On-Chain Analysis: Dipping Stablecoin Supply Ratio (SSR) Signals a New Bullish Rally For Bitcoin (BTC)

Bitcoin has remarkably bulged above its consolidation range and is on track for new price discovery. Since the first-ever digital currency dropped from its earlier attained all-time high of around $61,683.86, market trends have been remarkably unfavorable, creating a barrier for the coin from crossing above the $60,000 psychological level.

Less Bitcoin Sellers In the Market

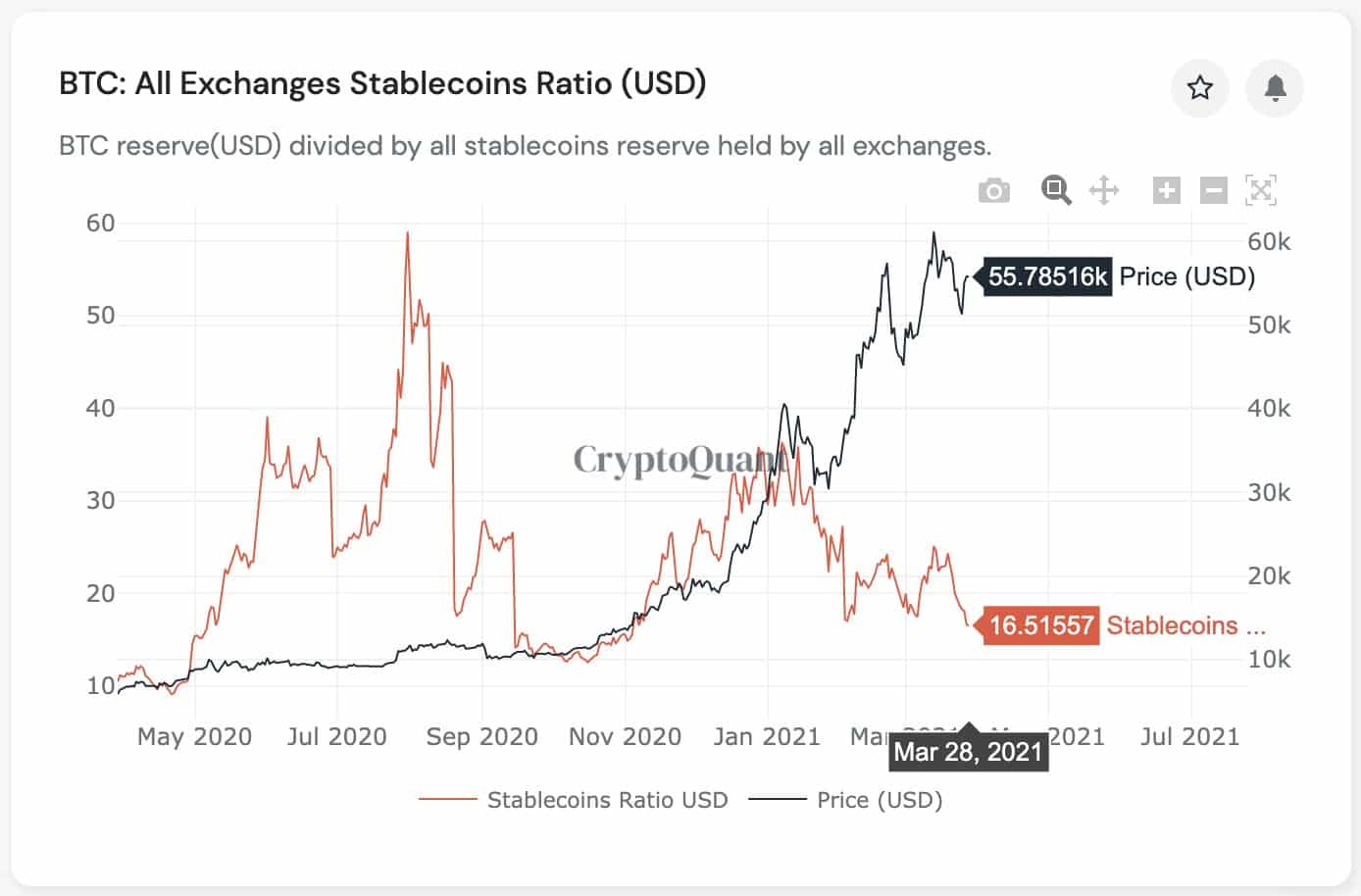

There is the likelihood of a twist in the market as on-chain metrics indicate a bullish Stablecoin Supply Ratio (SSR). The SSR is the metric that is used to showcase the selling trends featuring the influence of stablecoins in relation to Bitcoin. It is obtained by dividing the total BTC reserve on exchanges by the total stablecoin reserves.

As data provider CryptoQuant noted, the total stablecoin reserve on trading platforms is high owing to the increasing supply of USDC. At this time, the SSR is low, depicting a reduced intention to sell Bitcoins and take profits amid the on-going bull run.

The occurrence of a low SSR is highly noteworthy in the market and barring any unforeseen change in fundamentals, a bull run is imminent. Prior to the beginning of the ongoing price rise in the market, a low SSR was observed back in November according to technical analysis provider, Seer.

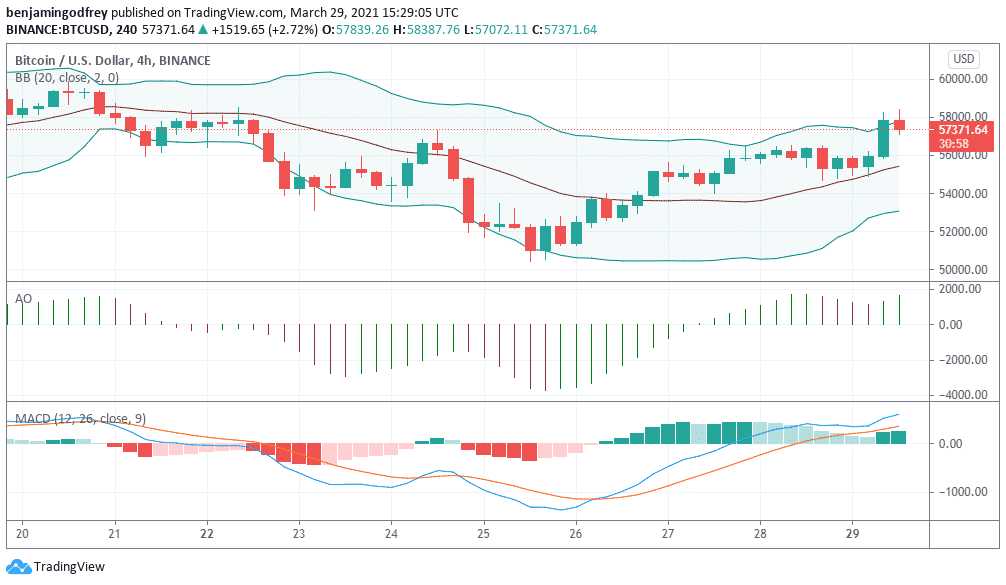

BTCUSD Price Analysis: 4 hr Chart

The on-chain metric is significantly impacting the current price of Bitcoin which is trading at $58,158.60, a 3.90% growth in the past 24 hours according to CoinMarketCap. As seen on the BTC-USD 4-hour chart on TradingView, the MACD indicator is well above the signal line reaffirming the ongoing bullish momentum. Additionally, the Awesome Oscillator and the price run of the coin around the upper Bollinger Band are indicative of intense bull action in the market.

While a healthy correction may be introduced as the bears are appearing concentrated at the tip as shown on the chart, it may signal room for the buyers to gather momentum and ultimately push the price above the $60,000 resistance, a move that may usher in a new ATH.

A recent Glassnode data also revealed the number of retail holders with at least 0.1 BTC is rising. Together with the influence of the market whales and institutional investors, an imminent price breakout in the near to long-term is inevitable.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- How Will Crypto Market Move amid Bitcoin, ETH, XRP Options Expiry and US PCE Inflation Data Today?

- CLARITY Act Not Expected to Pass Before April, Says Senate Leader John Thune

- TRUMP Coin Jumps as Team Announces Conference With President Trump as Keynote Speaker

- Breaking: Trump Calls For Emergency Fed Rate Cut Before Next Week’s FOMC Meeting

- Breaking: U.S. Senate Passes Bipartisan Housing Bill That Includes CBDC Ban

- What Happens to XRP Price If US Wins War Against Iran?

- COIN Stock Prediction as Crypto Crash Odds Jump as Expert Sees Inflation Hitting 3.4%

- Cardano Price Turns Bullish as ADA Futures OI Hits $416M Ahead Of Key Upgrades

- Dogecoin Price Outlook If Elon Musk’s X Money Integrates Crypto- Is $0.2 Possible This Week?

- Will XRP Price Rally After Ripple’s Strategic Acquisition in Australia?

- Bitcoin Price At Risk of Losing $65k as Iran Warns of “Continuous Strikes” That May Push Oil to $200