Aave Technical Analysis: LEND plummets 20% in 24 hours as altcoins bleed across the board

- Aave reacts to a bear flag, extending the lower leg to refresh support at $5.50.

- LEND/USD is mainly in the bulls’ hands, but a reversal is anticipated at $5.00.

The cryptocurrency market is deeply in the red following the initial declines recorded in September’s first week. Recovery has not been forthcoming both for the small coins and the large coins by market capitalization. For instance, Bitcoin dived to support at $9,800, but its recovery steam keeps losing momentum before hitting $11,000. Similarly, the smart contracts giant token, Ethereum, has not risen past the critical resistance at $400.

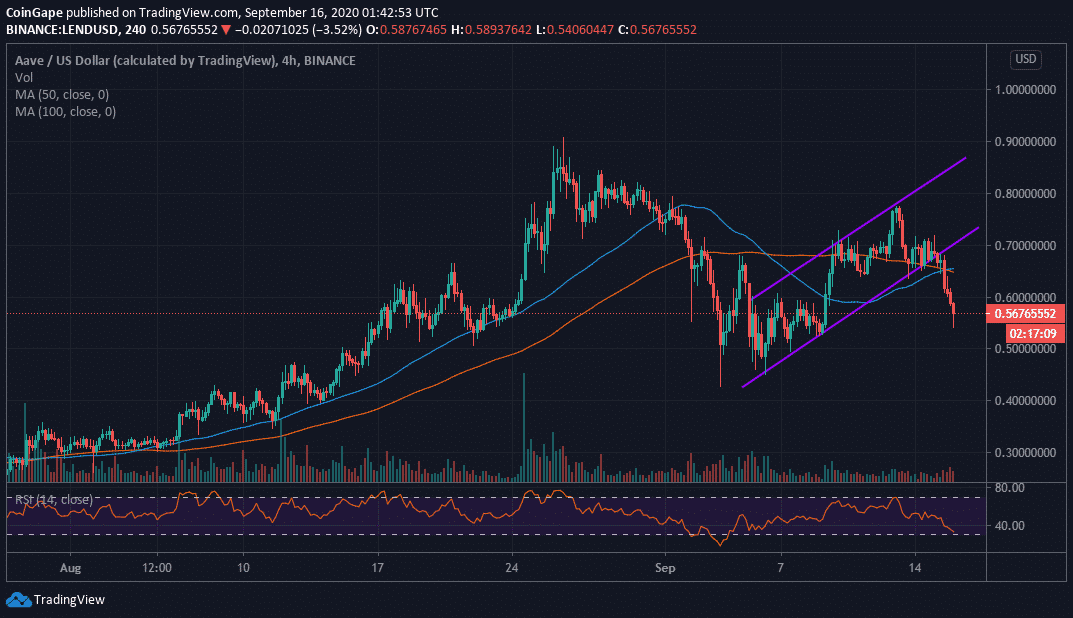

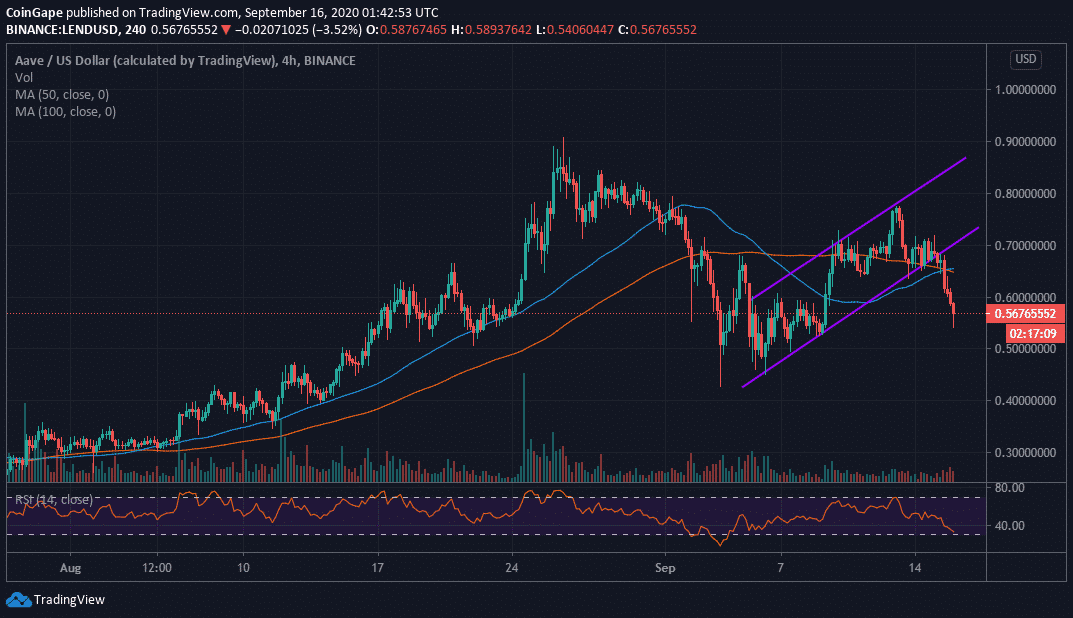

DeFi projects like Aave are performing worse than the major coins. In the last 24 hours, LEND has lost over 20%. At the time of writing, the token is seeking support at $0.55. The losses come after Aave reacted to a bear flag pattern, as illustrated in the 4-hour range.

LEND/USD 4-hour chart

Flag patterns are used in technical analysis to signal the continuation of the previous trend. For example, LEND succumbed to the bearish pressure in the first week of September. The token was forced to seek support above $0.40. A recovery ensued with a bear flag pattern that eventually broke down, paving the way to continue the bearish trend.

In the meantime, technical levels highlight that Aave is not down with the downside. The ongoing declines have potential aiming for support at $0.50 and $0.40, respectively.

Consequently, if support at $5.00 holds the fort, there a chance that Aave would resume the uptrend. The notion for recovery is brought to light by the golden cross formed like the 50 Simple Moving Average (SMA) crossed above the 100 SMA. In other words, there is some buying pressure in the market, perhaps not enough to cause an immediate reversal.

LEND Intraday Levels

Spot rate: $0.57

Percentage change: -3.86

Relative change: -0.021

Trend: Bearish

Volatility: Expanding

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Bitget Targets 40% of Tokenized Stock Trading by 2030, Boosts TradFi with One-Click Access

- Trump-Linked World Liberty Targets $9T Forex Market With “World Swap” Launch

- Analysts Warn BTC Price Crash to $10K as Glassnode Flags Structural Weakness

- $1B Binance SAFU Fund Enters Top 10 Bitcoin Treasuries, Overtakes Coinbase

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown