Amid Bitcoin Price Rally, BTC Funds See Major Outflows, This Cohort Is Booking Profits

As tremors spread across the global banking system, the world’s largest cryptocurrency Bitcoin (BTC) has delivered a strong performance. Last week, the BTC price gained more than 30% moving all the way to $28,000 level.

But just as the Bitcoin price made new highs last week, institutional outflows from Bitcoin continued simultaneously. In its latest weekly report, CoinShares reported that BTC funds saw massive outflows last week. But still, the inflows dominate the outflows on a year-to-date chart. CoinShares also added:

“Bitcoin, being the largest digital asset, was the primary focus, seeing outflows totalling US$244m last week. Short-bitcoin also saw outflows totalling US$1.2m, although it is now the investment product with the largest inflows year-to-date of US$49m”.

The report notes that the negative sentiment was broad, especially in the United States and Europe. Apart from institutional players, miners also seem to be offloading their holdings partially in this rally.

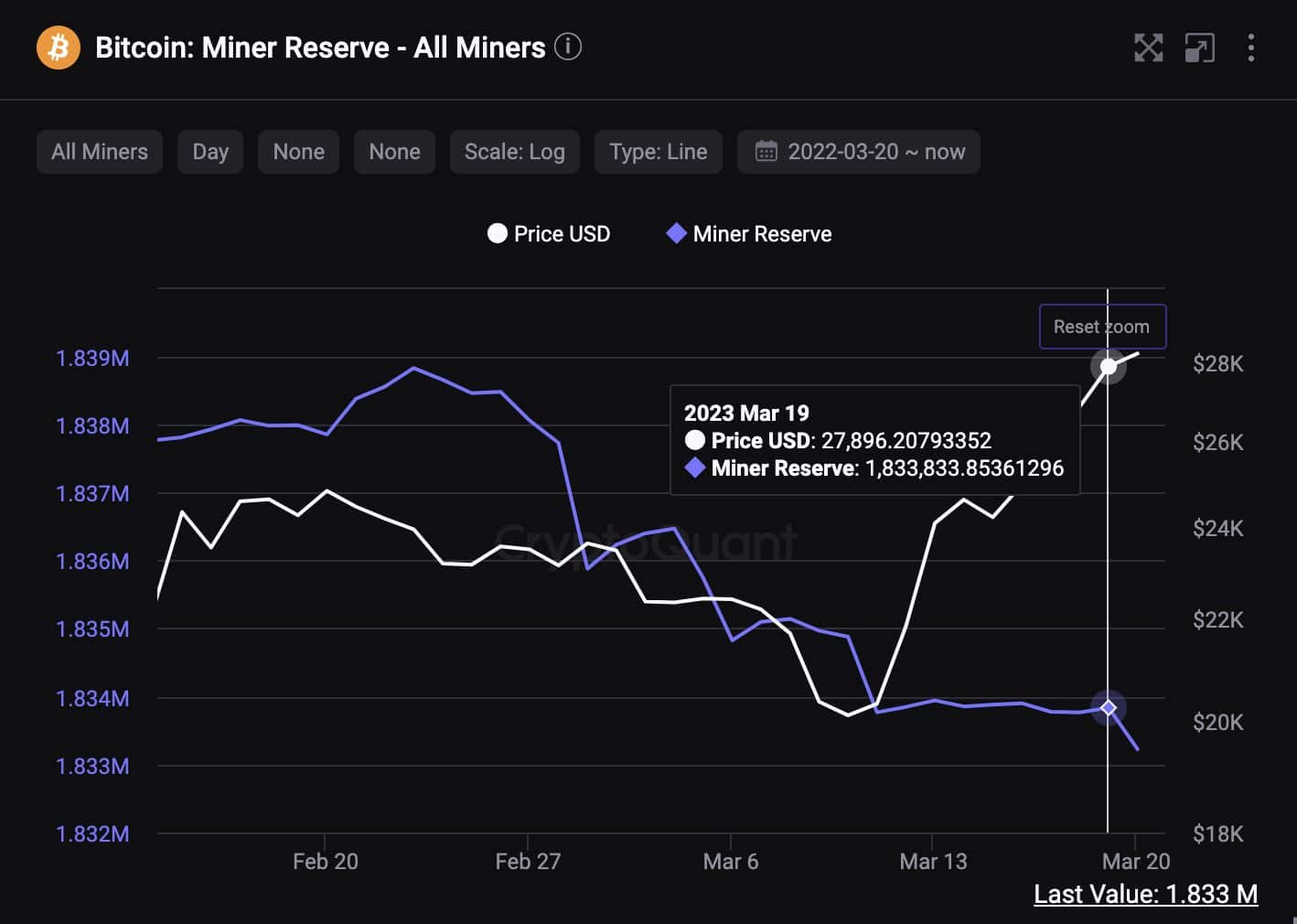

Bitcoin miners faced massive pain during the crypto winter of 2022 as mining costs skyrocketed and BTC prices continued to tank. This put a major dent in the miners’ profitability. Citing data from CryptoQuant, popular market analyst Ali Martinez reported:

Bitcoin miners appear to be booking profits! $BTC miner reserves have dropped by 609 #BTC over the past 24 hours, worth ~$17,052,000,.

Will Bitcoin (BTC) Continue to Face Selling Pressure?

Although Bitcoin made a move above the $28,000 level yesterday, it faced resistance and has partially retraced back. As of press time, Bitcoin is trading at $28,920 with a market cap of $539 billion.

It seems like Bitcoin and the broader crypto market are taking a pause ahead of the Fed meeting on Tuesday. Analysts are expecting the Fed to stop interest rate hikes in the wake of the current crisis. If the Fed pivots from its monetary tightening measures, we can see the Bitcoin price continue with its rally.

In its latest report, popular crypto market analysis firm Kaiko noted:

Despite surging volumes, liquidity remains thin. 2% market depth for BTC-USD and BTC-USDT pairs hit 10-month lows in the aftermath of Silvergate’s collapse. Overall, BTC’s rally could be exacerbated by thin liquidity, which makes it easier for market orders to both push up and push down the price of an asset.

Furthermore, the average returns for long-term and short-term Bitcoin investors have moved into positive territory. It will be interesting to see whether this cohort of investors book profits or continue to hold further.

📈 The average returns for #Bitcoin amongst long-term hodlers and short-term "new money" has blasted into positive territory for the first time in 14 months. Our latest insight covers how this key indicator cross is valuable to gauge the next #bullrun. https://t.co/g2lSi9OXoI pic.twitter.com/50z1LPmXcD

— Santiment (@santimentfeed) March 20, 2023

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- Fed’s Chris Waller Says Support For March Rate Cut Will Depend On Jobs Report

- Breaking: Tom Lee’s BitMine Adds 51,162 ETH Amid Vitalik Buterin’s Ethereum Sales

- Breaking: Michael Saylor’s Strategy Makes 100th Bitcoin Purchase, Buys 592 BTC as Market Struggles

- Satoshi-Era Whale Dumps $750M BTC as Hedge Funds Pull Out Billions in Bitcoin

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?