London hardfork: Surprisingly Low Adoption of EIP-1559 Miner Fee Model on Ethereum

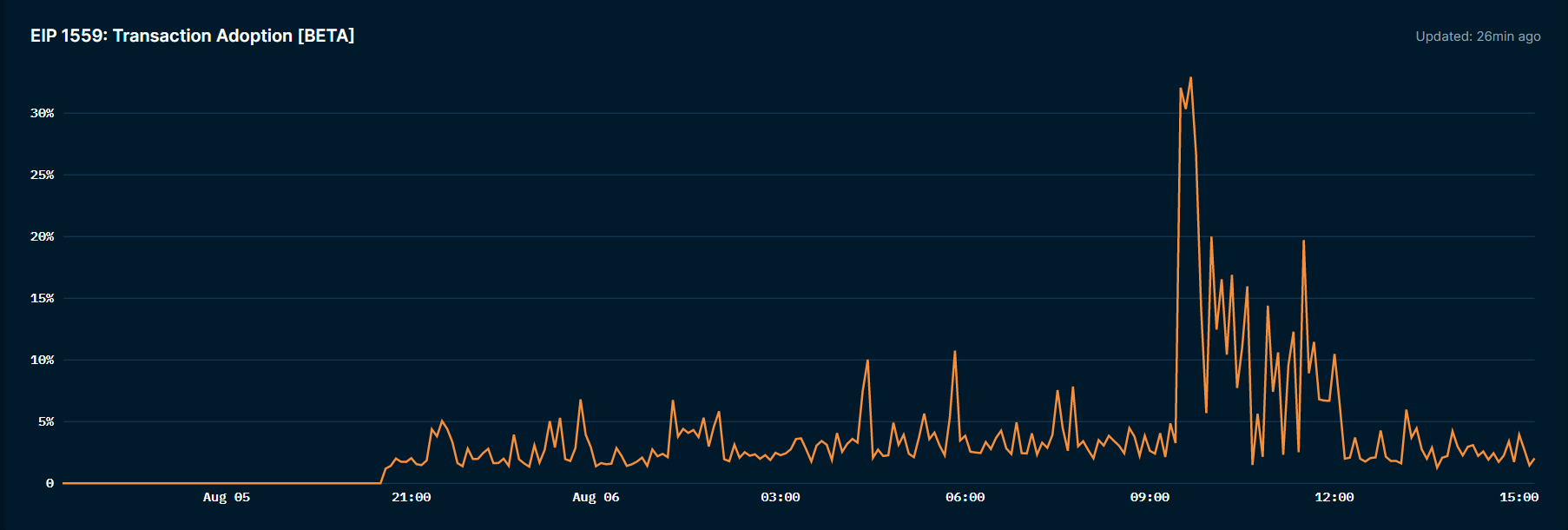

On Thursday, August 5, the much-awaited London hardfork finally went live with the implementation of the EIP-1559 protocol. However, it looks like the adoption of the EIP-1559 miner fee model is seeing a slow start.

Data provided by Nansen shows that only 5% of the Ethereum transactions are currently using the EIP-1559 model. This indicates that most of the current user transactions haven’t moved to EIP-1559.

However, the ETH burning has kickstarted on a good note. Data from Etherchain shows that 4371 ETH coins have been burnt so far at a rate of 3.04 ETH/minute. Considering the current ETH price of $2762, over $12 million of ETH has been burnt on the blockchain.

However, the rate of Ethereum supply still remains considerably higher than the rate of burning. However, the ETH burning has certainly put some pressure on ETH supply inflation reducing it from 3.3% on the course of the year to now under 2.65%.

But Why Did ETH Gas Price Shot Up?

As per data on BitInfoCharts, the average ETH gas price has shot up to $15 in the wake of EIP-1559. This is surprising since the protocol implementation was supposed to reduce the transaction costs.

Ethereum ecosystem researcher trent.eth explains the reason behind the same. He notes that there have been few major NFT drops leading to congestion. Furthermore, many exchanges disable functions in a window around the network upgrade.

This creates a pent-up demand which subsides only once each exchange has been satisfied with chain stability. He further explains: “Some miners are setting a gas limit below 30mm, which gives us a target of ~13.5mm gas. Comparatively, the gas limit before the upgrade was 15mm → less blockspace available → a reduction in throughput 4. Positive outcome → ETH market volatility → increase in gas prices”.

The picture will be more clear over the next week as more and more exchanges implement the network upgrades.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs