5 Top Stable Coins To Add To Your Portfolio This Week

Many investors are being saved by stablecoins from the almost inevitable volatility of the cryptocurrency market. Investors buy stable coins every day because they provide better security against cryptocurrency volatility. The technology of stablecoins is one that has great potential but also has a variety of advantages, strategies for implementation, risks related to liquidity, and potential acceptance barriers.

Here are the Top 5 Stable Coins To Add To Your Portfolio This Week

- Tether (USDT)

- USD Coin (USDC)

- Binance (BUSD)

- Dai (DAI)

- Pax Dollar (USDP)

1. Tether (USDT)

Tether was among the first stable coins to enter the market. A cryptocurrency based on the Bitcoin blockchain, it was first introduced as the Real coin in 2014. The Algorand, EOS, OMG, Tron, Bitcoin, Ethereum, and Tether blockchains are currently supported by Tether. Tether wants to bring together the advantages of cryptocurrency tokens. Also, the security of fiat money.

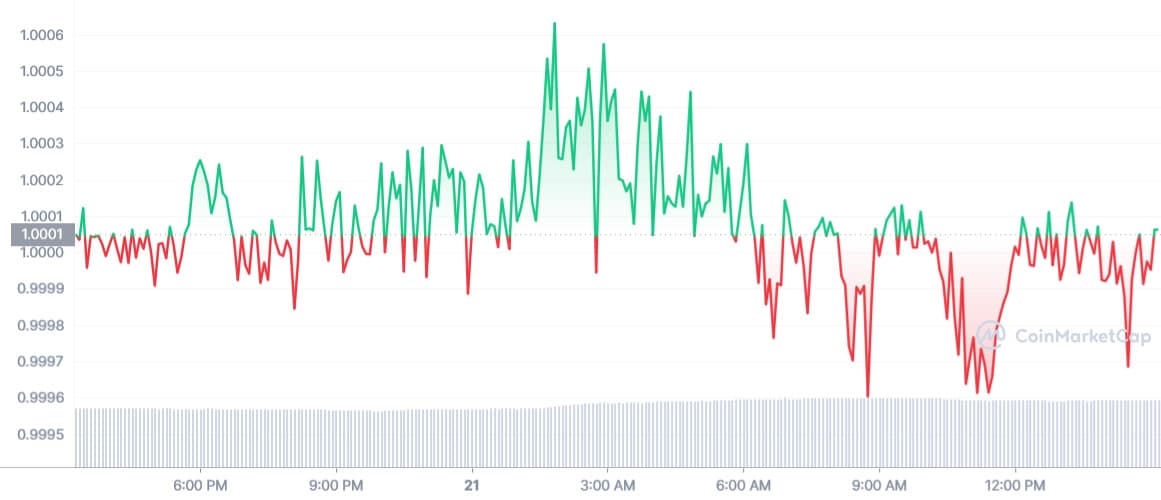

Tether’s price at the time of writing is $1.00, with a market capitalization of $ 66.5 B and a 24-hour trading volume up by 43.79%. Now it stands at $37.6 B. At the same time, the circulating supply is approximately 66,484,835,812 USDT as per the crypto market tracker CoinMarketCap.

2. USD Coin (USDC)

USDC calls itself a “digital dollar”. Both money and short-term US treasuries are used to secure it. This makes it possible for them to offer a 1:1 conversion. Also, allowing you to turn any USDC you possess into US dollars. Many US financial institutions are responsible for the reserves’ custody. In order to ensure transparency, this is also audited each month.

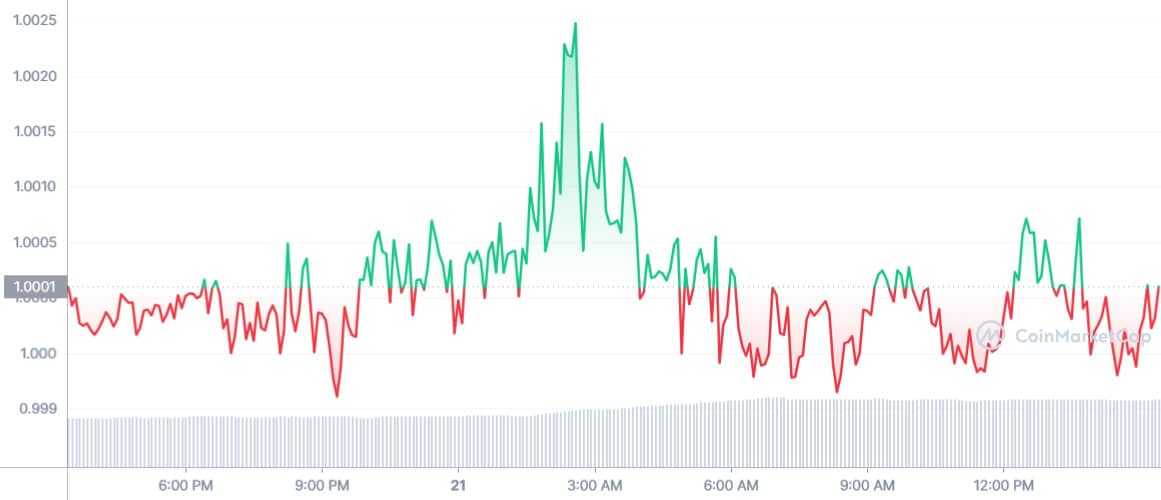

USD Coin’s price at the time of writing is $0.9999, with a market capitalization of $ 43 B and a 24-hour trading volume up by 15.67%. Now it stands at $3.4 B. At the same time, the circulating supply is approximately 43,210,272,437 USDC as per the crypto market tracker CoinMarketCap.

Also Read: Is ChatGPT The New Google? How Crypto Traders May Benefit From It

3. Binance (BUSD)

Binance USD was introduced in 2019. It is a stablecoin backed 1:1. Paxos and Binance, a cryptocurrency financial institution, founded it. Paxos holds reserves equal to the quantity of BUSD tokens in circulation. However, just like other fiat-backed stablecoins. BUSD’s ability to be used in virtually any situation where the ERC-20 Ethereum platform is supported is one of its many advantages.

Binance USD’s price at the time of writing is $1.00, with a market capitalization of $ 16 B and a 24-hour trading volume up by 51.11%. Now it stands at $11.4 B. At the same time, the circulating supply is approximately 16,336,869,437 BUSD as per the crypto market tracker CoinMarketCap.

4. Dai (DAI)

DAI was introduced by MakerDAO. It is a stablecoin that guards against censorship by lacking a centralized issuing authority like other stablecoins. DAI uses collateralized debt in the form of Ether (ETH). However, the native cryptocurrency of the Ethereum blockchain, and is pegged to the US dollar. Dai is one of the top-performing stablecoins.

Dai’s price at the time of writing is $1.00, with a market capitalization of $ 8.5 B and a 24-hour trading volume up by 39.45%. However, now it stands at $190 million. At the same time, the circulating supply is approximately 5,856,977,464 DAI as per the crypto market tracker CoinMarketCap.

5. Pax Dollar (USDP)

On Paxos’ website, the Pax Dollar is advertised as the “world’s leading regulated stablecoin.”Paxos Standard (PAX) debuted in 2018. However, Pax Dollar (USDP) made its debut in August of the same year. The coin’s name was changed by Paxos to more closely reflect the name and ticker of the American dollar.

Pax Dollar’s price at the time of writing is $0.9969, with a market capitalization of $ 875 million and a 24-hour trading volume up by 0.52%. Now it stands at $1.9 million. At the same time, the circulating supply is approximately 878,084,065 USDP as per the crypto market tracker CoinMarketCap

Disclaimer: This is not investment advice. Please do your due diligence before investing in any asset.

Also Read: Explained: What Are PFP NFTs And How Do They Work?

- 3 Reasons Why Bitcoin and Gold Prices Are Going Up

- Why is Crypto Market Up Today (Feb 9)

- Will Bitcoin Crash Again as ‘Trump Insider’ Whale Dumps 6,599 BTC

- XRP News: Ripple’s RLUSD Gets Boost as CFTC Expands Approved Tokenized Collateral

- Crypto Markets Brace as Another Partial U.S. Government Shutdown Looms Next Week

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry

- Ethereum Price Outlook as Vitalik Buterin Sells $14 Million Worth of ETH: What’s Next for Ether?

- Solana Price at Risk of Crashing Below $50 as Crypto Fear and Greed Index Plunges to 5

- Pi Network Price Prediction Ahead of PI KYC Validator Reward System Launch