Citi Group and Ruffer Predict Breakout Point for Bitcoin Mainstream Adoption

Ruffer, the British asset manager, and Citi Group, the investment banking giant in separate predictions said that Bitcoin and cryptocurrencies are inching closer towards mainstream adoption. The prediction comes at a time when Bitcoin price seems to be stuck under $50,000 ever since breaking past its new all-time-high above $58,000 a couple of weeks back.

Ruffer has a total of $28.6 billion in total assets under its management and recently also revealed that it has invested 3% of its asset in Bitcoin and also holds indirect exposure through its position in MicroStrategy. The firm in its half-yearly financial report lauded Bitcoin as the next-gen institutional investment asset and said,

“We think we are relatively early to this, at the foothills of a long trend of institutional adoption and financialisation of bitcoin,”

The firm added

“Bitcoin brings something significantly different to the portfolio.Due to zero interest rates the investment world is desperate for new safe-havens and uncorrelated assets,”

CITI Group Says Bitcoin Can Become Primary Choice of Currency For International Trade

CITI Group released its research note on Monday as well, in this note CITI Group cited Bitcoin’s growing adoption and believe it is at the starting point of mainstream adoption and its primary use could grow in the field of international trade. The investment banking giant in its research note said,

“Bitcoin is at the start of massive transformation of cryptocurrency into the mainstream,” and it could increasingly become “the currency of choice for international trade.”

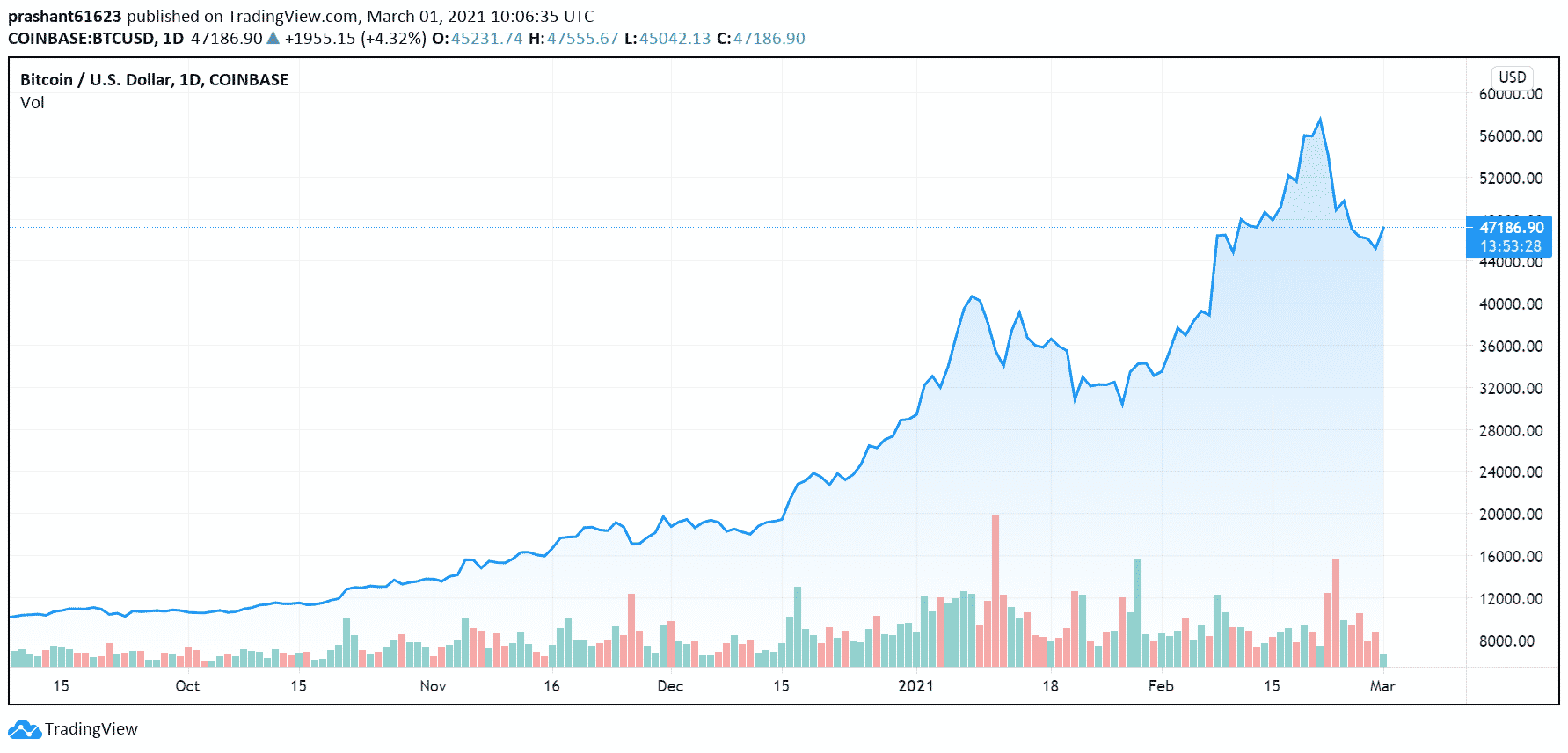

Bitcoin price has more than doubled since the start of the year, however, the price movements have changed significantly in 2021, where the top cryptocurrency has risen in the first week of every new month creating a new all-time high, followed by a sharp correction and weeks of consolidation before another price rise.

After covering the losses of the previous month in the first week of February, Bitcoin rose to a new ATH and corrected 20% in the following week followed by another week of consolidation to rising above $50,000. The highly bullish events such as MicroStrategy’s another Billion Dollar Bitcoin purchase and the US Government’s approval of the $1.9 Trillion Stimulus bill also couldn’t help Bitcoin price to stay above $50K. The start of the new month and continuous institutional buying along with other on-chain metrics suggest Bitcoin could start its next leg of the bull run.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin & Gold Bounce as Trump Admin Brokers US-Venezuela 1000 Kg Gold Deal

- SEC Advances Major Crypto Securities Plan to White House for Approval

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs