enigma nordic

|

Finance

|

M&A |

$

32M |

Dec 20, 2025 |

Hilbert Group

|

kodiak finance (KDK )

|

DEX

|

Series A |

$

2.9M |

Dec 18, 2025 |

Smape Capital

Ryan Fang

6+

Cypher Capital

Hack VC

Aquanow

Amber Group

CitizenX

Rubik Ventures

|

fuseenergy

|

Blockchain Service

|

Series B |

$

70M |

Dec 18, 2025 |

Balderton Capital

Lowercarbon Capital

|

dawn

|

DePIN

|

Series B |

$

13M |

Dec 18, 2025 |

Archetype

Polychain Capital

|

harbor 2

|

DEX

|

Seed Round |

$

4.2M |

Dec 17, 2025 |

Karatage

Figment Capital

6+

Triton Capital

Hermeneutic Investments

Selini Capital

Kronos Research

Auros Global

Susquehanna International Group (SIG)

|

eth gas

|

Infrastructure

|

Seed Round |

$

12M |

Dec 17, 2025 |

Stake Capital

Polychain Capital

7+

Tokka Labs

Node.Capital

Keyrock

BTCS

Amber Group

BlueYard

Susquehanna International Group (SIG)

|

deepbook ai

|

Blockchain Service

|

Funding Round |

$

2M |

Dec 17, 2025 |

BlockPulse

Alpha Capital

2+

Castrum Capital

BD Venture

|

redotpay

|

Blockchain Service

|

Series B |

$

107M |

Dec 16, 2025 |

HongShan (ex-Sequoia China)

Goodwater

3+

Circle Ventures

Blockchain Capital

Pantera Capital

|

moto card

|

Blockchain Service

|

Pre-seed |

$

1.8M |

Dec 16, 2025 |

Garrett Harper

Malisha

10+

Stepan Simkin

Reid MacInnes Cuming

Dirichlet

cyber Fund

WhiskyTitan

Chuk

Anna Yuan

Alexander Kehaya

Nom

Eterna Capital

|

strata

|

DeFi

|

Seed Round |

$

3M |

Dec 16, 2025 |

Split Capital

Nayt Technologies

5+

Faction

Heartcore Capital

Maven 11 Capital

Halo Capital

Anchorage Digital

|

worm wtf

|

Predictions

|

Pre-seed |

$

4.5M |

Dec 16, 2025 |

Nadav Hollander

Luca Netz

8+

Mert Mumtaz

Advancit Capital

Anatoly Yakovenko

Anil Lulla

Alliance

6MV (6th Man Ventures)

Borderless Capital

Solana Ventures

|

olea

|

Finance

|

Series A |

$

30M |

Dec 16, 2025 |

XDC Foundation

SC Ventures

2+

theDOCK

BBVA

|

speed

|

Blockchain Service

|

Strategic Round |

$

8M |

Dec 16, 2025 |

Tether

Ego Death Capital

|

holmesai

|

AI Agents

|

Strategic Round |

$

5M |

Dec 15, 2025 |

Cryptomeria Capital

IBG Capital

3+

GenerativeVentures

Bitrise Capital

CatcherVC

|

metya (MY)

|

Social

|

Strategic Round |

$

50M |

Dec 15, 2025 |

M2M capital

Vertex Labs

3+

Century United Holdings Group

Alpha Capital

Castrum Capital

|

yieldprotocol

|

Lending Platform

|

Extended Series A Round |

$

10M |

Dec 14, 2025 |

Scribble Ventures

Coinbase Ventures

2+

Launchpad Capital

Foundation Capital

|

testmachine

|

Blockchain Service

|

Funding Round |

$

6.5M |

Dec 11, 2025 |

Santiago Roel Santos

Baboon VC

8+

Auros Global

Contango Digital Assets

Blockchange Ventures

Delphi Ventures

Decasonic

UDHC

New Form Capital

GenerativeVentures

|

li fi

|

Infrastructure

|

Extended Series A Round |

$

29M |

Dec 11, 2025 |

Multicoin Capital

CoinFund

|

surf ai

|

Blockchain Service

|

Funding Round |

$

15M |

Dec 10, 2025 |

Digital Currency Group (DCG)

Pantera Capital

1+

Coinbase Ventures

|

goblin finance

|

Infrastructure

|

Strategic Round |

$

1M |

Dec 10, 2025 |

Hyperion

Gate Ventures

4+

OKX Ventures

Avery Ching

BlockBooster

Aptos

|

tenx protocols

|

Infrastructure

|

Funding Round |

$

22M |

Dec 10, 2025 |

HIVE Digital Technologies

Chorus One

3+

Borderless Capital

BONK Contributors

Defi technologies

|

ezeebit

|

Finance

|

Seed Round |

$

2.05M |

Dec 10, 2025 |

David de Picciotto

The Raba Partnership

5+

Chris Harmse

Anton Katz

Terry Angelos

Founder Collective

Nadir Khamissa

|

pheasant network

|

Infrastructure

|

Seed Round |

$

2M |

Dec 10, 2025 |

90s

mint

|

real finance

|

Blockchain

|

Funding Round |

$

29M |

Dec 09, 2025 |

Nimbus Capital

Frekaz Group

1+

Magnus Capital

|

metacomp

|

Blockchain Service

|

pre-Series A |

$

22M |

Dec 09, 2025 |

Sky9

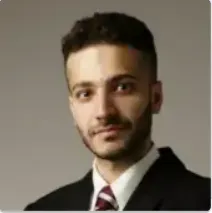

Noah

3+

Freshwave

Eastern Bell Capital

Beingboom Capital

|

cascade

|

CEX

|

Funding Round |

$

15M |

Dec 09, 2025 |

Archetype

Coinbase Ventures

2+

Polychain Capital

Variant

|

allscale

|

Finance

|

Seed Round |

$

5M |

Dec 08, 2025 |

V3V Ventures

Deep Mind

8+

Summer Sun Capital

INP Capital

Informed Ventures

GenerativeVentures

Carry Investment

Astera Ventures

Aptos

YZi Labs (prev Binance Labs)

|

magma finance (MAGMA)

|

DEX

|

Strategic Round |

$

6M |

Dec 08, 2025 |

Topspin Ventures

NAVI Protocol

4+

Puzzle Ventures

SNZ Holding

SevenX Ventures

HashKey Capital

|

crown 2

|

Finance

|

Series A |

$

13.5M |

Dec 08, 2025 |

Paradigm

|

frex

|

Blockchain Service

|

Pre-seed |

$

1.05M |

Dec 08, 2025 |

Zeropearl VC

White Venture Capital

4+

Kunal Shah

Raghav Chandra

Varun Khaitan

Abhiraj Singh Bhal

|

pye finance

|

DeFi

|

Seed Round |

$

5M |

Dec 08, 2025 |

Coinbase Ventures

Solana Labs

3+

Gemini Frontier Fund

Variant

Nascent

|

deepnode ai (DEEP)

|

Infrastructure

|

Strategic Round |

$

3M |

Dec 05, 2025 |

Blockchain Founders Fund

IOBC Capital

4+

Nestoris

TB Ventures (TBV)

FOMO Ventures

Side Door Ventures

|

layerbank

|

DeFi

|

Pre-seed |

$

2.3M |

Dec 05, 2025 |

CoinBureau

Taiko

4+

Rootstock

Torab

Future Trends

DV Chain

|

gondor

|

DeFi

|

Pre-seed |

$

2.5M |

Dec 05, 2025 |

Castle Island Ventures

Prelude

1+

Maven 11 Capital

|

asgard finance 2

|

DEX

|

Seed Round |

$

2.2M |

Dec 05, 2025 |

0xSoju

Anna Yuan

21+

Colosseum

Anatoly Yakovenko

Arihant

Andrea Fortugno

Eugene Chen

Uri Klarman

Nicolas Pennie

Thomas

Dirichlet

Joel John

Robert Chen

Dead King Society

Primal Capital

mtndao

wetmode wavey

Robot Ventures

Solana Ventures

Geoff Renaud

Nom

macbrennan

Presto Labs

|

coinmena

|

CEX

|

M&A |

$

240M |

Dec 05, 2025 |

Paribu

|

haiku

|

DEX

|

Pre-seed |

$

1M |

Dec 04, 2025 |

Frostlight

Auros Global

3+

Ahmed Al-Balaghi

Big Brain Holdings

Daedalus

|

truenorth

|

Artificial Intelligence (AI)

|

Pre-seed |

$

3M |

Dec 04, 2025 |

SNZ Holding

cyber Fund

3+

GSR Markets (GSR)

Ocular VC

Delphi Digital (Delphi Labs)

|

portal to bitcoin (PTB)

|

Infrastructure

|

Funding Round |

$

25M |

Dec 04, 2025 |

JTSA Global

|

canton network (CC)

|

Blockchain

|

Strategic Round |

$

50M |

Dec 04, 2025 |

S&P Global

iCapital

2+

BNY Global

Nasdaq

|

fin

|

Blockchain Service

|

Series A |

$

17M |

Dec 03, 2025 |

Samsung NEXT

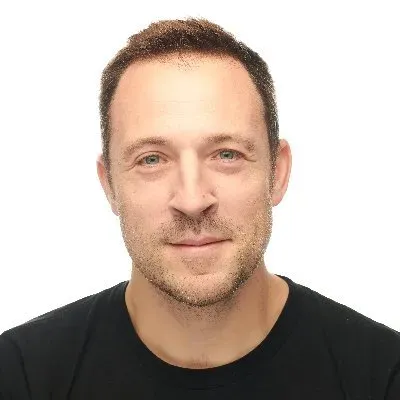

sheraz

10+

Amelia

Pantera Capital

Idobn

Richard Wu

Sequoia Capital

ilmoi

Jarry Xiao

Mert Mumtaz

Zach Abrams

Josh Fried

|

axis

|

DeFi

|

Strategic Round |

$

5M |

Dec 03, 2025 |

Marc Zeller

Caladan (Alphalab)

8+

CMS Holdings

CMT Digital

KuCoin Ventures

Maven 11 Capital

Gate Ventures

FalconX

GSR Markets (GSR)

Galaxy

|

pathpulse ai

|

Blockchain Service

|

Pre-seed |

$

900K |

Dec 03, 2025 |

Sensei Capital

Aptos

6+

Brinc

Baselayer Capital

CoinGecko Ventures

Decubate

PRIM3 Capital

Metalabs Ventures

|

ostium labs

|

DeFi

|

Series A |

$

20M |

Dec 03, 2025 |

General Catalyst

Jump Trading

3+

Coinbase Ventures

GSR Markets (GSR)

Wintermute

|

bitstack

|

Finance

|

Series A |

$

15M |

Dec 02, 2025 |

Stillmark

Plug and Play

4+

Serena

13bookscapital (prev. Element Ventures)

Y Combinator

AG2R LA MONDIALE

|

altura 2

|

Yield Aggregator

|

Seed Round |

$

4M |

Dec 01, 2025 |

InnoFinCon

Moonfare

1+

Ascension

|

zoo finance

|

DeFi

|

Strategic Round |

$

8M |

Dec 01, 2025 |

Bitrise Capital

Certik

4+

CGV FoF (Cryptogram Venture)

Signum Capital

The Open Platform

Cryptomeria Capital

|

nexton 2

|

DeFi

|

Strategic Round |

$

4M |

Nov 28, 2025 |

Danal Pay

Kaia

5+

Metalabs Ventures

TON Foundation

Amber Group

STON.fi

VistaLabs

|

gonka

|

Infrastructure

|

Strategic Round |

$

12M |

Nov 28, 2025 |

Bitfury Group (Bitfury Capital)

|

abrakadabra games

|

Gaming

|

Post-IPO |

$

500K |

Nov 27, 2025 |

MiA Teknoloji

|