commonwealth ico

|

|

Private Round |

$

20M |

May 01, 2022 |

Jump Capital

Mirana Ventures

3+

Spark Digital Capital

Wintermute

Polychain Capital

|

amberdata ico

|

|

Series B |

$

30M |

May 01, 2022 |

Innovius Capital

Susquehanna International Group (SIG)

13+

Nexo

NAB Ventures

Franklin Templeton

Pantera Capital

Knollwood Investment Advisory

Nasdaq

Galaxy

Boldstart Ventures

Aspenwood Ventures

Citi

Chicago Trading Company

Brevan Howard

Coinbase Ventures

|

azra games

|

Gaming

|

Seed Round |

$

15M |

May 01, 2022 |

Play Ventures

Franklin Templeton

4+

ROK Capital

Andreessen Horowitz (a16z)

Coinbase Ventures

NFX

|

goracle (GORA)

|

Layer-2

|

Seed Round |

$

1.5M |

May 01, 2022 |

EXA Finance

Xpand Capital

5+

Parea Capital

Valhalla Capital

Borderless Capital

Big Brain Holdings

Algorand

|

chibi clash ico (CLASH)

|

|

Private Round |

$

3M |

May 01, 2022 |

Shima Capital

Jump Capital

10+

Panony

Rainmaker Games

PetRock Capital

P2 Ventures

Kyros Ventures

Genblock Capital

NGC Ventures

C2 Ventures

Alliance

Avocado Guild (Avocado DAO)

|

mobipad (MBP)

|

Launchpad

|

Private Round |

$

50K |

May 01, 2022 |

WTMC

LB Capital

8+

Legion Ventures

Enjin

LD Capital

Griffin Art

Unicorn Venture

Lunox Capital

ICI Ventures

GOTBIT

|

cocreate ico

|

|

Seed Round |

$

25M |

May 01, 2022 |

Packy McCormick

RTFKT

2+

VaynerFund

Amy Wu

|

flowcarbon ico

|

|

Funding Round |

$

70M |

May 01, 2022 |

Samsung NEXT

General Catalyst

5+

Invesco Private Capital

RSE Ventures

BoxGroup

Andreessen Horowitz (a16z)

Celo

|

paper (PAPER)

|

|

Seed Round |

$

9.3M |

May 01, 2022 |

William Hockey

Electric Capital

12+

ThirdWeb

Long Journey Ventures

P2 Ventures

Kevin Lin

Zhuoxun Yin

Marc Bhargava

Gokul Rajaram

Justin Kan

FalconX

Initialized Capital

Andrew Steinwold

Alliance

|

fantiger ico

|

|

Seed Round |

$

5.5M |

May 01, 2022 |

IOSG Ventures

Krafton

5+

Polygon Studios

Pravega Ventures

Woodstock Fund

Multicoin Capital

Graticule Asset Management Asia

|

cyberconnect (CYBER)

|

Blockchain Service

|

Series A |

$

15M |

May 01, 2022 |

IOSG Ventures

GGV Capital

10+

Delphi Digital (Delphi Labs)

SevenX Ventures

Manifold Trading

Protocol Labs

Polygon Studios

The Spartan Group

Sky9

Tribe Capital

Amber Group

Animoca Brands

|

pine (PINE)

|

Lending Platform

|

Seed Round |

$

1.5M |

May 01, 2022 |

Gate.io

Shima Capital

5+

The Spartan Group

Impossible Finance

Alameda Research

Amber Group

Ryze Labs (Sino Global Capital)

|

bhnetwork (BHAT)

|

|

Private Round |

$

4M |

May 01, 2022 |

Parachain Ventures

ZBS Capital

3+

|

chainflip (FLIP)

|

AMM

|

Equity Round |

$

10M |

May 01, 2022 |

Framework Ventures

Pantera Capital

1+

Blockchain Capital

|

certora ico

|

|

Series B Round |

$

36M |

May 01, 2022 |

Framework Ventures

Jump Crypto

8+

Tiger Global Management

Electric Capital

VMware

Lemniscap

Galaxy

CoinFund

a_capital

Coinbase Ventures

|

bitget wallet (BWB)

|

Wallet

|

Series A |

$

15M |

May 01, 2022 |

Dragonfly Capital

SevenX Ventures

7+

Matrixport

Gaorong Capital

Peak Capital

DHVC

Foresight Ventures

A&T Capital

Bixin Ventures

|

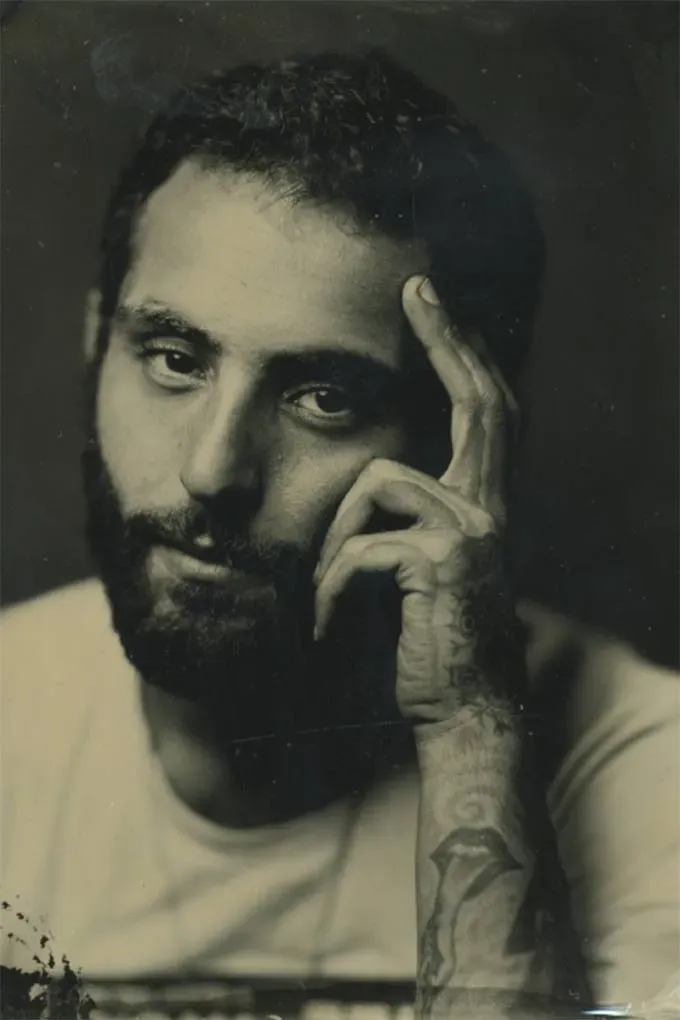

doppel

|

Blockchain Service

|

Seed Round |

$

5M |

May 01, 2022 |

Script Capital

Polygon Studios

12+

South Park Commons

Dapper Labs

Solana Ventures

The Spartan Group

Paxos

OpenSea Ventures

FTX Ventures

SV Angel

Gokul Rajaram

Quiet Capital

Caladan (Alphalab)

Balaji Srinivasan

|

![defy]()

defy (DEFY)

|

Polygon Ecosystem

|

Strategic Partnership |

$

3.13M |

May 01, 2022 |

Unanimous Capital

Polygon Studios

7+

The Spartan Group

GameFi Ventures

Play It Forward DAO

PathDAO

OliveX

Bixin Ventures

Animoca Brands

|

collector coin (AGS)

|

|

Seed Round |

$

900K |

May 01, 2022 |

Maven Capital

Big Brain Holdings

|

duskbreakers ico

|

|

Seed Round |

$

24M |

May 01, 2022 |

Dragonfly Capital

Pantera Capital

6+

Global Coin Ventures

Sfermion

FTX Ventures

Merit Circle

Andreessen Horowitz (a16z)

Breyer Capital

|

socol (SIMP)

|

Social

|

Funding Round |

$

3M |

May 01, 2022 |

Blockchain Capital

|

crypto pirates ico (PST)

|

|

Seed Round 1 |

$

160K |

May 01, 2022 |

Unicorn Venture

Kenzo Ventures

3+

Element

BNBSwap Ventures

ChainLink

|

centrifuge (CFG)

|

RWA (Real World Assets)

|

Funding Round |

$

3M |

May 01, 2022 |

Strobe (Prev. BlockTower Capital)

|

sx network (SX)

|

Gambling

|

Venture Round |

$

9.5M |

Apr 29, 2022 |

FJ Labs

Jack Herrick

8+

Hack VC

P2 Ventures

Naval Ravikant

Josh Hannah

Sandeep Nailwal

Nascent

CMCC Global

Hart Lambur

|

double jump tokyo

|

Gaming

|

Series C |

$

24M |

Apr 28, 2022 |

Next Web Capital

Wemade

14+

Arriba Studio

Circle

Com2uS

Access Ventures

Amber Group

JAFCO

Jump Crypto

Protocol Labs

Infinity Ventures Crypto (IVC)

P2 Ventures

Fenbushi Capital

PKO Investments

Dentsu Digital Holdings

Z Venture Capital

|

run together (RUN)

|

Sport

|

IDO on BSCstation |

$

200K |

Apr 27, 2022 |

Jade Labs

Fam Central

2+

ONUS

Moonlab

|

bikerush (BRT)

|

Move To Earn

|

Private Round |

$

8M |

Apr 27, 2022 |

Link VC

|

vertex protocol (VRTX)

|

DEX

|

Seed Round |

$

8.5M |

Apr 26, 2022 |

Dexterity Capital

HTX Ventures (previously Huobi Ventures)

8+

RNR Capital

GSR Markets (GSR)

HRT Ventures

Jane Street Capital

JST Capital

Hack VC

Big Brain Holdings

Collab+Currency

|

0x (ZRX)

|

DEX

|

Series B |

$

70M |

Apr 26, 2022 |

OpenSea Ventures

Jared Leto

3+

Reid Hoffman

Pantera Capital

Coinbase Ventures

|

holograph (HLG)

|

NFT

|

Seed Round |

$

6.5M |

Apr 26, 2022 |

Larry Warsh

Wave Financial Group

21+

Kosmos Ventures

Wendy Fisher

Diplo

Daniel Arsham

Jen Stark

Courtside Ventures

Nick Chong

Arca

Avalanche VC

Andy Chorlian

Company Ventures

Pharrell Williams

Daniel Armitage

Justin Aversano

Soma Capital

VaynerFund

Mirana Ventures

Infinity Ventures Crypto (IVC)

Palm Drive Capital

gmoney

Mechanism Capital

|

subsquid (SQD)

|

Web 3.0

|

Series A |

$

5.2M |

Apr 25, 2022 |

Zee Prime Capital

Old Fashion Research

5+

Digital Finance Group (DFG)

Momentum 6

Blockchange Ventures

Illusionist Group

D1 Ventures

|

apeiron 2 (APRS)

|

Gaming

|

Seed Round |

$

10M |

Apr 25, 2022 |

DeFi Capital

DeFiance Capital

3+

Hashed

The Spartan Group

Morningstar Ventures

|

afterparty

|

Social

|

Seed Round |

$

4M |

Apr 22, 2022 |

David Friedberg

TenOneTen Ventures

8+

Rudy Cline-Thomas

Spencer Rascoff

Jason Calacanis

Nicole Farb

Desiree Gruber

Blockchange Ventures

Paris Hilton

Reade Seiff

|

mbd financials (MBD)

|

Metaverse

|

Funding Round |

$

10M |

Apr 22, 2022 |

LDA Capital

|

liquifi

|

Blockchain Service

|

Funding Round |

$

5M |

Apr 21, 2022 |

Katie Haun

Robot Ventures

10+

Dragonfly Capital

Y Combinator

Alliance

Anthony Sassano

Balaji Srinivasan

6MV (6th Man Ventures)

Anthony Pompliano

Orange DAO

Packy McCormick

Nascent

|

privy

|

Web 3.0

|

Seed Round |

$

8.3M |

Apr 20, 2022 |

Paradigm

Electric Capital

2+

Archetype

BlueYard

|

tangany

|

Finance

|

Seed Round |

$

7.45M |

Apr 20, 2022 |

High-Tech Grunderfonds

Nauta Capital

1+

Philipp Treuner

|

coindcx ico (INR)

|

|

Series C |

$

135M |

Apr 19, 2022 |

Coinbase Ventures

B Capital

7+

Cadenza Ventures

Republic

Draper Dragon

Steadview Capital

Pantera Capital

Kindred Ventures

Polychain Capital

|

metashooter (MHUNT)

|

Play to Earn

|

Seed Round |

$

1.62M |

Apr 18, 2022 |

GOTBIT

Metavest

2+

Good Games Guild

MV Global

|

moonpay

|

Finance

|

Funding Round |

$

87M |

Apr 13, 2022 |

Paris Hilton

K5 Global

14+

Mantis VC

Diplo

Marcy Venture Partners

Gal Gadot

DreamCrew

Palm Tree Crew

New Enterprise Associates

Plus Capital

Maria Sharapova

Paul George

Electric Feel Entertainment

Time Ventures

BroadLight Capital

Ashton Kutcher

|

loop crypto

|

Infrastructure

|

Seed Round |

$

4M |

Apr 13, 2022 |

Paul Veradittakit

Imran Khan

4+

Alchemy Ventures

a_capital

Andreessen Horowitz (a16z)

Alex Svanevik

|

fluid ico (FLD)

|

|

Funding Round |

$

10M |

Apr 13, 2022 |

GSR Markets (GSR)

Ghaf Capital Partners

|

dfns

|

Blockchain Service

|

Seed Round |

$

13.5M |

Apr 11, 2022 |

Xavier Niel

Definitive Capital

21+

SGH Capital

Mike Dudas

Red Beard Ventures

Julien Bouteloup

Rand Hindi

Hashed

White Star Capital

Kerry Ritz

Kartik Varma

Miles Parry

Horseshoe Capital

Ryan Selkis

Armand Khatri

Barthelemy Kiss

ABN AMRO

Bpifrance

6MV (6th Man Ventures)

Coinbase Ventures

Julien Pageaud

Figment Capital

Semantic Ventures

|

shrapnel (SHRAP)

|

Gaming

|

Funding Round |

$

7M |

Apr 11, 2022 |

Dragonfly Capital

Three Arrows Capital

|

cybrid

|

Blockchain Service

|

Seed Round |

$

3.1M |

Apr 07, 2022 |

Luge Capital

Harvest Ventures

1+

Golden Ventures

|

community gaming

|

Gaming

|

Series A |

$

16M |

Apr 07, 2022 |

Multicoin Capital

Hashed

7+

Griffin Gaming Partners

SoftBank

Shima Capital

Animoca Brands

YZi Labs (prev Binance Labs)

BITKRAFT Ventures

CoinFund

|

jan3

|

Blockchain Service

|

Funding Round |

$

21M |

Apr 07, 2022 |

El Zonte Capital

Chun Wang

|

zoo finance

|

DeFi

|

Seed Round |

$

2M |

Apr 06, 2022 |

Pragma Ventures

Yenwen Feng

6+

Warburg Serres Investments

Big Brain Holdings

0xVentures

CMS Holdings

DefinanceX

Nick Tong

|

boba network (BOBA)

|

Layer-2

|

Series A |

$

45M |

Apr 05, 2022 |

M13

Kosmos Ventures

22+

Sanctor Capital

Rarestone Capital

HTX Ventures (previously Huobi Ventures)

Alliance

BitMart

10X Capital

ROK Capital

Hack VC

Ghaf Capital Partners

D1 Ventures

Crypto.com

TRGC

LD Capital

Old Fashion Research

Infinite Capital

Shima Capital

Krypital Group

Redline DAO

Defi technologies

Kinetic Capital

Genblock Capital

Hypersphere Ventures

|

parallel finance (PARA)

|

Lending Platform

|

Funding Round |

$

5M |

Apr 05, 2022 |

Coinbase Ventures

StarkWare Industries

|