renegade ico

|

|

Seed Round |

$

3.4M |

Feb 01, 2023 |

Dragonfly Capital

Balaji Srinivasan

4+

Lily Liu

Tarun Chitra

Naval Ravikant

Marc Bhargava

|

huma finance (HUMA)

|

DeFi

|

Seed Round |

$

8.3M |

Feb 01, 2023 |

Robot Ventures

Circle Ventures

4+

Folius Ventures

ParaFi Capital

Distributed Global

Race Capital

|

sentio ico

|

|

Seed Round |

$

6.4M |

Feb 01, 2023 |

HashKey Capital

Canonical Crypto

3+

Lightspeed Venture Partners

GSR Ventures

Essence VC

|

towns (TOWNS)

|

Social

|

Series A |

$

25.5M |

Feb 01, 2023 |

Framework Ventures

Benchmark

1+

Andreessen Horowitz (a16z)

|

polybase ico

|

|

Pre-seed Round |

$

2M |

Feb 01, 2023 |

Protocol Labs

Alumni Ventures

5+

6MV (6th Man Ventures)

CMT Digital

Upfront Ventures

Orange DAO

NGC Ventures

|

digift ico

|

|

Pre-Series A Round |

$

10.5M |

Feb 01, 2023 |

XIN Fund Management

HashKey Capital

3+

Shanda Group

North Beta Capital

Hash Global

|

dimensionals ico

|

|

Funding Round |

$

15M |

Feb 01, 2023 |

Standard Crypto

Boost VC

2+

Collab+Currency

Konvoy Ventures

|

eigenlayer (EIGEN)

|

Liquid Staking Protocols

|

Series A Round |

$

50M |

Feb 01, 2023 |

Finality Capital Partners

Hack VC

4+

Electric Capital

Blockchain Capital

Coinbase Ventures

Polychain Capital

|

kaito (KAITO)

|

Artificial Intelligence (AI)

|

Seed Round |

$

5.3M |

Feb 01, 2023 |

Dragonfly Capital

Mirana Ventures

8+

Smrti Lab

Folius Ventures

Sequoia Capital

Caladan (Alphalab)

DWeb3 Capital

TIME RESEARCH

Taurus Ventures

Jane Street Capital

|

port3 network (PORT3)

|

DePIN

|

Seed Round |

$

3M |

Feb 01, 2023 |

Jump Crypto

SNZ Holding

5+

ViaBTC Capital

KuCoin

Cogitent Ventures

Cryptonite Capital

Momentum 6

|

ether fi (ETHFI)

|

Liquid Staking Protocols

|

Funding Round |

$

5.3M |

Feb 01, 2023 |

Purpose Investments

Arrington Capital

5+

Chapter One Ventures

Maelstrom

North Island Ventures

Node Capital

Version One Ventures

|

sesame labs ico

|

|

Seed Round |

$

4.5M |

Feb 01, 2023 |

Script Capital

South Park Commons

10+

Wing VC

Moonfire Ventures

Balaji Srinivasan

Double Jump Capital

Ryan Spoon

Patron

Forte

Twin Ventures

Robin Chan

Samsung Ventures

|

fin

|

Blockchain Service

|

Seed Round |

$

6M |

Feb 01, 2023 |

Solana Ventures

Asymmetric

8+

Big Brain Holdings

Circle Ventures

Sarah Guo

Paxos

Vinny Lingham

Sequoia Capital

Multicoin Capital

Liu Jiang

|

chaos labs ico

|

|

Seed Round |

$

20M |

Feb 01, 2023 |

Jump Crypto

PayPal Ventures

26+

THETA

P2 Ventures

Primitive Ventures

General Catalyst

HashKey Capital

Itay Malinger

Lyrik Ventures

OpenSea Ventures

Folius Ventures

Third Prime

Santiago Roel Santos

Lightspeed Venture Partners

Blockdaemon

Castle Island Ventures

Alliance

Balaji Srinivasan

Avalanche Foundation

Coinbase Ventures

Naval Ravikant

Samsung NEXT

Paul Veradittakit

Quiet Capital

Uniswap

Tioga Capital

Wintermute

Galaxy

|

azra games

|

Gaming

|

Seed Plus Round |

$

10M |

Feb 01, 2023 |

Franklin Templeton

Coinbase Ventures

3+

Andreessen Horowitz (a16z)

Play Ventures

NFX

|

mangrove ico

|

|

Series A Round |

$

7.4M |

Feb 01, 2023 |

gumi Cryptos Capital

Cumberland

2+

CMT Digital

Greenfield Capital

|

strider ico

|

|

Seed Round |

$

5.5M |

Feb 01, 2023 |

Sfermion

Makers Fund

3+

Shima Capital

Magic Eden

Fabric Ventures

|

paprmeme ico

|

|

Funding Round |

$

3M |

Feb 01, 2023 |

Coinbase Ventures

|

hypergpt (HGPT)

|

Artificial Intelligence (AI)

|

Private Round B |

$

480K |

Feb 01, 2023 |

YAY Network

|

really ico

|

|

Seed Round |

$

18M |

Feb 01, 2023 |

Polychain Capital

|

addressable

|

Social

|

Seed Round |

$

7.5M |

Jan 31, 2023 |

Fabric Ventures

North Island Ventures

2+

Viola Ventures

Mensch Capital Partners

|

rysk finance (rysk)

|

DeFi

|

Pre-seed Round |

$

1.4M |

Jan 31, 2023 |

Yunt Capital

Lemniscap

5+

Encode Club

Ascensive Assets

Manifold Trading

Windra Thio

Ivangbi

|

oh baby games

|

Gaming

|

Seed Round |

$

6M |

Jan 30, 2023 |

Santiago Roel Santos

gmjp

6+

Serkan Toto

Wing Vasiksiri

eGirl Capital

Kevin Lin

Merit Circle

Synergis Capital

|

hypernative

|

Blockchain Service

|

Seed Round |

$

9M |

Jan 30, 2023 |

Nexo

Alchemy

5+

Boldstart Ventures

Blockdaemon

Borderless Capital

CMT Digital

IBI Tech Fund

|

planetwatch (PLANETS)

|

IOT

|

Funding Round |

$

3.2M |

Jan 26, 2023 |

Borderless Capital

Algorand Foundation

|

gifto (GFT)

|

Media

|

Strategic Fundraise |

$

2.5M |

Jan 22, 2023 |

Poolz

|

architect

|

DeFi

|

Funding Round |

$

5M |

Jan 20, 2023 |

Motivate VC

Third Kind Venture Capital

4+

SV Angel

Anthony Scaramucci

Circle

Coinbase Ventures

|

hashport

|

Blockchain Service

|

Funding Round |

$

6.9M |

Jan 20, 2023 |

Sumitomo Mitsui Banking Corporation

The University of Tokyo Edge Capital Partners(UTEC)

|

mask network (MASK)

|

Social

|

Strategic Round |

$

5M |

Jan 19, 2023 |

DWF Labs

|

elixir 2 (ELX)

|

DeFi

|

Seed Round |

$

2.1M |

Jan 17, 2023 |

OP Crypto

FalconX

2+

BitMex

Chapter One Ventures

|

obol labs (OBOL)

|

DeFi

|

Series A Round |

$

12.5M |

Jan 17, 2023 |

Ethereal Ventures

Stakely.vc

15+

DSRV

Swift Staking

Swiss Staking

Placeholder

Nascent

IEX Group

The Spartan Group

Kukis Global

Pantera Capital

Strobe (Prev. BlockTower Capital)

Blockscape

Cosmostation

Archetype

a41 Ventures

Coinbase Ventures

|

trusta ai (TA)

|

Artificial Intelligence (AI)

|

Seed Round |

$

3M |

Jan 17, 2023 |

GGV Capital

Vision Plus Capital

4+

Redpoint Ventures

SNZ Holding

SevenX Ventures

HashKey Capital

|

swan chain (SWAN)

|

DePIN

|

Funding Round |

$

3M |

Jan 16, 2023 |

Cabin VC

Chain Capital

6+

YZi Labs (prev Binance Labs)

Waterdrip Capital

FBG Capital

Protocol Labs

SNZ Holding

LD Capital

|

exa (EXA)

|

DeFi

|

Funding Round |

$

2M |

Jan 12, 2023 |

Newtopia VC

Kaszek Ventures

5+

NXTP Ventures

Kain Warwick

Daedalus

Bodhi Ventures

Esteban Ordano

|

debox (BOX)

|

Social

|

Seed Round |

$

2M |

Jan 09, 2023 |

ABCDE Capital

Bitrise Capital

1+

TokenPocket

|

ora (ORA)

|

Infrastructure

|

Pre-seed Round |

$

3M |

Jan 01, 2023 |

dao5

Future Money

2+

Foresight Ventures

HongShan (ex-Sequoia China)

|

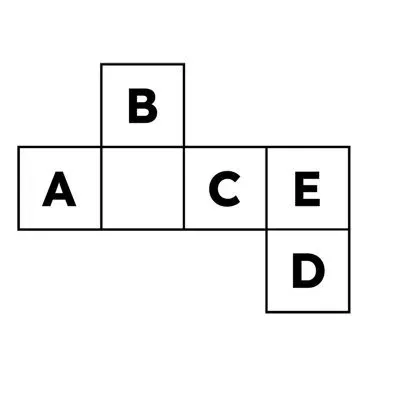

quasar 2 (QSR)

|

DeFi

|

Funding Round |

$

5.43M |

Jan 01, 2023 |

Polychain Capital

EverStake

4+

HASH CIB (HASH#CIB)

Shima Capital

Cosmostation

Blockchain Capital

|

carry1st ico

|

|

Series B Round |

$

27M |

Jan 01, 2023 |

Kepple Africa Ventures

Konvoy Ventures

5+

TTV Capital

Lateral Capital

BITKRAFT Ventures

Alumni Ventures

Andreessen Horowitz (a16z)

|

squidrouter

|

Blockchain Service

|

Seed Round |

$

3.5M |

Jan 01, 2023 |

Zaki Manian

Fabric Ventures

11+

Dean Eigenmann

North Island Ventures

Stani Kulechov

Derek Yoo

Node Capital

Distributed Global

Waikit Lau

Athabasca Capital

Axelar

Ashleigh Schap

Chapter One Ventures

|

parfin ico

|

Layer-2

|

Funding Round |

$

15M |

Jan 01, 2023 |

Valor Capital Group

L4 Venture Builder

2+

Alexia Ventures

Framework Ventures

|

sec3 ico

|

|

Seed Round |

$

10M |

Jan 01, 2023 |

Santiago Roel Santos

Sanctor Capital

3+

Multicoin Capital

Essence VC

Anatoly Yakovenko

|

momentum 3 (MMT)

|

DEX

|

Seed Round |

$

5M |

Jan 01, 2023 |

Superscrypt

SV Angel

6+

Shima Capital

Circle Ventures

Coinbase Ventures

Jump Crypto

Redpoint Ventures

The Spartan Group

|

intella x ico (IX)

|

|

Private Round |

$

12M |

Jan 01, 2023 |

Pearl Abyss Capital

Magic Eden

10+

Planetarium

WEMIX

CRIT Ventures

GCR (Global Coin Research)

JoyCity

NEOWIZ

P2 Ventures

Big Brain Holdings

Animoca Brands

Block Crafters

|

asset reality ico

|

|

Seed Round |

$

4.91M |

Jan 01, 2023 |

SGH Capital

Techstars

2+

Framework Ventures

Chris Adelsbach

|

spatial labs ico

|

|

Seed Round |

$

10M |

Jan 01, 2023 |

Marcy Venture Partners

Blockchain Capital

|

nil foundation ico

|

|

Venture Round |

$

22M |

Jan 01, 2023 |

Polychain Capital

Mina Protocol

2+

StarkWare Industries

Blockchain Capital

|

candy digital ico

|

|

Series A1 Round |

$

38.4M |

Jan 01, 2023 |

Galaxy

ConsenSys Mesh

2+

10T Holdings

ConsenSys

|

gateway ico

|

|

Seed Round |

$

4.2M |

Jan 01, 2023 |

Figment Capital

Redbeard Ventures

8+

Visary Capital

Ryan Li

Ryan Selkis

Sandeep Nailwal

Hannah Grey

The Spartan Group

Reciprocal Ventures

6MV (6th Man Ventures)

|

irreducible

|

Infrastructure

|

Seed Round |

$

15M |

Jan 01, 2023 |

Paradigm

Bain Capital Ventures

2+

Jump Crypto

Robot Ventures

|

kea

|

Blockchain Service

|

Seed Round |

$

2.7M |

Jan 01, 2023 |

Mark Carnegie

|