MicroStrategy Stock Declines Despite 5,262 Bitcoin Purchase

Highlights

- MicroStrategy has acquired more Bitcoin for the seventh consecutive week.

- The software company now holds 444,262 BTC.

- This recent purchase comes amid MSTR's Nasdaq listing, which is set to take place today.

American business intelligence and software firm MicroStrategy has witnessed a stock declined despite another Bitcoin purchase, the company’s seventh in as many weeks. This recent purchase brings the company’s total holdings to 444,262 BTC, and it comes amid its Nasdaq-100 listing today.

Michael Saylor’s Company Acquires Another 5,262 BTC

In a press release, MicroStrategy announced that it acquired 5,262 BTC for $516 million at an average price of $106,662 per bitcoin and has achieved a BTC yield of 47.4% quarter-to-date (QTD) and 73.7% year-to-date (YTD).

The company now holds 444,262 BTC, which it acquired for $27.7 billion at an average price of $62,257 per bitcoin. This purchase marks the company’s seventh in as many weeks.

Last week, MicroStrategy announced that it acquired 15,350 BTC for $1.5 billion. The software company continues to increase its Bitcoin holdings despite the flagship crypto’s tepid price action.

Meanwhile, this recent purchase comes amid the company’s Nasdaq-100 listing, which is set to take place today. This achievement has been partly thanks to the company’s Bitcoin exposure, which has worked out greatly so far.

The company currently boasts an unrealized profit of around $15 billion on its Bitcoin investment. Meanwhile, the MicroStrategy stock has been one of the best-performing assets for a while now.

The MicroStrategy stock is up over 470% YTD, outperforming Bitcoin and other major stocks, including the ‘Magnificent 7’. It is worth mentioning that MSTR has outperformed all these assets since 2020, when Michael Saylor and his company adopted the ‘Bitcoin Strategy.’

MicroStrategy Stock Declines

In an unusual manner, the MicroStrategy stock failed to react positively to news of MicroStrategy’s recent purchase. Nasdaq data shows that the stock is down over 4% and currently trading at around $347.

Meanwhile, the Bitcoin price remains tepid as it continues to range between $94,000 and $96,000. This has led to concerns that the bull run may be over.

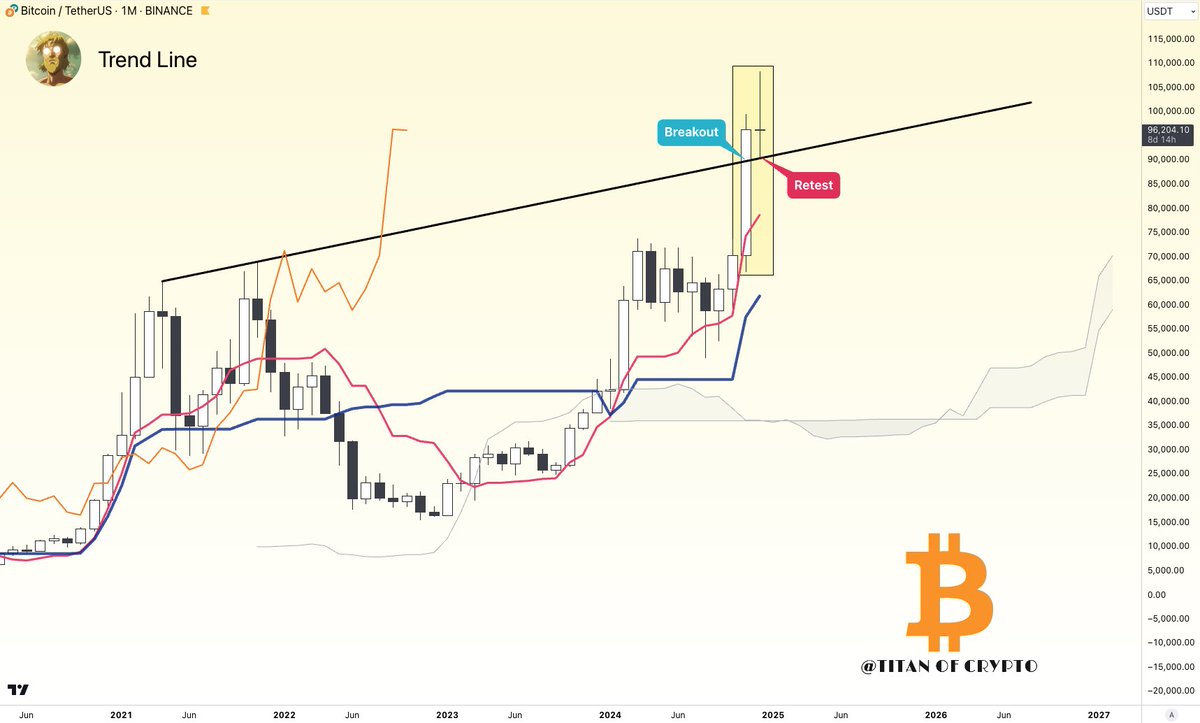

However, crypto analysts have suggested that the flagship crypto is still in bullish territory. Crypto analyst Titan of Crypto stated that there is no reason to worry as long as BTC stays above the trend line between $85,000 and $90,000.

The analyst added that the monthly candle may not look bullish now, but there is still one week before it closes.

It is worth mentioning that the Bitcoin price action greatly affects MicroStrategy’s structure due to their BTC exposure. CryptoQuant CEO Ki Young Ju recently revealed that the software company’s Bitcoin Strategy could lead to bankruptcy if BTC drops below $16,500.

- Bitcoin Sentiment Weakens BTC ETFs Lose $103M- Is A Crash Imminent?

- Trump Backed Rick Rieder Now Leads the Odds for New Fed Chair

- Trump Threatens 100% Canada Tariffs as Bitcoin Holds $89K

- Is a Bitcoin Bull Run Possible in 2026? Here’s Why Arthur Hayes Thinks Yes

- Trump’s World Liberty Bank Charter Advances as OCC Rejects Senator Warren Criticism

- PEPE vs PENGUIN: Can Pengu Price Outperform Pepe Coin in 2026?

- Binance Coin Price Outlook As Grayscale Files S-1 for BNB

- Solana Price Prediction as SOL ETF Inflows Outpace BTC and ETH Together

- Bitcoin and Gold Outlook 2026: Warsh, Rieder Gain Traction in Trump’s Fed Pick

- PEPE Coin Price Eyes 45% Rebound as Buyers Regain Control on Spot Markets

- Pi Network Price Prediction: Will PI Coin Hold Steady at $0.18 Retrace Lower?