BlackRock, Fidelity, And Spot Bitcoin ETF Applicants Meeting US SEC: Bloomberg Analysts

BlackRock, Fidelity Investments, and other spot Bitcoin ETF filers and the U.S. Securities and Exchange Commission (SEC) will hold a meeting next week. The move comes after all spot ETF applicants have refiled their applications with the U.S. SEC, mentioning their surveillance-sharing partners and other required details.

Spot Bitcoin ETF Applicants to Meet US SEC Next Week

Bloomberg ETF analysts Eric Balchunas and James Seyffart tweeted spot Bitcoin ETF applicants and the U.S. SEC meeting next week, according to their reliable source. Balchunas believes they should meet and definitely need to talk about the possibilities of spot Bitcoin ETF and amendments required to rules.

“Just to be clear, we can’t 100% confirm this is true! Just trying to share things we find interesting or useful in all this from legit sources.”

The US SEC staff routinely meets with ETF applicants after an official filing to decide on approval or denial and clarify their stance over it. However, meeting to approve spot Bitcoin is crucial for the crypto industry as the SEC under Chair Gary Gensler continues to deny a spot Bitcoin ETF while approving other similar ETFs.

After a flurry of Bitcoin ETF filings last month, the US SEC approved the first leveraged Bitcoin futures ETF — Volatility Shares 2x Bitcoin Strategy ETF.

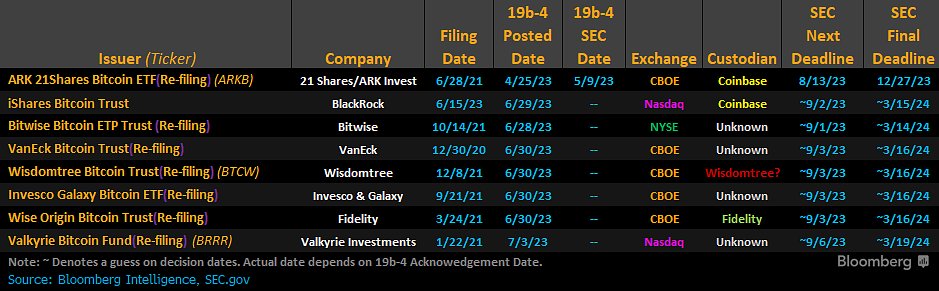

Meanwhile, BlackRock, Fidelity Digital Assets, Invesco, Valkyrie, WisdomTree, and others have refiled their spot Bitcoin ETF after details on their surveillance-sharing agreements.

Also Read: Massive 5292 Bitcoin (BTC) Linked To Terra Founder Do Kwon And LFG On The Move

BlackRock CEO Larry Fink Praises Bitcoin as Digital Gold

BlackRock CEO Larry Fink on Wednesday said their ETF filing is a “way to democratize crypto and make it cheaper.” He asserts Bitcoin is an international asset and new gold. BlackRock hopes to work with regulators to approve its first spot Bitcoin ETF application.

Bloomberg analysts agreed that Bitcoin ETF would make it cheaper, which will cost 0.01% to trade on all major crypto exchanges. Compare that to any crypto exchange and you can see the potential here.

Also Read: Binance CEO “CZ” On Bull Market, US SEC Lawsuit, BNB Chain, & Others

- Are XRP and Midnight Ahead in Tokenization? Cardano’s Hoskinson Sparks Debate Amid Canton Push

- Breaking: U.S.-China Tensions Heat Up as China Imposes New Sanctions; Bitcoin Falls

- BlackRock Hints at a Big Sell-Off As $27B In Crypto Options Expire

- Aave DAO vs Labs: Aave Founder Pledges Clearer Economic Alignment as DAO Rejects Brand Asset Transfer

- Universal Exchange Bitget Partners UNICEF to Equip Youths to Thrive in the Digital Economy

- Cardano Price Eyes a 40% Surge as Key DeFi Metrics Soar After Midnight Token Launch

- FUNToken Price Surges After MEXC Lists $FUN/USDC Pair

- Bitcoin Price on Edge as $24B Options Expire on Boxing Day — Is $80K About to Crack?

- Crypto Market Rebounds: Are Bulls Positioning for a Santa Rally?

- XRP, Bitcoin, Ethereum Price Predictions Ahead of Jan 2026 CLARITY Act and US Crypto Reserve Plans

- Pi Network Analysis: Pi Coin Price Surges on Christmas Eve, Can It Hit Year-End Highs?

Claim $500

Claim $500