207,000 Bitcoins Have Exited Exchanges From Late July Till Present

- Despite the present bearish trend of the market, Bitcoin balances on leading exchanges remain a source of bullish expectations. Glassnode’s latest on-chain report notes that aside from a few exchanges, there have been massive outflows of Bitcoin from the market.

Bitcoin exchange balances are trending towards relative equilibrium

The report, published earlier this week, noted that the market seemed to be striking a balance between inflows and outflows from exchanges. While one group of exchanges were seeing net inflows, another cohort balanced it out with inflows.

Glassnode names Binance, Bittrex, and FTX to be the main culprits responsible for massive inflows. Combined, the three exchanges had seen inflows of 207,000 BTC since July 2021. This is a growth of 24.3%, the report said.

Of the three exchanges, Binance and FTX still stand out for inflows. The two exchanges hold a combined total of 103.2k BTC, while they used to hold only about 3k BTC two years ago.

Where the increase would ordinarily be very bearish for the market, there is some bullish aspect to it. Glassnode attributes Binance’s and FTX’s increasing balance dominance to the proliferation of derivatives trading in the market where Bitcoin is probably being used as margin collateral.

Binance and FTX represent the stand-out exchanges in market share increase over the last two years, both of which have a corresponding increase in futures market dominance, the analysts observed.

On the outflows side, Glassnode mentioned that Huobi, Gemini, Kraken, and Bithumb have witnessed a dip in BTC supply during the last few months. Huobi was the biggest hit, having fallen from over 400k BTC in 2020 to just around 12.3k BTC at present.

However, Glassnode revealed that on aggregate, 574,876 BTC (or 3.655% of Bitcoin’s circulating supply) has left the coffers of exchanges since March 2020. Adding that the market has established a relative equilibrium since September 2021.

Glassnode intoned that the net outflow was made even more impressive by the fact that more metrics were in favor of exchange inflow than outflows.

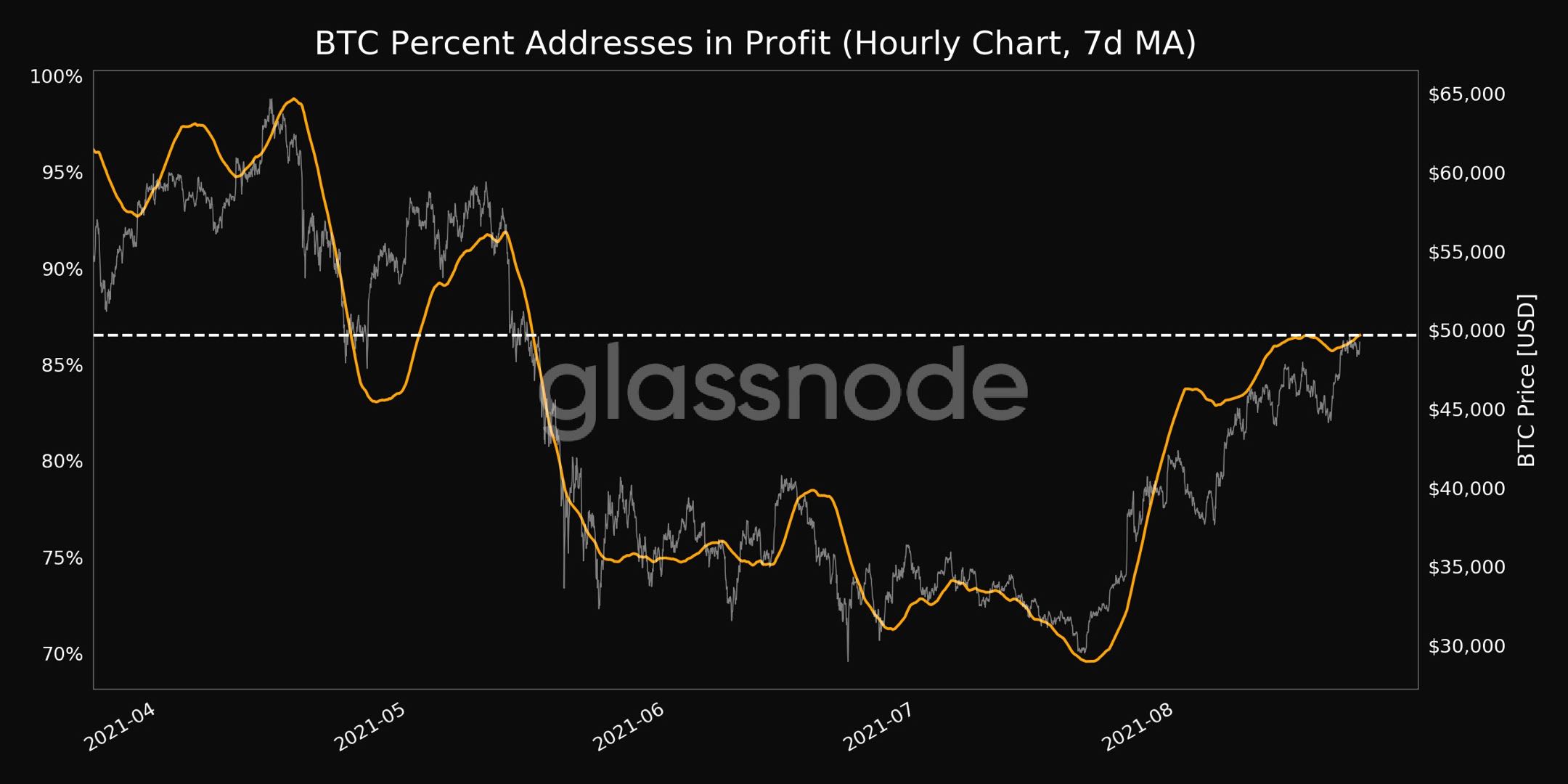

The impact of the outflows on Bitcoin’s price

Exchange supply has historical precedence for affecting the price of Bitcoin. The drop in supply on major exchanges usually creates demand that eventually drives prices upwards.

This is one reason that Glassnode points out the on-chain data. The firm anticipates that if the market should see increased demand at these exchange supply levels, the price of Bitcoin could skyrocket. Failing to increase demand, there might be a “re-invigoration of sellers.”

Bitcoin is trading at about $39,900, up 2.24% in the last 24 hours at the time of writing. However, the market is down 4.06% in the last week as Bitcoin’s market cap continues to linger below $800 billion as liquidations continue to surge.

Recent Posts

- Crypto News

Breaking: U.S. GDP Rises To 4.3% In Q3, BTC Price Climbs

The U.S. economy grew faster than expected in the third quarter of this year, its…

- Crypto News

Breaking: Bank of Russia Proposes Allowing Investors to Buy Bitcoin and Crypto in Major Regulatory Shift

Russia is willing to transform its approach to cryptocurrencies. According to the Bank of Russia,…

- Crypto News

Crypto ETF Issuer 21Shares Advances Dogecoin ETF Bid with Amended S-1 Filing

Crypto ETF issuer 21Shares has indicated it still intends to launch its Dogecoin ETF, as…

- Bitcoin News

Bitcoin Crash Risk Mounts As Peter Brandt Points to 80% Declines in Every Major Cycle

Veteran trader Peter Brandt has recently sparked a debate in the crypto market, predicting Bitcoin’s…

- Bitcoin News

Bitcoin Whale Doubles Down on BTC, ETH, SOL Short Positions, $243M at Stake

A Bitcoin whale has made a bold move, betting big on short positions in BTC,…

- Bitcoin News

IMF and El Salvador in Bitcoin Talks: Progress Made, Compliance Deadline Set

El Salvador is nearing a crucial milestone in its Bitcoin initiatives as the International Monetary…