We Are Still Very Early in DeFi Market Investment: Analyst

Decentralized finance and crypto markets may have slumped this week, but zooming out to look at the bigger picture suggests that we are still at very early stages of investment.

Crypto investor Andrew Kang has taken a deep dive into the state of decentralized finance markets and concluded that things are currently somewhere between the first selloff and bear trap.

Where are we in the DeFi market?

We're definitely not at the 2018 stage of the market where we see a long bear market

Probably somewhere between First Sell Off and Bear Trap

Some analysis below. https://t.co/XHnvoLYS2D

— Andrew Kang (@Rewkang) September 23, 2020

This chart is reminiscent of the one in 2017 for cryptocurrencies when there were a number of pullbacks before the huge parabolic spike at the end of the year. Of course, we all know what came next, a long painful bear market that lasted 18 months.

DeFi Market Pullback

Kang delved into the technicals first noting that there has been a 50% retrace, wiping out a month’s worth of price action in terms of DeFi index perpetual futures.

The Messari DeFi asset index confirms this reporting a current total market capitalization of $5.2 billion for all DeFi related coins. At its peak, this figure exceeded $12 billion.

He added that short interest in DeFi coins, using LINK as an example, continues to grow on the way down as Open Interest increases indicating a return is imminent. Larger traders have taken off their DeFi exposure by now which has reduced prices to a fairer value.

Kang also noted that many ‘degens’, or degenerate farmers as they’re known in the industry, are still fully deployed in liquidity pools and retail traders have yet to enter.

“True retail doesn’t seem to have entered much yet, and I’m still debating whether/how that happens this cycle.”

Innovation in the space is advancing at ‘blistering pace’, he added, and this can be evidenced by the rush to deploy Layer 2 scaling solutions by major DeFi protocols such as Uniswap, Yearn Finance, Aave, and Synthetix.

DeFi TVL Still Strong

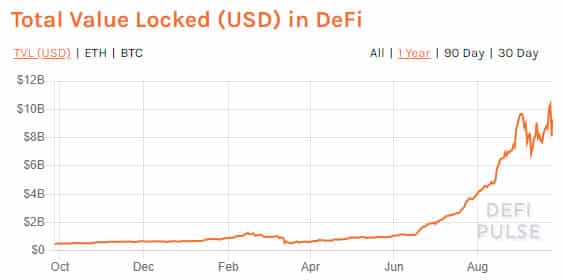

Taking total value locked, which is a measure of dollar equivalent crypto collateral, into consideration reveals that it has continued to advance parabolically despite this week’s market pullback.

Figures from Defipulse.com state that there is $9.3 billion locked across DeFi protocols, which is a gain of 1840% since the same time last year.

The crypto ecosystem has pivoted fully into DeFi in 2020 as terms like blockchain, ICO, and altcoin, are replaced with these;

Wake the fk up and learn about:

– Metamask

– Uniswap

– Ethereum contracts

– telegram groups

– Presales

– Launches

– Airdrops

– liquidity pools

– DeFi

– NFT

– $UNIYour financial future might depend on it. pic.twitter.com/sglDZugTUb

— Don Crypto Collector (@DonCryptoDraper) September 23, 2020

- CLARITY Act: White House to Hold Another Meeting as Crypto and Banks Stall on Stablecoin Yield Deal

- Bitcoin as ‘Neutral Global Collateral’? Expert Reveals How BTC Price Could Reach $50M

- XRP Ledger Validator Spotlights Upcoming Privacy Upgrade as Binance’s CZ Pushes for Crypto Privacy

- Harvard Management Co (HMC) Cuts BlackRock Bitcoin ETF Exposure by 21%, Rotates to Ethereum

- Morgan Stanley, Other TradFi Load Up SOL as Solana RWA Tokenized Value Hits $1.66B ATH

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)