Starknet has unveiled a bold plan to bridge Bitcoin and Ethereum. Here’s How.

Many of you likely entered the Web3 world through your exposure to Bitcoin. Well that’s understandable since it remains the largest cryptocurrency by market cap, currently standing at approximately $1.6 trillion, followed closely by Ethereum.

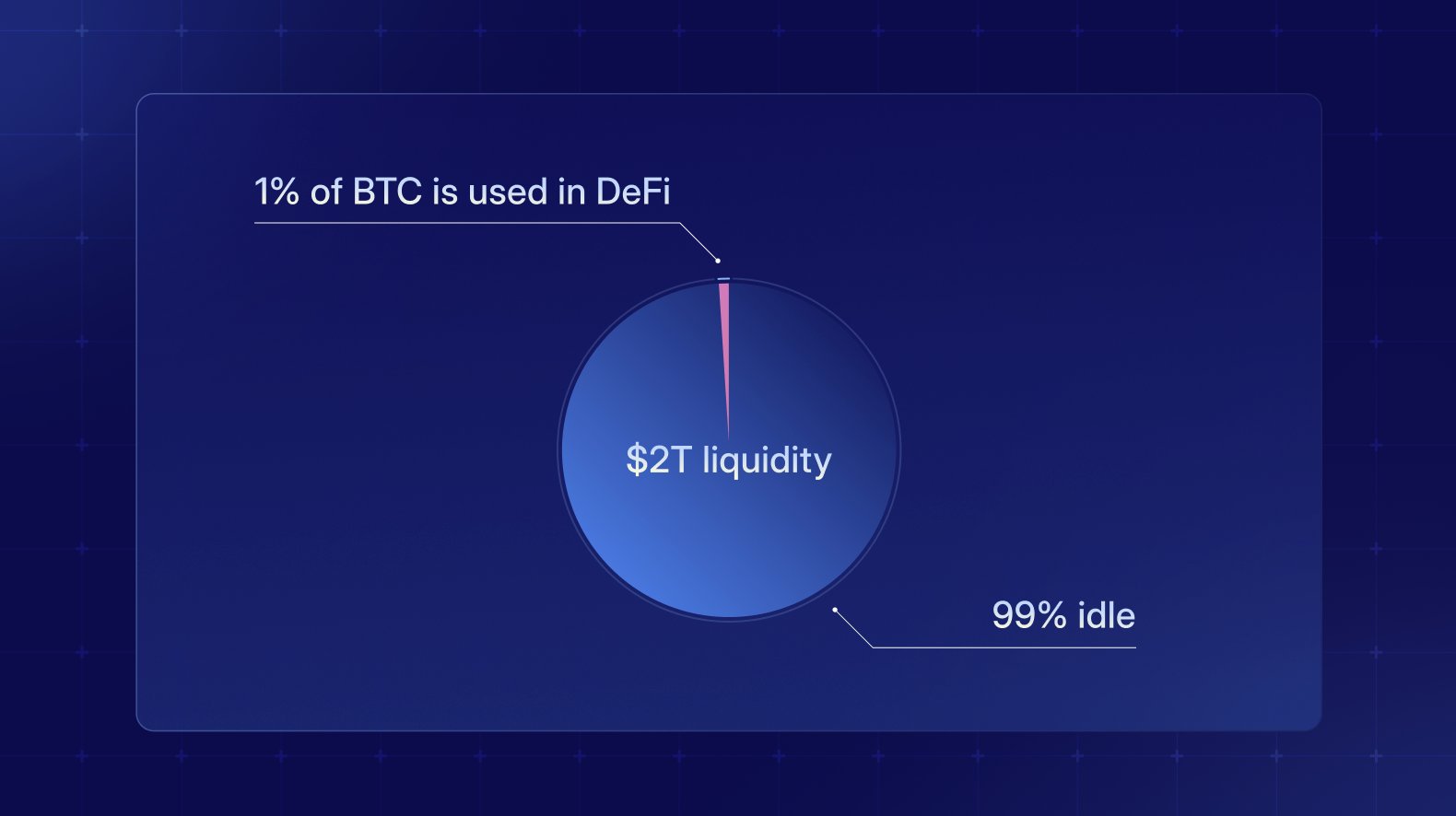

However, what if I told you that only about 1% of Bitcoin’s circulating supply is actively utilized in Web3 applications, including DeFi and other innovative initiatives, while the vast majority of BTC remains largely unused within traditional wallets and exchanges?

Historically, Bitcoin and Ethereum have operated in largely separate domains: Bitcoin as a store of value and Ethereum as the foundation for decentralized applications (dApps).

Starknet announces Bold Vision

In a groundbreaking move to bridge this gap, Starknet, a leading Layer-2 scaling solution for Ethereum, has unveiled an ambitious plan to integrate Bitcoin and Ethereum, enhancing scalability, interoperability, and liquidity across both networks.

As a Zero-Knowledge Rollup (ZK-Rollup) that enhances Ethereum’s scalability by processing transactions off-chain before settling them on the Ethereum mainnet, it is planning to expand its reach by utilizing Bitcoin’s network for added security and decentralization.

Notably, in a similar step aimed at bringing Bitcoin into DeFi, Bitlayer too recently announced partnerships with prominent blockchains, viz., Base, Arbitrum, Plume, Base, SonicSVM and Starknet itself, in order to scale BTC by its BitVM.

The first L2 to settle on both Bitcoin and Ethereum

In a March 11 X post, it has revealed that Bitcoin’s scope lies more than beyong existing application of HODLing.

Though Bitcoin has been restricted in its application due to limited programmability, Starknet (STRK) is aiming to allow developers to build a variety of DeFi apps on Bitcoin though it’s smart contracts functionality. In order to achieve that, it is aiming to advance from its current throughput of 13 transactions per secon, to thousands of transactions in order to be able to scale Bitcoin.

Currently it is targeting applications such as staking, borrowing and lending, leveraged trading, and yield farming, making them natively possible on Bitcoin.

The integration will be facilitated through a Bitcoin reserve mechanism, allowing Bitcoin to be used as a settlement layer while maintaining Starknet’s existing functionalities on Ethereum. This hybrid approach will enable Bitcoin-backed transactions on Ethereum’s DeFi ecosystem while leveraging Starknet’s advanced cryptographic technologies.

Notably, following the announcement, in a March 11 X space discussing Starknet’s plan, Ethereum co-founder Vitalik Buterin too backed the idea saying a proper Bitcoin L2 that can satisfy the needed security properties would “make crypto payments great again, and all those use cases can work.

To Continue Supporting OP_CAT Research

Hilighting its earlier connection with Bitcoin with Professor Eli Ben-Sasson, CEO and Co-Founder of StarkWare, pioneering the idea of using ZK proofs to scale Bitcoin, it is also pushing for OP_CAT update. It is a proposed Bitcoin update that would allow users to set spending conditions for BTC and enable zero-knowledge proofs, which are cryptographic techniques for verifying transactions without revealing personal data.

OP_CAT, a Satoshi-era opcode for unlocking programmability on Bitcoin that was disabled over security concerns, can allow Starknet to settle on the Bitcoin blockchain. It will till then take support from the BitVM-powered bridge, calling it “the most secure Bitcoin bridge possible today:.

Xverse Partnership and BTC Reserve

A key component of this initiative is Starknet’s partnership with Xverse, a prominent Bitcoin wallet provider.

Through this collaboration, Bitcoin holders will be able to interact with Ethereum’s DeFi ecosystem seamlessly. The partnership has also introduced a BTC Reserve that will act as collateral for cross-chain transactions, ensuring liquidity and security for users engaging in decentralized finance.

Implications for the Crypto Industry

The integration of Starknet with Bitcoin and Ethereum is expected to have far-reaching implications for the cryptocurrency market. Some key benefits include:

- Bitcoin’s robust security model combined with Ethereum’s smart contract functionality will create a more scalable blockchain infrastructure.

- The BTC Reserve and cross-chain functionality will enable greater liquidity flow between Bitcoin and Ethereum-based assets.

- Bitcoin holders will gain access to DeFi applications on Ethereum, increasing Bitcoin’s utility beyond being a store of value.

- Notably, the use of its roll-up technology will reduce fees associated with cross-chain transactions.

Challenges and Future Outlook

While the announcement has been met with optimism, there are challenges ahead. Ensuring security in cross-chain transactions remains a priority, as bridging solutions have been a target for exploits in the past. Additionally, regulatory considerations surrounding Bitcoin’s integration into DeFi could pose hurdles.

Despite these challenges, Starknet’s initiative represents a bold step toward a more interconnected blockchain ecosystem. The move is expected to attract developers, institutions, and investors eager to explore the potential of a unified Bitcoin-Ethereum framework. If successful, this initiative could redefine the way Bitcoin and Ethereum interact, setting a precedent for future blockchain collaborations.

Why trust CoinGape: CoinGape has covered the cryptocurrency industry since 2017, aiming to provide informative insights to our readers. Our journalists and analysts bring years of experience in market analysis and blockchain technology to ensure factual accuracy and balanced reporting. By following our

Editorial Policy,

our writers verify every source, fact-check each story, rely on reputable sources, and attribute quotes

and media correctly. We also follow a rigorous

Review Methodology when evaluating exchanges and tools. From emerging blockchain projects and coin launches to industry events and technical developments, we cover all facets of the digital asset space with unwavering commitment to timely, relevant information.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Share