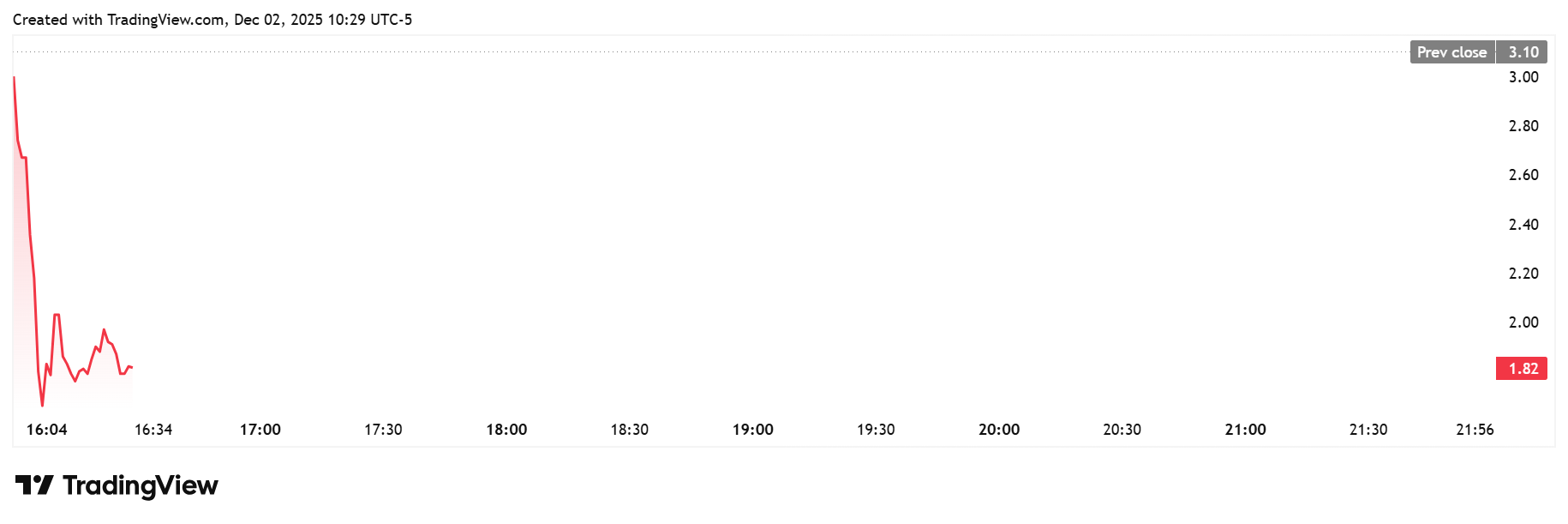

Meanwhile, the Sonnet stock is down over 42% after the announcement of the approval of the merger to create the Hyperliquid treasury firm. TradingView data shows that the stock is currently trading at around $1.84 after opening today’s trading session at around $3.

- Bitamp Wallet Review: User-friendly Web Wallet for Bitcoin Transactions

- Breaking: First U.S. Chainlink ETF Goes Live as Grayscale Launches ‘GLNK’

- Breaking: SEC Chair Reveals Innovation Exemption for Crypto Firms Could Start in January

- WhiteBIT Enters U.S. Market, Unveils High-Impact Times Square Campaign

- “Forget the 4-Year Cycle” Grayscale Says, Projects 2026 as Bitcoin’s Breakout Year

- XRP Price Slowly Forms a Rare Pattern as Ripple ETFs Near $1B Milestone

- Chainlink Price Eyes More Recovery After Grayscale’s Spot ETF Launch

- FUNToken Is Surging: Will FUN Price Recapture Early 2025 Growth?

- Ethereum Price Prediction: ETF Outflows Hit $79M as Institutional Accumulation Surges

- Pump Coin Price Jumps 10% as Whale Accumulates $23.5M; What’s Next?

- XRP Price Prediction as Ripple Gets MAS Licence in Singapore