Editorial: Why the 2020 Bitcoin Bull Run Ain’t Over Yet?

Bitcoin experienced a $3,000 price crash as it was inching close to its 2017 price high, the price fell from $19,800 to below %16,500. Currently, bitcoin is consolidating around $17,000 and is expected to bounce back and go past its all time high. However, despite the price crash, the bitcoin community is quite bullish as the price correction was expected and unlike 2017, the institutional Fomo has driven the price throughout.

In a bull market when prices continue to rise, a pullback of 30% is considered normal and not something to worry about and key bitcoin charts indicate the same. The 2017 bitcoin bull run was mostly a fan frenzy and the prices rose suddenly towards the last week of December and fell right after touching the all-time-high. Thus, the present crash is being seen as a good sign as even during the last bull run bitcoin price slumped to a 30% fall right before creating an all-time-high price of nearly $20,000 on some exchanges.

The Differentiating Factor Between 2020 and 2017 Bull Run

The current bitcoin bull rally is being considered to be quite different from the 2017 one for a number of reasons, the key reason being adoption. Bitcoin is no more just a speculative internet bubble, in fact 2020 has been quite bullish for bitcoin right from the block reward halving to the adoption from mainstream hedge funds as well as the likes of PayPal who have openly endorsed bitcoin, phenomenon never witnessed before.

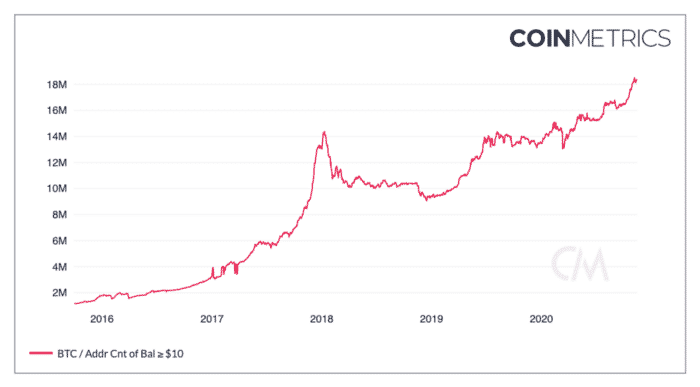

If we look at the number of bitcoin addresses with more than $10 in balance, we will see a constant rise from the end of 2018 and currently nearing 18 million mark.

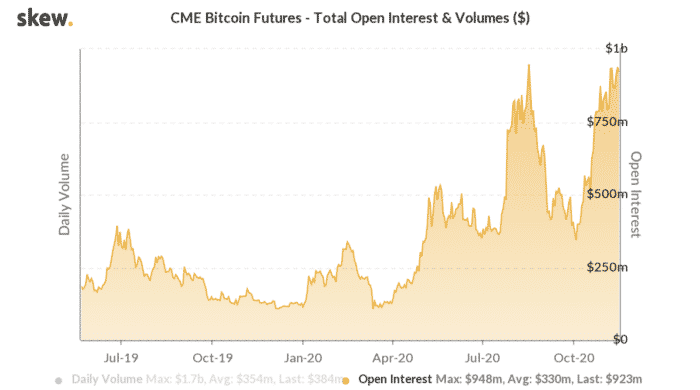

Another key factor which points towards the growing confidence of institutional players in Bitcoin as a safe bet and a store of value is the record growing volume of open interest on CME. Bitcoin Futures contracts backed by liquid bitcoin on CME has seen the volume of open interest volume near $1 billion mark. Open interest referees to the total value of outstanding contracts that are yet to be settled.

The fact that CME is a heavily regulated platform which is a clear indication of rising interest of institutional players in bitcoin.

The growing retail interest along with the influx of institutional players has made bitcoin one of the most sought after asset class at the present movement. Many believe bitcoin is currently shifting gears and catapulting to mainstream adoption with the ongoing bull run.

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- U.S. CPI Release: Wall Street Predicts Soft Inflation Reading as Crypto Market Holds Steady

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter