Here’s Why XRP Price May Crash Below $2 Despite Today’s 4% Gains

Highlights

- XRP price has recorded a 4% intraday gains amid bullish sentiment caused by the adoption of XRP Ledger by Japan's Web3 Salon.

- Despite recent gains, XRP risks crashing below $2 to $1.70 amid a bearish technical outlook.

- The extreme long positioning by traders opening long positions increases the risk of a bearish reversal.

As of June 9, the XRP price is up 4% and trades at $2.26, in tune with the broader crypto market rebound. This uptick can be attributed to Bitcoin (BTC) reclaiming the $107,000 level. Although the short-term outlook is bullish, it is contingent on BTC sustaining its recent bounce. Failure to do so could cause altcoins to decline, including XRP, which faces concerns about a potential crash below $2 due to its inability to produce a decisive close above a critical resistance level. Technical indicators also forecast a similar outlook for this token, with analysts predicting a potential dip before the token triggers an uptrend.

Here’s Why an XRP Price Crash Below $2 is Imminent?

XRP price’s 4% intraday gains stem from the adoption of XRP Ledger by Web3 Salon. This ephemeral gain was cut short at the 50-day SMA level of $2.27, which the altcoin has been attempting to breach since late May. This rejection highlights that the short-term sentiment remains weak and buyers are taking early profits by selling whenever the price approaches this resistance.

A similar rejection appears in the RSI indicator, as it fails to make a decisive close above the 50 mean level. This also indicates that investors are stepping in to book early profits and preventing a decisive close above the 50-day SMA despite a looming update in the Ripple vs. SEC case.

Additionally, XRP price trades within a descending triangle pattern, which forecasts a bearish breakout. If Ripple’s XRP loses support at the lower trendline of $2.12, it could lead to a decline to $1.79.

BitGet analyst Ryan Lee agrees with this correction in XRP. Lee told CoinGape in a personal note that XRP price risks crashing to $1.70 in the short term.

“XRP, benefiting from regulatory clarity and institutional interest, shows bullish stability around $2 but risks a dip to $1.70 short-term; its long-term growth depends on legal outcomes, with prices likely ranging between $1.70-$3.69, averaging $2.50 by June 2025.”

Meanwhile, the recent formation of an XRP death cross has also spooked traders, and with the bearish momentum growing strong, buyers may remain hesitant, making it more likely that the price falls below $2.

Heavy Long Positioning May be Bearish

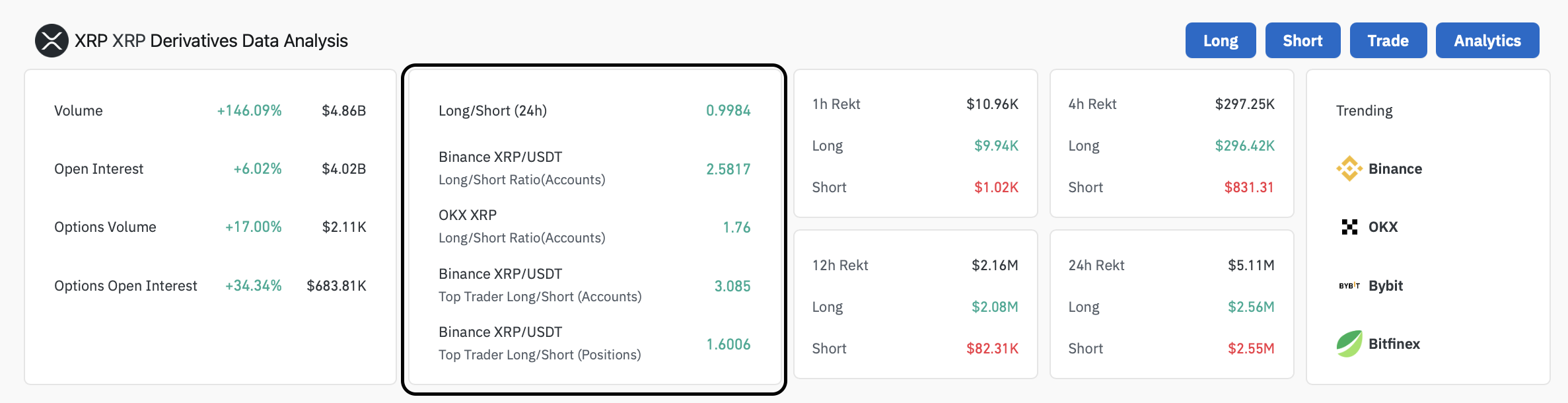

Data from Coinglass shows that many traders are opening long positions on XRP, and this could have a bearish effect in the long term. On Binance, the long/short ratio stands at 2.45, wherein 72% of derivative traders are betting that the price will record gains.

On OKX, there are 3 long positions for every one short position. At the same time, the top trader long/short positioning stands at 1.59, which also leans towards a bullish bias.

This outlook may end up causing an XRP price decline below $2 to the next support level around $1.70. This is because, as long positions face liquidations, traders may sell, and the cascade of long liquidations in case of an unexpected price decline may accelerate the downward trend.

To sum up, XRP price is still facing bearish pressure despite recording a slight 2% gain today. A market expert notes that Ripple faces the risk of a price decline to $1.70, and this bearish sentiment is strengthened by the extreme long positioning that increases the possibility of a long squeeze.

Frequently Asked Questions (FAQs)

1. Can XRP price crash below $2?

2. What is the key resistance level for XRP?

3. What does the long/short ratio show about XRP price?

- What’s Behind Ethereum’s Drop: Macro, TVL, DeFi & Liquidity Zones

- Bitcoin ETFs Record Biggest Daily Outflow Since August as OG Whales Cash Out

- CZ Trump Pardon: Binance Founder Denies Any Trump Family Ties

- Odds for December Rate Cut Soar to 71% After Michigan Consumer Sentiment Hits 2nd-Lowest in History

- Breaking: James Chanos Exits MSTR Short After Premium Drop

- After a 17% Jump, Is Litecoin Price Rebound Sustainable Amid Dominant Sell Activity?

- Cardano Price Soars 10% Amid Retail Accumulation: Will Bulls Target $1?

- Bitcoin Price: How Low BTC Could Fall by the End of 2025?

- Post-Giveaway Supply Shock: Impact on FUNToken’s Liquidity and Market Depth

- Aster Price Poised to Hit $2 as Coinbase Adds ASTER to Listing Roadmap

- Filecoin Price Rockets 51% as Grayscale’s FIL Holdings Hit Record High — What’s Next for FIL?

MEXC

MEXC