Worst Polkadot Tokens This Week: Polkadot, Chainlink, Ankr, Ontology Dipped

Worst Polkadot Tokens This Week:

The tokens on the Polkadot ecosystem have shown some optimism by going slightly up today. However, some of the major tokens in the chain have plunged down in the past 7 days.

Bestay has seen a double-digit downfall of 21.44%. OAX and Polkapets have fallen sharply by 9.88% and 11.09% respectively. Unido EP dipped by 6.24%.

The market cap of the ecosystem stands at 123.81 billion USD an increase of 0.67%. Trading volume is down by 1.97%.

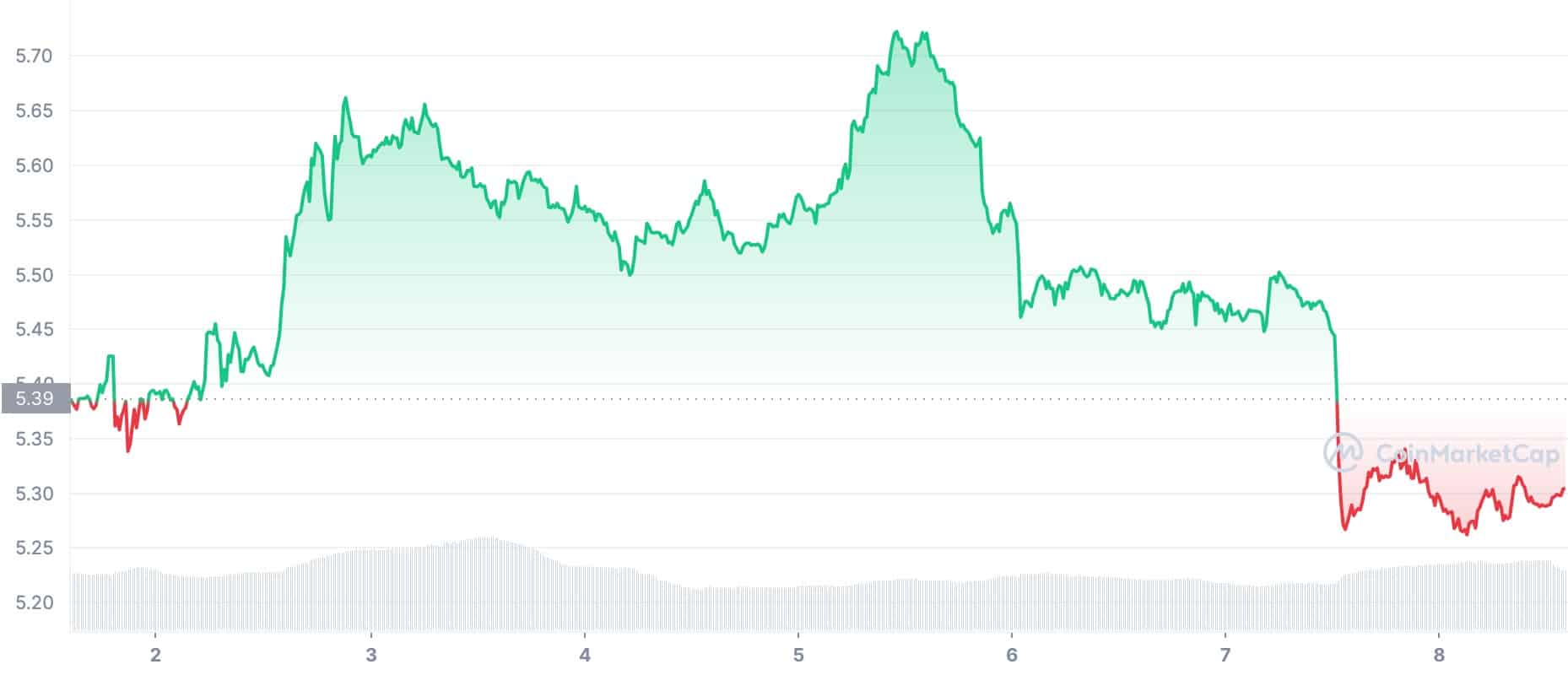

Polkadot (DOT)

Polkadot is up by a mere 0.39% today and each token is selling at 5.30 USD. The market cap is 607.85 billion USD. Trading volume is up by 5.66%. In the past week, it has shown a decline of 1.41%. Precisely, Polkadot has been going up and down in the week.

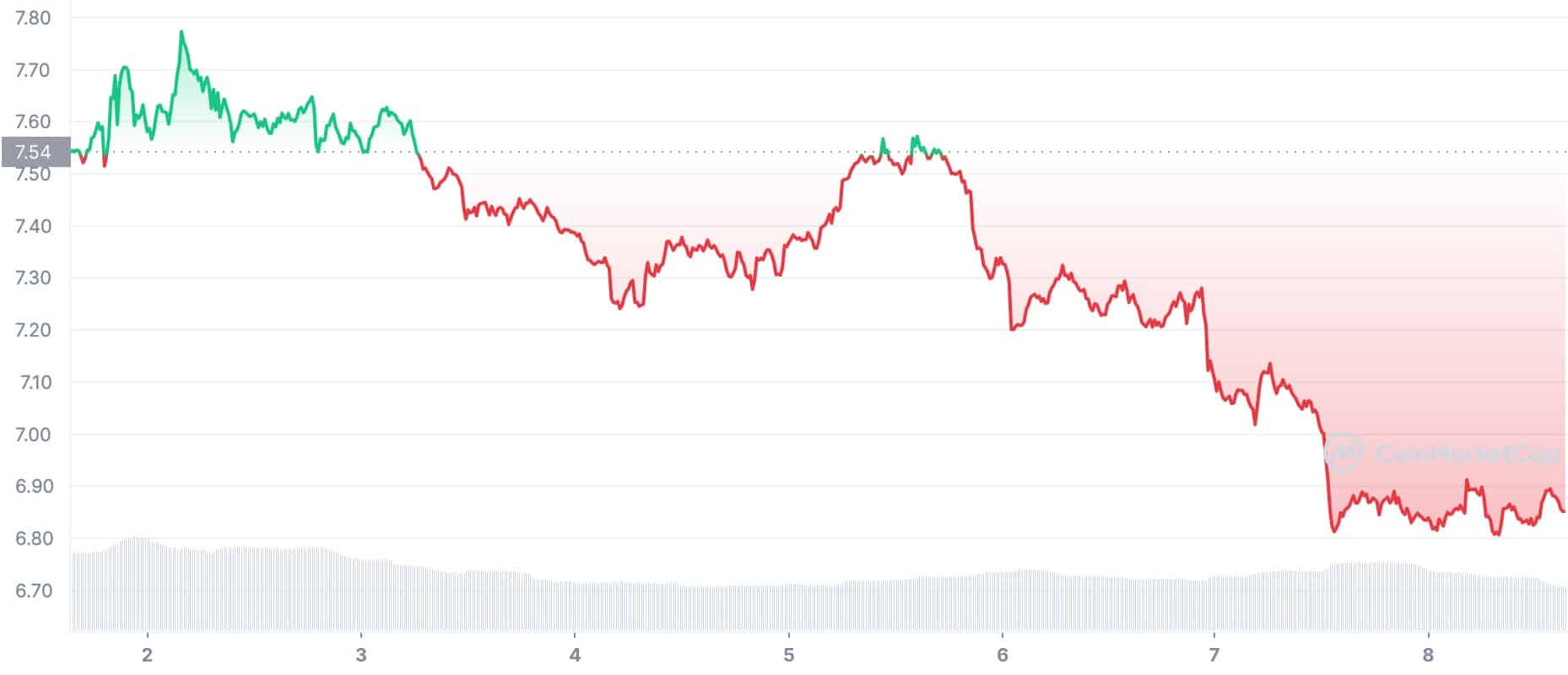

Chainlink (LINK)

With an increase of 0.48% in the last 24 hours, each LINK token is costing 6.88 USD. The market cap stands at 349.29 billion USD. Trading volume has seen a fall of 34.23%. In this week, it has fallen drastically downwards by 8.94%.

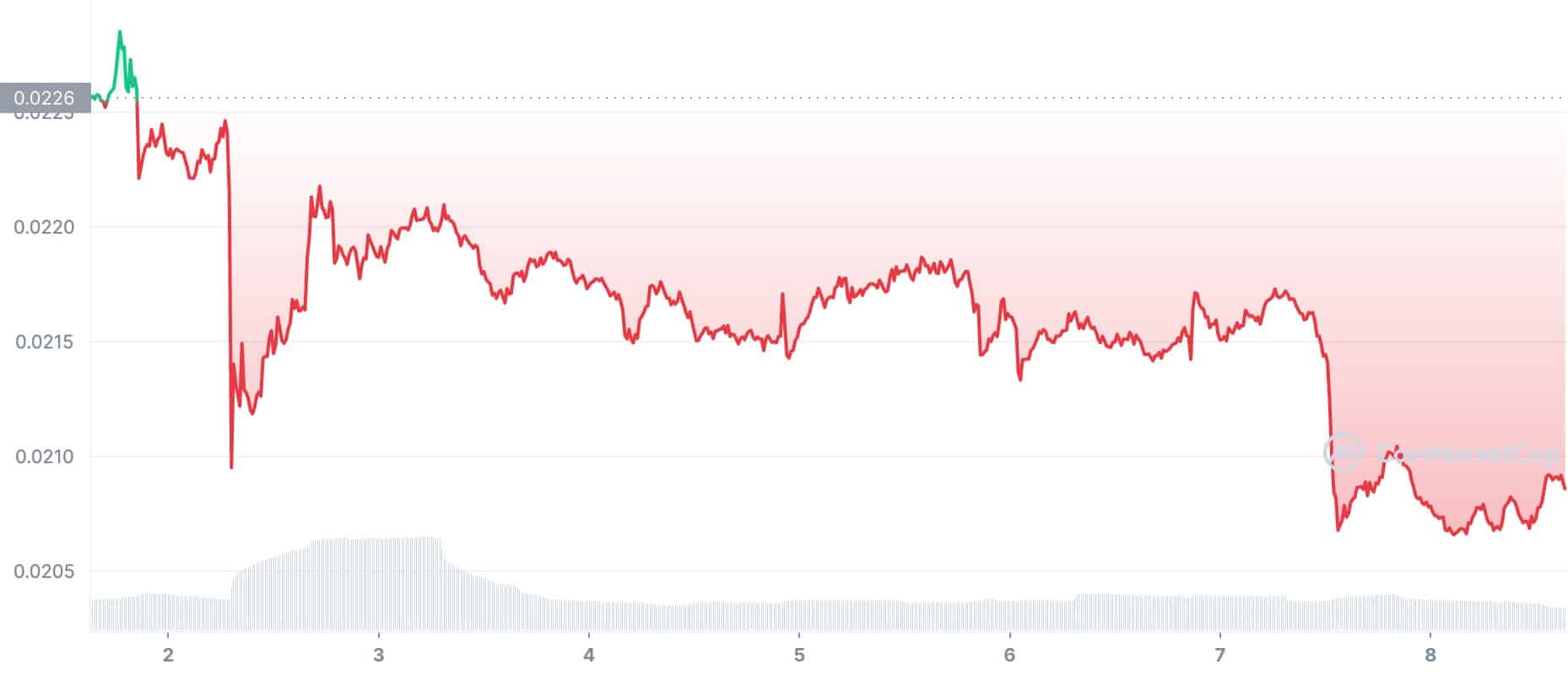

Ankr (ANKR)

Ankr has risen by 0.24% in the last 24 hours, however, it has dropped by 7.42% in the week. Presently, the market cap is 201.83 billion USD. Trading volume has slashed by 34.93% in the last 24 hours.

Conclusion

The coins in Polkadot have been dipping in the past 7 days, however, coins are showing some recovery today.

- 3 Reasons Why Bitcoin and Gold Prices Are Going Up

- Why is Crypto Market Up Today (Feb 9)

- Will Bitcoin Crash Again as ‘Trump Insider’ Whale Dumps 6,599 BTC

- XRP News: Ripple’s RLUSD Gets Boost as CFTC Expands Approved Tokenized Collateral

- Crypto Markets Brace as Another Partial U.S. Government Shutdown Looms Next Week

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry

- Ethereum Price Outlook as Vitalik Buterin Sells $14 Million Worth of ETH: What’s Next for Ether?

- Solana Price at Risk of Crashing Below $50 as Crypto Fear and Greed Index Plunges to 5

- Pi Network Price Prediction Ahead of PI KYC Validator Reward System Launch