ton (TON)

|

Blockchain

|

Strategic Round |

$

10M |

Oct 08, 2024 |

Gate.io

|

apro (AT)

|

Blockchain Service

|

Seed Round |

$

3M |

Oct 07, 2024 |

Comma3 Ventures

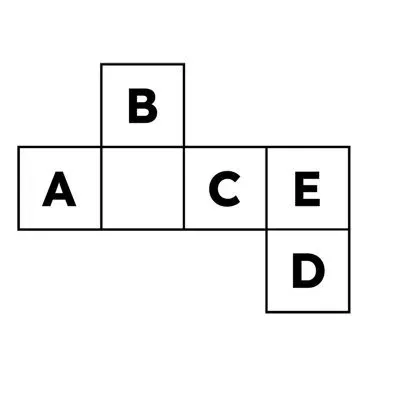

ABCDE Capital

6+

CMS Holdings

UTXO Management

Presto Labs

Franklin Templeton

Oak Grove Ventures

Polychain Capital

|

humanode (HMND)

|

Blockchain Service

|

Funding Round |

$

10M |

Oct 07, 2024 |

Big Brain Holdings

Republic

|

layer

|

Infrastructure

|

Seed Round |

$

6M |

Oct 03, 2024 |

IOBC Capital

Rok Kopp

6+

Mike Silagadze

Sreeram Kannan

1kx

Arrington Capital

Paul Taylor

Fabric Ventures

|

moonray (MNRY)

|

Gaming

|

Funding Round |

$

4.75M |

Oct 03, 2024 |

Cardano Foundation

Animoca Brands

1+

P2 Ventures

|

synnax technologies

|

Artificial Intelligence (AI)

|

Strategic Round |

$

550K |

Oct 03, 2024 |

TON Ventures

Wintermute

|

secondlive (LIVE)

|

Metaverse

|

Private Token Sale |

$

12M |

Sep 30, 2024 |

Titans Ventures

Spark Digital Capital

8+

NewTribe Capital

CSP DAO

Taisu Ventures

Cypher Capital Group

Newave Capital

MetaEstate

Crypto.com

BitValue Capital

|

rd technologies

|

Finance

|

Series A1 Round |

$

7.8M |

Sep 30, 2024 |

Aptos

Anagram Crypto

6+

HongShan (ex-Sequoia China)

Upward Capital

Hivemind Capital Partners

Hash Global

Solana Foundation

SNZ Holding

|

meshmap

|

Blockchain Service

|

Funding Round |

$

4M |

Sep 27, 2024 |

GSR Markets (GSR)

Raj Gokal

8+

Paul Bohm

Escape Velocity

Lattice

Colosseum

Anatoly Yakovenko

Balaji Srinivasan

Andreessen Horowitz (a16z)

Andy Chatham

|

mawari

|

Blockchain Service

|

Strategic Round |

$

10.8M |

Sep 26, 2024 |

Anfield

Accord Ventures

14+

Borderless Capital

1kx

Blockchange Ventures

Animoca Brands

Pete Townsend

Ivan Brightly

Mulana Capital

Samsung NEXT

Sean Carey

Waldo Holdings

Joshua Frank

Parami Investors

iAngels

Draper Dragon

|

mind network (FHE)

|

Blockchain Service

|

pre-Series A |

$

10M |

Sep 26, 2024 |

Cogitent Ventures

ArkStream Capital

11+

Animoca Brands

G. Ventures

Moonhill Capital

MH Ventures

Mike Silagadze

IBC Ventures

Mr. Block

MV Global

Kyle Chasse

Mario Nawfal

SwissBorg Ventures

|

earthfast

|

Blockchain Service

|

Pre-seed |

$

1.4M |

Sep 25, 2024 |

Kain Warwick

Bodhi Ventures

3+

Roneil Rumburg

The General Partnership

Nascent

|

initia (INIT)

|

Blockchain

|

Series A |

$

14M |

Sep 25, 2024 |

Keone Hon

icebergy

9+

Bryan Pellegrino

Guy Young

Hack VC

Jordi Alexander

Zaki Manian

Theory VC

Nick Chong

Michael Egorov

Delphi Digital (Delphi Labs)

|

aminochain

|

Infrastructure

|

Seed Round |

$

5M |

Sep 25, 2024 |

Andreessen Horowitz (a16z)

|

meridian

|

DeFi

|

Seed Round |

$

4M |

Sep 24, 2024 |

ParaFi Capital

Saison Capital

6+

DCF GOD

Amber Group

Borderless Capital

Oak Grove Ventures

Interop

Serafund

|

daylight

|

Blockchain Service

|

Seed Round |

$

6M |

Sep 24, 2024 |

Ido Ben-Natan

Vadim Koleoshkin

9+

Corbin Page

Chapter One Ventures

1kx

Shreyas Hariharan

Union Square Ventures

Nir Kabessa

Raz Niv

Evgeny Yurtaev

Framework Ventures

|

berkeley compute

|

DeFi

|

Pre-seed |

$

5M |

Sep 24, 2024 |

Chia Network

|

helix labs

|

DeFi

|

Pre-seed |

$

2M |

Sep 23, 2024 |

Double Peak

LD Capital

3+

Tribe Capital

Emurgo

Taureon

|

smolbound

|

Gaming

|

Seed Round |

$

6M |

Sep 23, 2024 |

Gam3Girl Ventures

King River Capital

7+

RockawayX

Zentry

Arbitrum Foundation

Anthos Capital

BITKRAFT Ventures

Caballeros Capital

Play Ventures

|

celestia (TIA)

|

Modular Blockchain

|

Funding Round |

$

100M |

Sep 23, 2024 |

Robot Ventures

Bain Capital Crypto

3+

1kx

Syncracy Capital

Placeholder

|

octra (OCT)

|

Infrastructure

|

Pre-seed |

$

4M |

Sep 20, 2024 |

zeroDAO

Wise3 Ventures

11+

lobsterdao

Curiosity Capital

Karatage

ID Theory

Builder Capital

Cogitent Ventures

Big Brain Holdings

Vamient Capital

Presto Labs

Finality Capital Partners

Outlier Ventures

|

infinex app crypto

|

DEX

|

NFT Sale |

$

65.29M |

Sep 20, 2024 |

Infinite Capital

Tim Beiko

40+

Larry Cermak

Hart Lambur

Sam Kazemian

Wintermute

Eden Block

Moonrock Capital

Jordi Alexander

Nic Carter

cyber Fund

Sergej Kunz

Alex Svanevik

0xMaki

Arthur Cheong

BlueYard

Barthazian

chainyoda.eth

Bankless

Bodhi Ventures

AGE Fund

Breyer Capital

Anatoly Yakovenko

Solana Ventures

Framework Ventures

Guy Young

Rushi Manche

Evan Van Ness

Smokey The Bera

Jason Yanowitz

Wormhole

Zeneca

David Hoffman

Synthetix

Loi Luu

Stani Kulechov

ZAGABOND

Pyth Network

Luca Netz

icebergy

Reinventure

NEAR Foundation

|

chaos labs ico

|

|

Funding Round |

$

4M |

Sep 20, 2024 |

PayPal Ventures

|

bool network

|

Infrastructure

|

Seed Round |

$

2M |

Sep 19, 2024 |

Web3Port

Spark Digital Capital

7+

D11 Labs

Sharding Capital

CKB Eco Fund

Antalpha

Cogitent Ventures

SatoshiLabs

ViaBTC Capital

|

drift protocol (DRIFT)

|

Perpetual

|

Series B |

$

25M |

Sep 19, 2024 |

Folius Ventures

Multicoin Capital

2+

Blockchain Capital

Primitive Ventures

|

helius

|

Blockchain Service

|

Funding Round |

$

21.75M |

Sep 19, 2024 |

Foundation Capital

Chapter One Ventures

4+

6MV (6th Man Ventures)

Haun Ventures

Spearhead

Founders Fund

|

sorted

|

Wallet

|

Pre-seed |

$

1.5M |

Sep 19, 2024 |

Tether

|

hemi network (HEMI)

|

Modular Blockchain

|

Strategic Round |

$

15M |

Sep 18, 2024 |

The SALT Fund

HyperChain Capital

20+

SNZ Holding

Impossible Finance

Crypto.com

TRGC

Sunflower Fund

Web3.com Ventures

Gate Ventures

Protein Capital

Jihan Wu

George Burke

BTC Inc

Capital6 Eagle

Artichoke Capital

Alchemy

Breyer Capital

Big Brain Holdings

YZi Labs (prev Binance Labs)

DNA Fund

Cypher Capital Group

Quantstamp

|

cudis (CUDIS)

|

Blockchain Service

|

Seed Round |

$

5M |

Sep 18, 2024 |

MonkeVentures

SNZ Holding

7+

Penrose Ventures

Mozaik Capital

Foresight Ventures

NGC Ventures

SkyBridge Capital

Draper Associates

Draper Dragon

|

roolz (GODL)

|

Gaming

|

Private Token Sale |

$

1M |

Sep 18, 2024 |

TON Ventures

Yolo Investments

1+

Contango Digital Assets

|

truex (PYUSD)

|

CEX

|

Seed Round |

$

9M |

Sep 18, 2024 |

RRE Ventures

Hack VC

5+

Reciprocal Ventures

Aptos

Accomplice

Solana Foundation

Paxos

|

ton (TON)

|

Blockchain

|

Funding Round |

$

30M |

Sep 18, 2024 |

Bitget

Foresight Ventures

|

amnis finance (AMI)

|

Liquid Staking Protocols

|

Funding Round |

$

2M |

Sep 18, 2024 |

Flowdesk

Gate Ventures

9+

OKX Ventures

Re7 Capital

Arkgrow Pte Ltd

Aptos

Ambush Capital

Chorus One

Borderless Capital

Old Fashion Research

SkyVision Capital

|

vana (VANA)

|

Artificial Intelligence (AI)

|

Strategic Round |

$

5M |

Sep 18, 2024 |

Coinbase Ventures

|

yellow network (YELLOW)

|

Blockchain Service

|

Seed Round |

$

10M |

Sep 17, 2024 |

Gate Labs

ZBS Capital

10+

MathWallet

GSR Markets (GSR)

NxGen

Moonrock Capital

Noia Capital

LD Capital

MV Global

Cobo

Chris Larsen

ConsenSys

|

fermah

|

Zero Knowledge

|

Seed Round |

$

5.2M |

Sep 17, 2024 |

zeroDAO

Velocity Capital

9+

Public Works

Sandeep Nailwal

LambdaClass

zkValidator (ZKV)

Lemniscap

Bankless

Balaji Srinivasan

Andreessen Horowitz (a16z)

LongHash Ventures

|

0xastra

|

Gaming

|

Seed Round |

$

3M |

Sep 17, 2024 |

Orbiter Finance

Skyland Ventures

4+

Folius Ventures

Ultiverse

Redpoint Ventures

Animoca Brands

|

filament

|

DEX

|

Seed Round |

$

1.1M |

Sep 17, 2024 |

Halo Capital

P2 Ventures

5+

CoinBureau

Archerman Capital

Chorus One

LIF

Spyre Capital

|

magicblock

|

Infrastructure

|

Pre-seed |

$

3M |

Sep 17, 2024 |

Andreessen Horowitz (a16z)

|

logx (LOGX)

|

DEX

|

Strategic Round |

$

4M |

Sep 16, 2024 |

Saison Capital

Cumberland

7+

Hashed

DWF Labs

Gate.io

Kairos Capital

WAGMI Ventures

CoinSwitch

Antler

|

pipe network (PIPE)

|

Blockchain Service

|

Funding Round |

$

10M |

Sep 16, 2024 |

Multicoin Capital

|

rise chain

|

Blockchain

|

Seed Round |

$

3.2M |

Sep 16, 2024 |

Finality Capital Partners

P2 Ventures

12+

ether.fi

Public Works

Orange DAO

Vitalik Buterin

Sandeep Nailwal

DCF GOD

Stani Kulechov

MH Ventures

Scott Moore

Sam Kazemian

Digital Asset Capital Management (DACM)

Anthony Sassano

|

universal health token

|

Healthcare

|

Pre-seed |

$

1.2M |

Sep 13, 2024 |

Animoca Brands

KGeN

2+

Tezos Foundation

P2 Ventures

|

ore (ORE)

|

Cryptocurrency

|

Seed Round |

$

3M |

Sep 13, 2024 |

Colosseum

B+J Studios

7+

Third Kind Venture Capital

Stepan Simkin

Santiago Roel Santos

Solana Ventures

Dead King Society

Mert Mumtaz

Foundation Capital

|

infinit 2 (IN)

|

DeFi

|

Funding Round |

$

6M |

Sep 12, 2024 |

Faction

Hashed

7+

Nomad Capital

Maelstrom

tangent

Presto Labs

Mirana Ventures

Robot Ventures

Electric Capital

|

fuseenergy

|

Blockchain Service

|

Strategic Round |

$

12M |

Sep 12, 2024 |

Multicoin Capital

Anatoly Yakovenko

|

wingbits

|

Blockchain Service

|

Seed Round |

$

3.5M |

Sep 12, 2024 |

Antler

Borderless Capital

1+

Tribe Capital

|

carrot 2 (CRT)

|

DeFi

|

Pre-seed |

$

600K |

Sep 11, 2024 |

TraderKoz

ChartFu

8+

Bartosz Lipiński

BOOGLE

Vibhu Norby

Nom

Topo Gigio

Retired Chad Dev

Iced

Kash Dhanda

|

huma finance (HUMA)

|

DeFi

|

Series A |

$

38M |

Sep 11, 2024 |

Stellar Foundation

Folius Ventures

12+

Santiago Roel Santos

Circle

Anagram Crypto

500 Global

Blockchain Founders Fund

Robot Ventures

HashKey Capital

Fenbushi Capital

Distributed Global

ParaFi Capital

Race Capital

Hard Yaka

|

gashawk

|

Ethereum Ecosystem

|

Pre-seed |

$

1.6M |

Sep 11, 2024 |

Jason Novack

Matt Cutler

21+

Forrest Browning

Vinny Lingham

Jason Hitchcock

Dawson Botsford

Jordan Lyall

Alex Michelsen

3SE Holdings

Connor Howe

Artemis Capital

AVID3

Alchemy

Andromeda Capital

AppWorks

Eric Arsenault

dcbuilder.eth

Roneil Rumburg

RedBread Ventures

Vijay Michalik

Mika Honkasalo

Scott Keto

The Crypto Dog

|