10x Research’s Markus Thielen Says Bitcoin Indicator Predicting Crash To $30K

Highlights

- Top analyst Markus Thielen said Bitcoin price correction was expected amid weak market structure.

- Bitcoin price might crash as an indicator even forecasts a fall to $30,000.

- CryptoQuant CEO Ku Young Ju said new Bitcoin whales and spot ETF buyers are now underwater.

- BTC price trades near $58,000.

Markus Thielen, one of the top crypto analysts, on Thursday said Bitcoin price correction was expected amid weak market structure. Thielen predicted a Bitcoin crash to a range of 52,000-55,000, and BTC price fell to a low of $56,552 due to the Fed rate jitters. He revealed an indicator that even forecasts a further drop in BTC price to $30,000.

Is Bitcoin Price Moving Towards A Crash?

Markus Thielen, CEO of crypto research firm 10x Research, has pointed out an indicator predicting a BTC price crash to $30,000. In a new report for clients, he revealed that their clients have closed out longs at 68,300 or some even went short on Bitcoin price.

“We have been expecting a severe Bitcoin correction. The signs were all there that the Bitcoin bull market was losing momentum. Now everybody is asking how steep the fall will be,” he added.

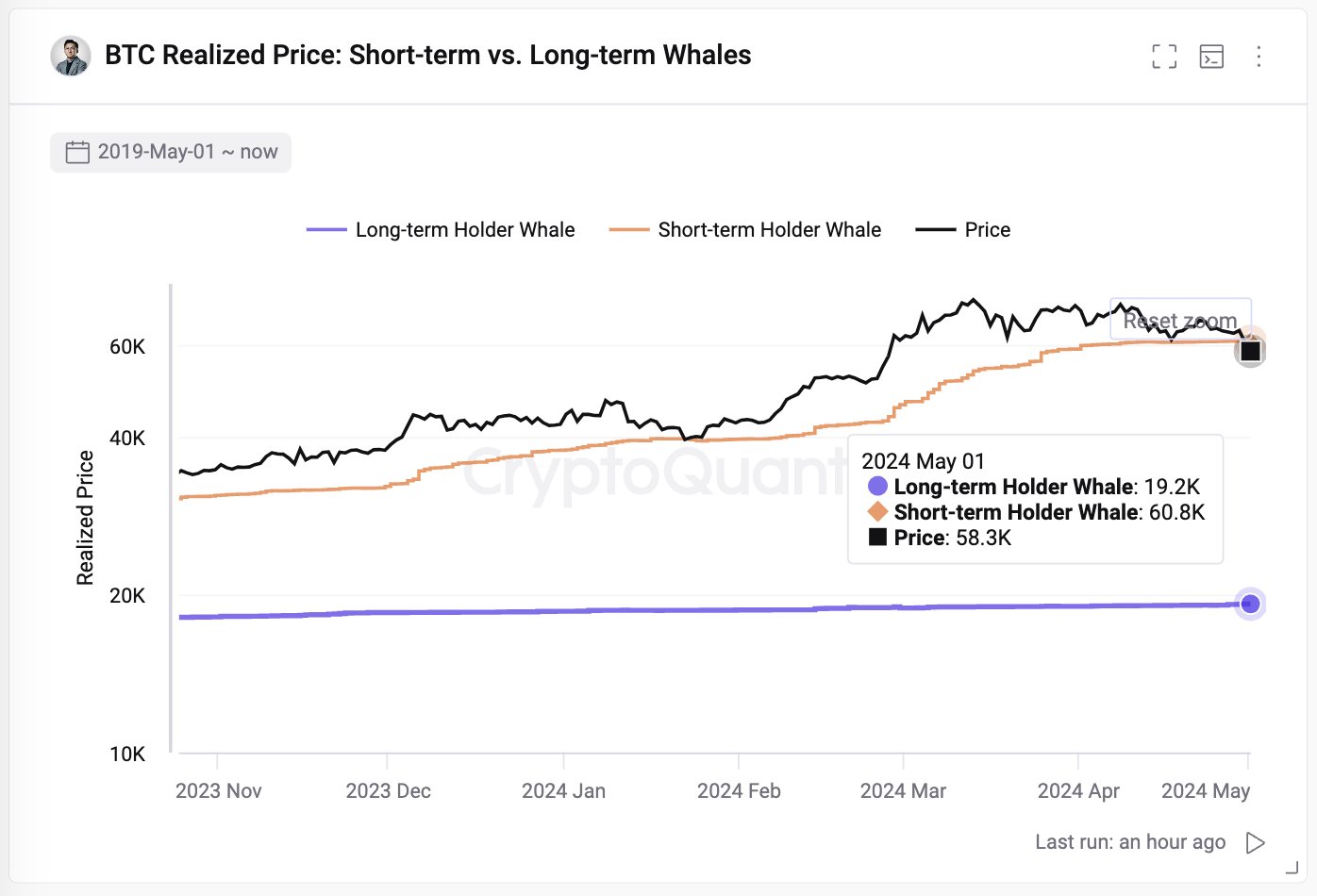

The current situation in the Bitcoin market is quite intriguing, as BTC price currently hovers around the average purchase price of buyers of spot Bitcoin ETFs, ranging from approximately $57,000 to $58,000. The average Bitcoin ETF buyer is now underwater and institutional investors struggle to justify allocating more capital to Bitcoin ETFs.

Without an immediate catalyst, despite BlackRock leading the Bitcoin ETF, portfolio managers are questioned about Bitcoin ETF risk limits as investors are at a slight loss. Spot Bitcoin ETF saw the worst selloff of $550 million on Wednesday, with outflows continuing daily.

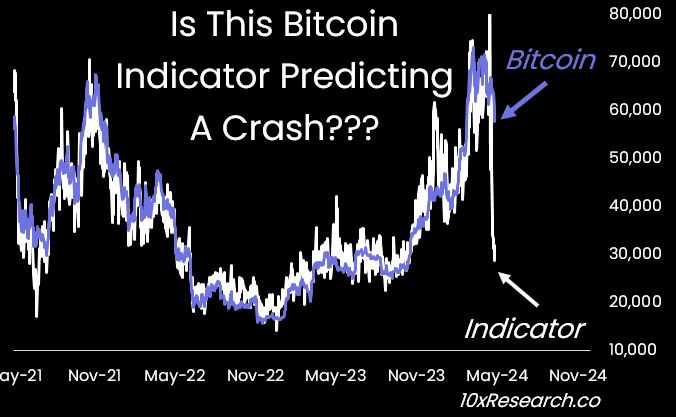

Markus Thielen highlighted an indicator predicting a much lower Bitcoin price, price fluctuations and trends are almost accurate by the indicator.

The indicator predicts a crash to $30,000, which is lower that what veteran trader Peter Brandt predicted in his BTC price prediction. He said Bitcoin risks falling to a higher $40s level.

Perhaps dip into high 40s, then bull resumes

— Peter Brandt (@PeterLBrandt) May 1, 2024

BTC Price Trades at $58K

CryptoQuant CEO Ku Young Ju said new Bitcoin whales and spot ETF buyers are now underwater. He predicts a max pain near the $51,000 level, but suggests buying the dip as may be a rare chance to beat TradFi whales.

BTC price jumped 1% in the past 24 hours, with the price currently trading at $58,700. The 24-hour low and high are $56,592 and $59,389, respectively. Furthermore, the trading volume has decreased by 10% in the last 24 hours, indicating a decline in interest among traders.

Also Read:

- Ripple Vs. SEC: What To Expect From Ripple’s Reply As XRP Price Jumps 4%

- Shiba Inu News: 1.75 Trillion SHIB Moves From Robinhood, What’s Happening?

- BNP Paribas With $600B AUM Reveals Exposure To BlackRock Bitcoin ETF

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- U.S. CPI Release: Wall Street Predicts Soft Inflation Reading as Crypto Market Holds Steady

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter