After Bitcoin (BTC) Fails to Breach $50K, It Finds Strong Support At $46K

On Sunday, February 14, the Bitcoin (BTC) price shot to its new all-time high above $49,450 levels in a rally supported by strong buying on Asia exchanges. However, Bitcoin (BTC) failed to breach $50,000 levels and has seen minor pullback since then.

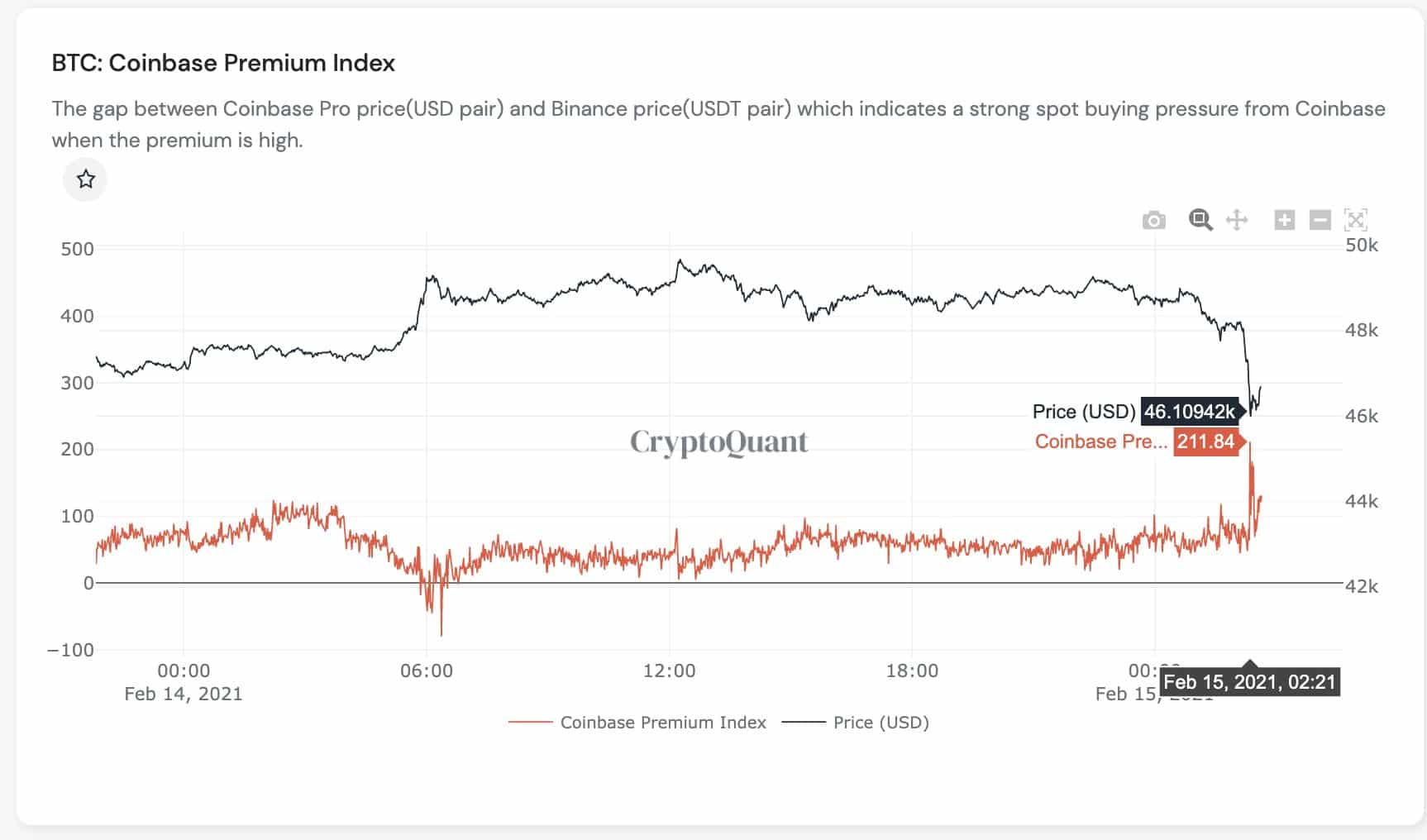

At press time, Bitcoin (BTC) is trading at a price of $46,904 with a market cap of $871 billion. The Bitcoin price pullback was obvious as the Coinbase Premium had turned negative as BTC hit a new all-time high. The latest data from CryptoQuant shows that the Coinbase Premium has flipped once again to +$211. As noted by CryptoQuant, “the gap between Coinbase Pro price(USD pair) and Binance price(USDT pair) which indicates a strong spot buying pressure from Coinbase when the premium is high”.

- They might protect this level in the short term.

- Whales from other exchanges were selling $BTC so hard

Bitcoin (BTC) Supply Transition from Long Term to Short Term Holders

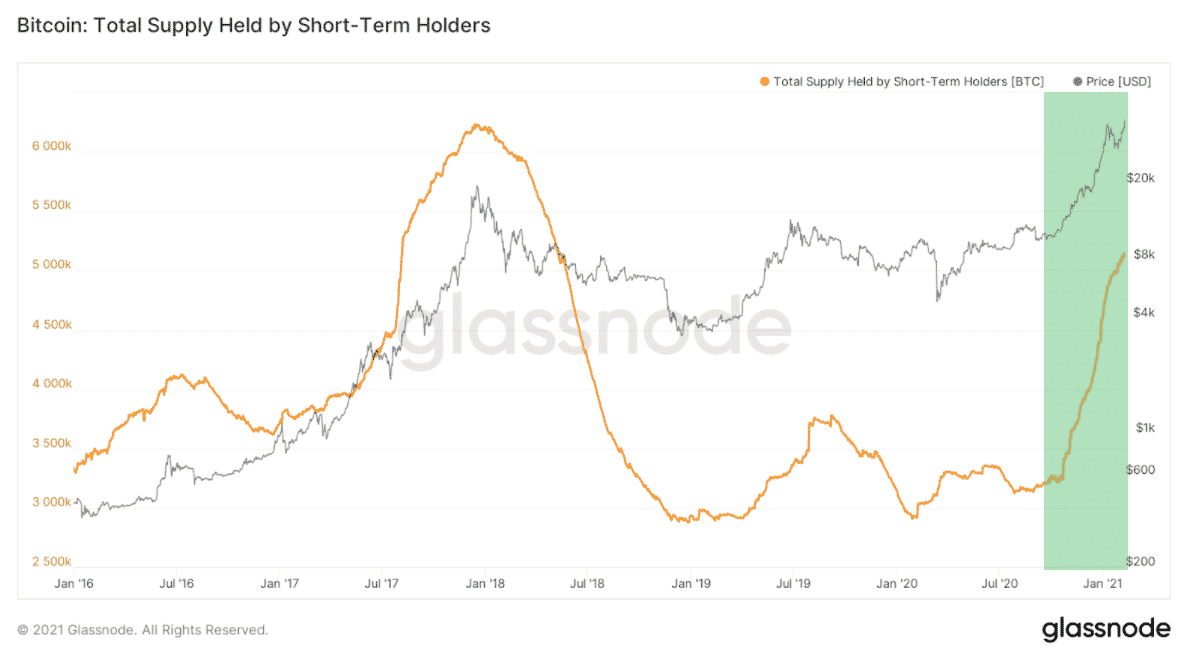

As per cryptocurrency on-data analytics platform Glassnode, we are somewhere in the middle of supply transition taking place from long term to short term holders. The data from Glassnode shows that short-term holders have also been accumulating so far in 2021.

The recent accumulation by short-term holders suggests that they are critical in driving the BTC price action in a short period of time. Unlike long-term holders, “short-term holders are much more elastic to price, and therefore respond faster to changes in bitcoin’s price” states Glassnode. The on-chain data provider also notes:

“It is important to keep track of the short term supply that is in profit, as any change in price over a certain magnitude can cause a mass short term selloff. This effect becomes extreme at the later stages of the bull market, as short term holders become more and more sensitive to price movements”.

Interestingly, another data from Glassnode shows that unlike the previous Bitcoin bull cycles, miner outflows are as prominent this time. Meaning miners are willing to hold their Bitcoins at this stage.

Previous #Bitcoin bull markets are characterized by fingerprints of increased miner outflows of $BTC that had been acquired throughout prior years.

Even though we're seeing slightly higher outflows of older BTC, this same pattern has not emerged in the current bull market. pic.twitter.com/XdaZvNIz38

— glassnode (@glassnode) February 14, 2021

- Crypto Market Watches as Federal Reserve Injects $6.8B in Liquidity Today

- BOJ Rate Hike Backfires: Yen Crashes, Bitcoin Price Rally Uncertain

- Canary Capital Announces Major Changes to Its SUI ETF

- Michael Saylor’s “Green Dots” Message Hints At Fresh Bitcoin Buying As BTC Faces $90K Wall

- Fed’s Hammack Signals No Rush to Cut Rates as January Hold Odds Near 80%

- Will Solana Price Hit $150 as Mangocueticals Partners With Cube Group on $100M SOL Treasury?

- SUI Price Forecast After Bitwise Filed for SUI ETF With U.S. SEC – Is $3 Next?

- Bitcoin Price Alarming Pattern Points to a Dip to $80k as $2.7b Options Expires Today

- Dogecoin Price Prediction Points to $0.20 Rebound as Coinbase Launches Regulated DOGE Futures

- Pi Coin Price Prediction as Expert Warns Bitcoin May Hit $70k After BoJ Rate Hike

- Cardano Price Outlook: Will the NIGHT Token Demand Surge Trigger a Rebound?

Claim $500

Claim $500