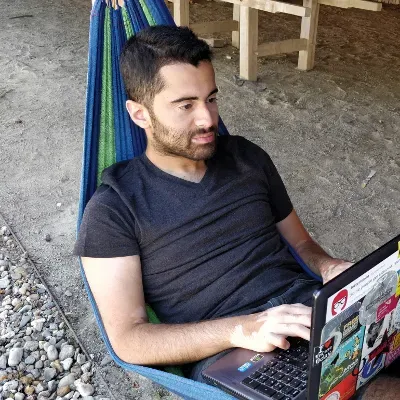

validation cloud

|

Infrastructure

|

Funding Round |

$

10M |

Oct 23, 2024 |

True Global Ventures (TGV)

|

variational

|

Perpetual

|

Seed Round |

$

10.3M |

Oct 23, 2024 |

Hack VC

Dragonfly Capital

4+

North Island Ventures

Peak XV Partners(ex-Sequoia India)

Bain Capital Crypto

Coinbase Ventures

|

genius 2

|

DeFi

|

Seed Round |

$

6M |

Oct 23, 2024 |

MASON VERSLUIS

The SALT Fund

9+

ScottMelker

Flow Traders

Mav

Psalion VC

Anthony Scaramucci

Arca

CMCC Global

Balaji Srinivasan

Avalanche Foundation

|

fluid protocol

|

DeFi

|

Seed Round |

$

3.9M |

Oct 23, 2024 |

Veil

Meltem Demirors

14+

Infinity Ventures Crypto (IVC)

Kartik Talwar

Wise3 Ventures

Mike Silagadze

Relayer Capital

Maelstrom

Stake Capital

RockTree Capital

Alan Curtis

Bloccelerate

Builder Capital

Ben Lakoff

CMS Holdings

Animoca Brands

|

craftt

|

Blockchain Service

|

Seed Round |

$

2M |

Oct 23, 2024 |

Superscrypt

Digital Currency Group (DCG)

|

karpatkey

|

Blockchain Service

|

Funding Round |

$

7M |

Oct 22, 2024 |

Stani Kulechov

AppWorks

3+

Joseph Lubin

Fernando Martinelli

Wintermute

|

sparkball

|

Gaming

|

Funding Round |

$

2M |

Oct 22, 2024 |

Keone Hon

L1D

3+

Impossible Finance

CMS Holdings

Yield Guild Games (YGG)

|

azura

|

DeFi

|

Seed Round |

$

6.9M |

Oct 22, 2024 |

Raj Gokal

Initialized Capital

15+

0xSisyphus

Bharat Krymo

Alliance

Stephane Gosselin

Smokey The Bera

Meltem Demirors

WSB Mod

Forrest Browning

icebergy

Siqi Chen

DCF GOD

gainzy

The Crypto Dog

Volt Capital

Winklevoss Capital

|

hata

|

Finance

|

Seed Round |

$

4.2M |

Oct 22, 2024 |

Plug and Play

Castle Island Ventures

3+

Alliance

Bybit

Cadenza Ventures

|

ordzaar (ZAAR)

|

NFT

|

Seed Round |

$

2M |

Oct 21, 2024 |

GSR Markets (GSR)

PG

4+

Bitcoin Frontier Fund

OIG Oracles Investment Group

LongHash Ventures

Sora Ventures

|

bridge 2

|

Infrastructure

|

M&A |

$

1.1B |

Oct 20, 2024 |

Stripe

|

zerobase (ZBT)

|

Zero Knowledge

|

Funding Round |

$

5M |

Oct 19, 2024 |

Oak Grove Ventures

dao5

9+

K24 Ventures

MH Ventures

Symbolic Capital

Web3Port

Faction

Lecca Ventures

Cherry Ventures

YZi Labs (prev Binance Labs)

PAKA

|

xpl (XPL)

|

Blockchain

|

Funding Round |

$

3.5M |

Oct 18, 2024 |

Zaheer

Christian Angermayer

5+

Anthos Capital

Bitfinex

Karatage

Manifold Trading

Paolo Ardoino

|

zkpass (zkPass)

|

Blockchain Service

|

Series A |

$

12.5M |

Oct 17, 2024 |

Flow Traders

WAGMI Ventures

5+

dao5

MH Ventures

Signum Capital

Amber Group

Animoca Brands

|

drop protocol

|

DeFi

|

Seed Round |

$

4M |

Oct 17, 2024 |

Jon Kol

Ismail Khoffi

15+

Orthogonal Labs

Vasiliy Shapovalov

Kahuna

Mustafa Al-Bassam

Anagram Crypto

Cosmostation

BreederDAO

Chorus One

CMS Holdings

BitScale Capital

CoinFund

Ekram Ahmed

Shane Mac

Sam Hart

Interop

|

surge 2

|

Infrastructure

|

Pre-seed |

$

1.8M |

Oct 17, 2024 |

Autonomy

Sats Ventures

4+

Vamient Capital

Gerstenbrot Capital

Double Peak

Samara Asset Group

|

hyve da

|

Blockchain Service

|

Pre-seed |

$

1.85M |

Oct 17, 2024 |

Frachtis

P-OPS Team

2+

Paper Ventures

Lemniscap

|

canyon network

|

Oracle

|

Funding Round |

$

6M |

Oct 17, 2024 |

DeData Technologies

Vinci Labs

2+

Fission Digital Capital

DAO Venture

|

limitless (LMTS)

|

Predictions

|

Pre-seed |

$

3M |

Oct 17, 2024 |

Public Works

Paper Ventures

2+

Collider Ventures

1confirmation

|

yellow card

|

Finance

|

Series C |

$

33M |

Oct 16, 2024 |

Hutt Capital

Galaxy

6+

Polychain Capital

Third Prime

Blockchain Coinvestors

Castle Island Ventures

Blockchain Capital

Winklevoss Capital

|

mento

|

DeFi

|

Funding Round |

$

10M |

Oct 16, 2024 |

T Capital

Verda Ventures

5+

Flori Ventures

Richard Parsons

w3.fund

No Limit Holdings

HashKey Capital

|

hermetica

|

DeFi

|

Seed Round |

$

1.7M |

Oct 16, 2024 |

UTXO Management

CMS Holdings

1+

Ethos Fund

|

lombard (BARD)

|

DeFi

|

Funding Round |

$

1M |

Oct 16, 2024 |

YZi Labs (prev Binance Labs)

|

the arena (ARENA)

|

Social

|

Pre-seed |

$

2M |

Oct 16, 2024 |

Blizzard Fund (Avalanche Ecosystem)

AlphaCrypto

5+

Abstract Ventures

Balaji Srinivasan

Sarson Funds

C2Ventures (Csquared)

D1 Ventures

|

vue protocol (V)

|

Social

|

Seed Round |

$

6M |

Oct 15, 2024 |

PAKA

GBV Capital

2+

Eureka Capital

AU21 Capital

|

praxis

|

Artificial Intelligence (AI)

|

Funding Round |

$

525M |

Oct 15, 2024 |

Dan Romero

Manifold Trading

7+

Rob Hadick

Mert Mumtaz

Global Emerging Markets (GEM Digital Limited)

Tom Schmidt

Will Price

Anirudh Pai

Arch

|

opacity network

|

Zero Knowledge

|

Seed Round |

$

12M |

Oct 15, 2024 |

Escape Velocity

Finality Capital Partners

7+

GD1 Crypto

North Island Ventures

Bodhi Ventures

Archetype

Ambush Capital

Breyer Capital

a16z Cultural Leadership Fund

|

pell network (PELL)

|

DeFi

|

Pre-seed |

$

3M |

Oct 15, 2024 |

Sats Ventures

Mantle

12+

Paper Ventures

Halo Capital

Side Door Ventures

J17 Capital

Mirana Ventures

D11 Labs

Delta Blockchain Fund

Web3Port

Caliber Venture Builder

Contribution Capital

Cogitent Ventures

ArkStream Capital

|

blockcast

|

Blockchain Service

|

Seed Round |

$

2.85M |

Oct 15, 2024 |

RW3 Ventures

Lattice

5+

Protocol Labs

Finality Capital Partners

Zee Prime Capital

Alliance

Anatoly Yakovenko

|

predicate

|

Blockchain Service

|

Funding Round |

$

7M |

Oct 15, 2024 |

Matthew Katz

Victor Ji

22+

Mike Silagadze

Marek Olszewski

EverStake

Sandeep Nailwal

Vishesh Choudhry

Georgios Vlachos

Very Early Ventures

Rene Reinsberg

White Star Capital

Reciprocal Ventures

HashKey Capital

The Department of XYZ

cyber Fund

GSR Markets (GSR)

Figment Capital

NEAR Foundation

Tribe Capital

Batu

Austin Green

Calvin Liu

ConsenSys

1kx

|

azra games

|

Gaming

|

Series A |

$

42M |

Oct 15, 2024 |

Pantera Capital

|

bitnomial

|

Finance

|

Funding Round |

$

25M |

Oct 15, 2024 |

Ripple

|

towns (TOWNS)

|

Social

|

Series A |

$

25.5M |

Oct 15, 2024 |

Framework Ventures

Benchmark

1+

Andreessen Horowitz (a16z)

|

solv protocol (SOLV)

|

DeFi

|

Strategic Round |

$

11M |

Oct 14, 2024 |

gumi Cryptos Capital

Laser Digital

3+

OKX Ventures

Blockchain Capital

CMT Digital

|

flappy bird

|

Gaming

|

Funding Round |

$

2M |

Oct 14, 2024 |

Four Seasons Ventures (4SV)

Scytale

3+

Optic Capital

Kenetic Capital

Big Brain Holdings

|

infinitar governance token (IGT)

|

Gaming

|

Series A |

$

9M |

Oct 11, 2024 |

AccelByte

AC Capital

4+

Lam Group

Dex Ventures

Waterdrip Capital

Mason Labs

|

commonware

|

Infrastructure

|

Funding Round |

$

9M |

Oct 11, 2024 |

Sreeram Kannan

Haun Ventures

7+

Dan Romero

Mert Mumtaz

Zaki Manian

Viktor Bunin

Smokey The Bera

Nick White

Dragonfly Capital

|

ithaca

|

Blockchain

|

Funding Round |

$

20M |

Oct 11, 2024 |

Paradigm

|

yala finance (YALA)

|

DeFi

|

Seed Round |

$

8M |

Oct 10, 2024 |

UTXO Management

Ethereal Ventures

12+

GeekCartel

UpHonest Capital

Galaxy

Polychain Capital

L2 Iterative Ventures (L2IV)

SatoshiLab

HashKey Capital

280 Capital

Anagram Crypto

ABCDE Capital

Ambush Capital

Amber Group

|

trendies

|

Social

|

Pre-seed |

$

1.75M |

Oct 10, 2024 |

Zhuoxun Yin

Achal Srinivasan

7+

Base Ecosystem Fund

Archetype

Antonio Juliano

Marc Boiron

Jake Werrett

Vijay Chetty

Henri Stern

|

pip world

|

Gaming

|

Seed Round |

$

10M |

Oct 10, 2024 |

Exinity

|

fission labs

|

DeFi

|

Pre-seed |

$

1.6M |

Oct 10, 2024 |

Kraynos Capital

The SALT Fund

1+

Anthony Scaramucci

|

moonveil (MORE)

|

Gaming

|

Funding Round |

$

2M |

Oct 10, 2024 |

P2 Ventures

|

opengradient

|

Infrastructure

|

Seed Round |

$

8.5M |

Oct 09, 2024 |

NEAR Foundation

SV Angel

17+

Pragma Ventures

Foresight Ventures

Andreessen Horowitz (a16z)

Balaji Srinivasan

Black Dragon Capital

Celestia

Anand Iyer

Canonical Crypto

Ajit Tripathi

Coinbase Ventures

Sandeep Nailwal

Illia Polosukhin

Thanefield Capital

Paul Taylor

The SALT Fund

Ryan Watkins

Symbolic Capital

|

delta

|

Infrastructure

|

Funding Round |

$

11M |

Oct 09, 2024 |

Zero Knowledge Ventures

Reverie

12+

Maven 11 Capital

Credibly Neutral

DBA

Ergodic Capital

Figment Capital

Delphi Ventures

Ambush Capital

Castle Island Ventures

Public Works

Komorebi Collective

Robot Ventures

Variant

|

dragonz land

|

Gaming

|

Funding Round |

$

9M |

Oct 09, 2024 |

Syndicate Capital Group

|

kiva ai

|

Artificial Intelligence (AI)

|

Pre-seed |

$

7M |

Oct 08, 2024 |

Peer Ventures

Jack Herrick

7+

HashKey Capital

Actai Ventures

Big Brain Holdings

CoinFund

Protagonist

Foresight Ventures

NGC Ventures

|

semantic layer (42)

|

Infrastructure

|

Seed Round |

$

3M |

Oct 08, 2024 |

Perridon Ventures

Hack VC

5+

Robot Ventures

Fenbushi Capital

Figment Capital

Bankless

Anagram Crypto

|

bitlayer (BTR)

|

Layer-2

|

Series A Extension |

$

9M |

Oct 08, 2024 |

Selini Capital

Franklin Templeton

1+

Polychain Capital

|

ppking

|

DeFi

|

Seed Round |

$

2M |

Oct 08, 2024 |

Crypto Labs

Faculty Group

3+

Seed Club Ventures

Cityblok

BlackBridge

|