Arthur Hayes Flags High Downside Risk in Tether’s Shift Toward Bitcoin and Gold Reserves

Highlights

- Hayes says Tether’s gold and BTC shift raises risk if markets drop sharply.

- S&P flags weak stability due to rising exposure to volatile reserve assets.

- Joseph argues Tether’s strong corporate assets and profits offset reserve risks.

BitMEX co-founder Arthur Hayes said Tether is preparing for a coming Federal Reserve rate-cut cycle by shifting more reserves into Bitcoin and gold. He pointed to the firm’s latest attestation, which shows a reduced focus on Treasury-driven returns and a stronger tilt toward alternative assets that may gain in a lower-rate environment.

Hayes Warns of Strain in Tether’s Reserves

In a recent X post, Hayes warned that the strategy brings notable risk. Falling prices in Bitcoin and gold could strain Tether’s equity cushion. Such pressure could revive long-running disputes about USDT’s solvency. He said the reserve mix signals a clear attempt to adapt to changing macro conditions.

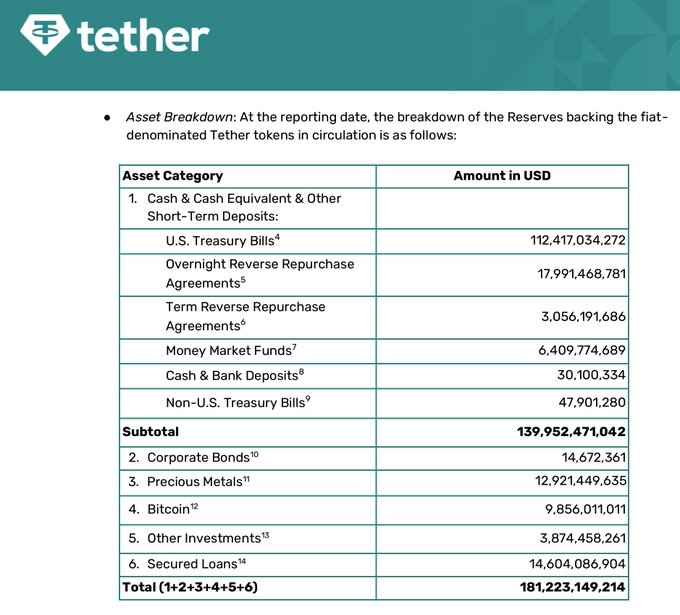

The latest reserve report cites total assets of roughly $181 billion. The collateral consists mainly of cash, T-bills, repo positions and money market instruments. Almost $13 billion comes under precious metals. Bitcoin is at nearly $10 billion. Secured loans exceed $14 billion. The remaining categories are filled in with smaller allocations.

S&P Global Ratings published a “weak” stability score following an analysis of Tether’s array of reserves. The rating signalled a concern of increasing exposure to volatile assets. S&P said the combination increases the risk of undercollateralization in periods of significant market distress. The downgrade drew swift industry reactions.

Corporate Assets Reveal a Stronger Financial Base

Former Citi analyst Joseph said Tether’s disclosed reserves only reflect assets tied to USDT backing. A separate corporate equity sheet contains equity stakes, mining operations, corporate reserves, and additional Bitcoin not included in the public reports. He said these holdings alter the overall risk profile.

Joseph referred to Tether as very profitable. Treasuries that pay interest amount to about $120 billion. Since 2023, those holdings have resulted in nearly $10 billion in annual profit. Operating costs remain low.

Efficiency multiples the equity value of Tether. Joseph estimated a range from around $50 billion to about $100 billion. He pointed to reports of a $20 billion raise at 3%, which would imply a much higher valuation, and he said was unrealistic.

Other key points related to differences with banks. The vast majority of banks keep just 5% to 15% of their deposits in liquid assets. The rest lies in far less liquid securities. Central banks backstop banking failures. The platform operates without that support. Strong returns help to make up for a lack of lender of last resort, Joseph said.

As CoinGape reported ealier, Paolo Ardoino responded to S&P’s downgrade USDT with criticism. He said negative views from traditional agencies do not concern the company. Past rating models, in his view, failed to capture the real risk of many firms that later collapsed.

Tether, he said, holds no toxic reserves. He described the company as overcapitalized and profitable. He added that the firm’s progress shows rising demand for alternative financial structures.

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?