Bitcoin (BTC) Price Reaches $60k; Max Keiser Predicts Next Target $77,000

After a brief period of consolidation, Bitcoin price today finally breached its previous all time high of $58, 350 and moved past $60,000 mark. Bitcoin analyst Max Keiser has predicted next short target as $77,000. Analysts are contributing this rise in price to large negative bitcoin price premium difference at coinbase & binance suggesting large spot buys for bitcoin.

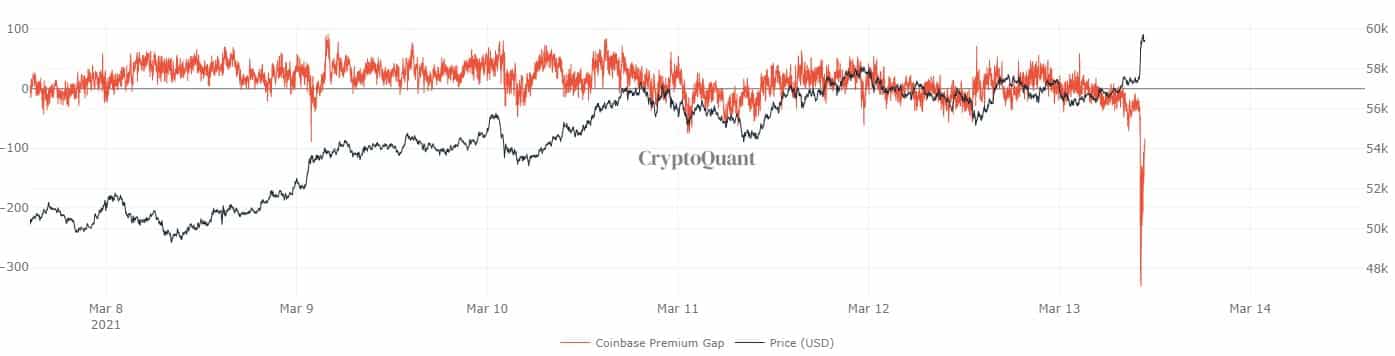

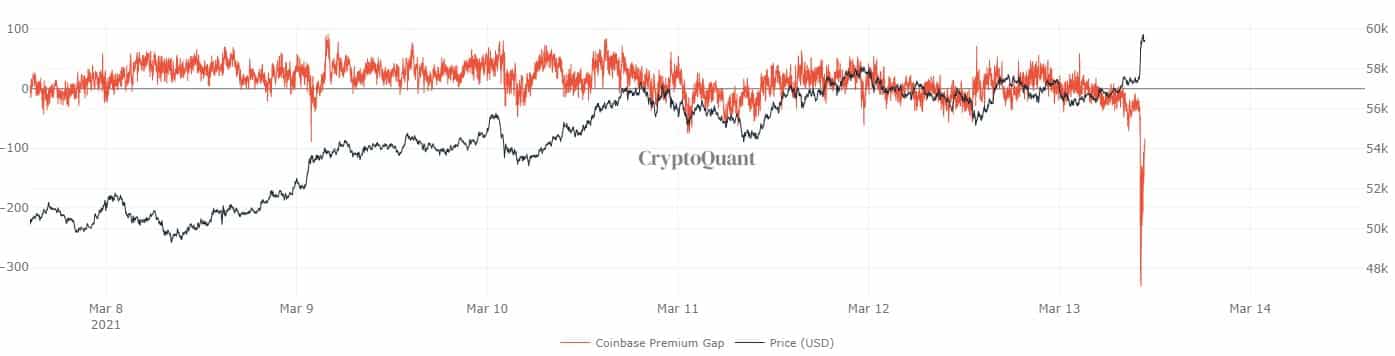

Coinbase Pro (USD pair) and Binance premium gap at -$332

Coinbase premium as reported by coingape has served as one of the indicators for quantifying price movement. It is worth noting that this move up past $60,000 by Bitcoin seems to be fueled by large Bitcoin spot buying at Binance. As per the data shared by CryptoQuant, the bitcoin price premium difference between Coinbase Pro and Binance for USD pairs reached as low as -$332 which is one among the lowest so far.

This means that price was probably driven by huge spot buys at Binance. Apart from this stablecoin inflows to exchanges is continuously up suggesting bulls are still buying.

As predicted by famous Bitcoin analyst Max Keiser, next short term target for Bitcoin price is $77,000 while the long term target of $220,000 is still in play by the end of 2021.

Before the thought police try to ban us join our Telegram group ???? https://t.co/qxhe5CUQf3

$77,000 short term in play

$220,000 in 2021 in play pic.twitter.com/zSrBXyGt7k— Max Keiser (@maxkeiser) March 13, 2021

As for Altcoin market, prominent cryptocurrencies like Ethereum & LTC as also showing great recovery and approaching their previous ATHs. The previous all time highs for Ethereum is $2042 and at the time of reporting is trading at $1893 while previous all time high for LTC was $247 and is currently trading at $225.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- JPMorgan Projects Bullish Crypto Market in H2 Following CLARITY Act Approval

- Hong Kong Moves Closer to Crypto Tax Cuts Amid Stablecoin Regulatory Framework

- Popular Analyst Willy Woo Predicts Major Bitcoin Price Crash, Bear Market Bottom Timeline

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs