Analyst Reveals Timeline When Bitcoin Price Could Jump To $140,000

Highlights

- Crypto analyst Jelle predicts that the Bitcoin price could reach $140,000 in the next three months.

- Crypto analyst Titan of Crypto also provided a similar bullish outlook for Bitcoin.

- Bitcoin is expected to rebound soon enough.

Crypto analyst Jelle has provided a bullish outlook for the Bitcoin price for the remainder of this market cycle. The analyst predicted that the flagship crypto will reach $140,000 and revealed when this price surge could likely happen.

When The Bitcoin Price Will Jump To $140,000

In an X post, Crypto Jelle predicted that the Bitcoin price could rally to $140,000 in the next three months. This came as the analyst highlighted a cup and handle pattern, which put BTC’s price target at this level.

Crypto analyst Titan of Crypto also suggested that Bitcoin could rally to $140,000 in the next three months. In an X post, the analyst shared an accompanying chart, which he tagged as the ‘Bitcoin 2025 Roadmap.’

The accompanying chart showed that the Bitcoin price could reach $140,000 at the start of the new year. However, this price is unlikely to mark the top for Bitcoin, as it could still surge to $150,000.

Other market experts have even provided a more bullish outlook for the flagship crypto. Engineer Ted Boydston predicted that BTC could hit $225,000, the biggest bull run for the flagship crypto.

Meanwhile, renowned finance author Robert Kiyosaki predicted that the flagship crypto will hit $350,000 in 2025. While it remains to be seen if the flagship crypto could reach such heights, fundamentals such as Donald Trump’s inauguration support a bullish continuation.

A Price Rebound Is Imminent

In an X post, crypto analyst Ali Martinez stated that the Bitcoin price could be preparing for a rebound. The analyst mentioned that Bitcoin is showing a bullish divergence on the hourly chart against the Relative Strength Index (RSI).

The analyst added that the percentage of Binance traders going long on BTC has increased from 53.12% to 64%. These traders are said to have a solid record of being right.

Martinez further stated that the Bitcoin price needs to break above $94,800 to confirm this rebound. A break above this level could send BTC to $95,300 or even $96,000.

On the flip side, the analyst warned that if Bitcoin drops below $93,600, the bull case is off the table as the flagship crypto could drop to $84,000 or even $70,000.

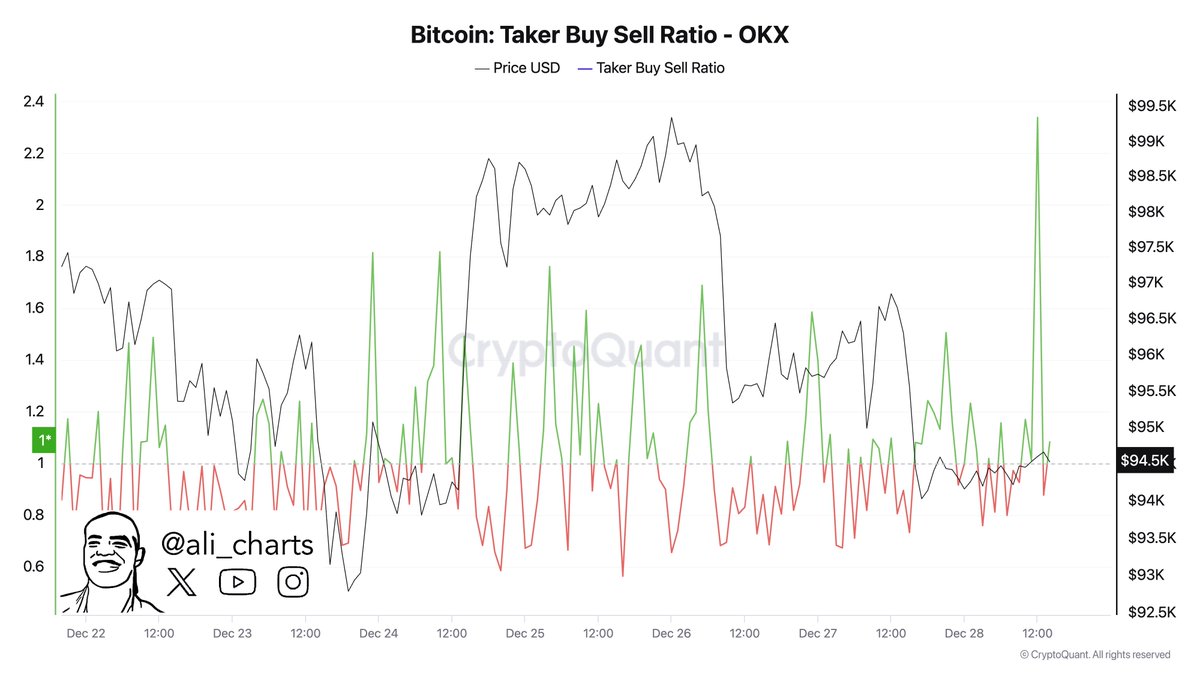

However, the bullish case is looking more likely. In another X post, the analyst revealed that there was a spike in Bitcoin’s Taker Buy/Sell ratio on the top crypto exchange OKX. This indicates a surge in aggressive buying, which is a sign of upward momentum ahead.

- US–India Trade Deal: Will Trump’s Tariff Relief Boost Crypto Market?

- Why Is Pi Coin Price Rising Today? Key Reasons Explained

- BestChange Wins Best Crypto Exchange Rate Aggregator at the Crypto Impact Awards 2025

- Arthur Hayes Blames BlackRock’s IBIT Hedging for Bitcoin Crash as BTC Price Rebounds 7%

- When Will the Crypto Winter Finally End?

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry

- Ethereum Price Outlook as Vitalik Buterin Sells $14 Million Worth of ETH: What’s Next for Ether?

- Solana Price at Risk of Crashing Below $50 as Crypto Fear and Greed Index Plunges to 5

- Pi Network Price Prediction Ahead of PI KYC Validator Reward System Launch

- XRP Price Outlook As Peter Brandt Predicts BTC Price Might Crash to $42k