Theta Price Prediction Hints Early Signs of Trend Reversal; Will Buyers Regain $1?

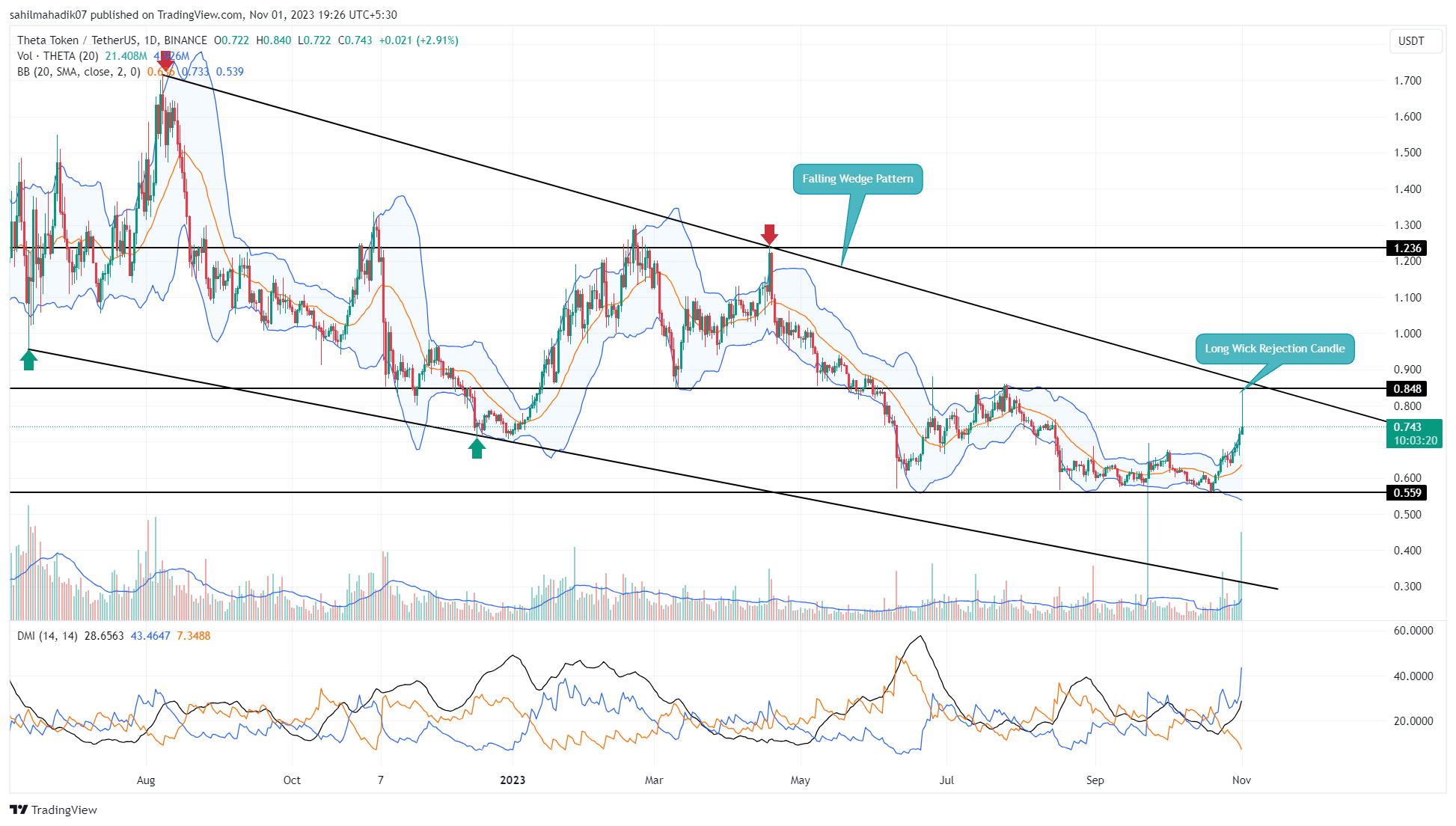

Theta Price Prediction: In sync with the market’s broader recovery sentiment, Theta coin price has experienced a substantial uptick starting from the fourth week of October. The altcoin has soared from $0.564 to its current trading price of $0.745, marking a 32% increase. Given this sustained buying interest, the coin price is poised to challenge the upper trendline of a longstanding falling wedge pattern, aiming to extend its bullish momentum.

Also Read: VanEck Updates Spot Bitcoin ETF Filing With US SEC

Overhead Supply Threatens New Correction

- The Theta price may face intense supply at $0.85 aligned with the downsloping trendline.

- A bearish reversal from the resistance trendline may trigger a 26% drop

- The intraday trading volume in Theta is $105.5 Million, indicating a 505% gain.

Over a span of 16 months, the THETA price has witnessed a persistent downtrend, with the formation of a falling wedge pattern. Within this timeframe, the price has twice rebounded from both the upper and lower trendlines, emphasizing the pattern’s significant impact on market behavior.

Earlier today, the Theta price jumped 17.67% amid a surge in trading volume, attempting to break through the overhead resistance trendline. However, the coin failed to maintain these gains, leading to a long-wick rejection candle on the daily chart.

This supply pressure at crucial resistance indicates the sellers continue to defend higher levels which could trigger a significant correction in the near term. Should the price close below today’s low of $0.722, the October gains may be rapidly erased, pulling this altcoin back to the $0.56 region.

Will THETA Price Recovery Hit $1?

The near-term outlook for Theta ranges from sideways to bearish amid market volatility and overhead supply pressures. In theory, the converging nature of the pattern’s trend lines reflects the exhaustion of bearish momentum which buyers can take advantage of to retake trend control A successful bullish breakout above the upper trendline would serve as an early indication of a trend reversal, providing an solid foundation for further recovery. Such a move could propel the coin toward the $1.236 level, representing a remarkable 66% growth from its current position.

- Bollinger band: the upswing in the upper boundary of the Bollinger band indicator reflects the buying momentum is aggressive.

- Average Directional Index: The rising ADX slope at 28% suggests that buyers possess sufficient strength to sustain the ongoing recovery rally

- India’s Crypto Taxation Unchanged as the Existing 30% Tax Retains

- Crypto News: Strategy Bitcoin Underwater After 30% BTC Crash

- Expert Predicts Ethereum Crash Below $2K as Tom Lee’s BitMine ETH Unrealized Loss Hits $6B

- Bitcoin Falls Below $80K as Crypto Market Sees $2.5 Billion In Liquidations

- Top Reasons Why XRP Price Is Dropping Today

- Here’s Why MSTR Stock Price Could Explode in February 2026

- Bitcoin and XRP Price Prediction After U.S. Government Shuts Down

- Ethereum Price Prediction As Vitalik Withdraws ETH Worth $44M- Is a Crash to $2k ahead?

- Bitcoin Price Prediction as Trump Names Kevin Warsh as new Fed Reserve Chair

- XRP Price Outlook Ahead of Possible Government Shutdown

- Ethereum and XRP Price Prediction as Odds of Trump Attack on Iran Rise