Balancer Set to Refund Investors After Recovering Funds From $128M Exploit

Highlights

- Balancer has begun its reimbursement process for investors in its platform.

- The protocol will distribute $8 million in recovered assets to liquidity providers impacted by the hack.

- Claims are expected to remain open for 90–180 days upon going live.

Balancer is set to return the funds to the victims of its $128 million exploit which occurred earlier in the month. The team has shared a detailed reimbursement plan after recovering some of the lost tokens.

Balancer Prepares to Refund LPs After Major Recovery of Funds

In a new proposal, the team announced it would return about $8 million in rescued assets to users who were impacted by the v2 pool exploit. The plan explains how funds secured by whitehat responders and the protocol’s internal rescue teams will be distributed across affected networks.

Also, $19.7 million in osETH and osGNO positions is handled separately by StakeWise. They are running their own recovery process for the impacted users.

Several whitehat actors drained the vulnerable pools ahead of the attacker during the hours of the exploit. They actually raced the exploiter to secure funds that would later be returned.

These contributors will now get bounties of 10% of the assets that they assisted in saving. Payment would be made in the same tokens they recovered.

Because payouts are part of Balancer’s Safe Harbor Agreement, participants must undergo verification of their identity as whitehat. The platform’s Foundation has already approved these individuals for compliance.

This comes after the attacker started moving the stolen funds. Recently, the exploiter transferred 6,999 ETH to a new wallet. This simply means that the entity was ready to cash out through laundering routes.

How Would the Claims Process Work?

A claim interface is planned to be launched by the team that would work similarly to a withdrawal portal. The affected users would connect the wallet that held BPT at the snapshot block and verify their token balance. They would then sign a short legal waiver acknowledging the settlement terms and releasing Balancer from further liability.

Users would receive their tokens instantly once approved. The estimated time for the claim window is 90 to 180 days. While unclaimed funds would be redirected based on a future governance vote.

Community discussion of the proposal is already ongoing. If it gets the go-ahead, the claim portal can go live as early as December or early January. The recovery specific to StakeWise will have a timeline of its own.

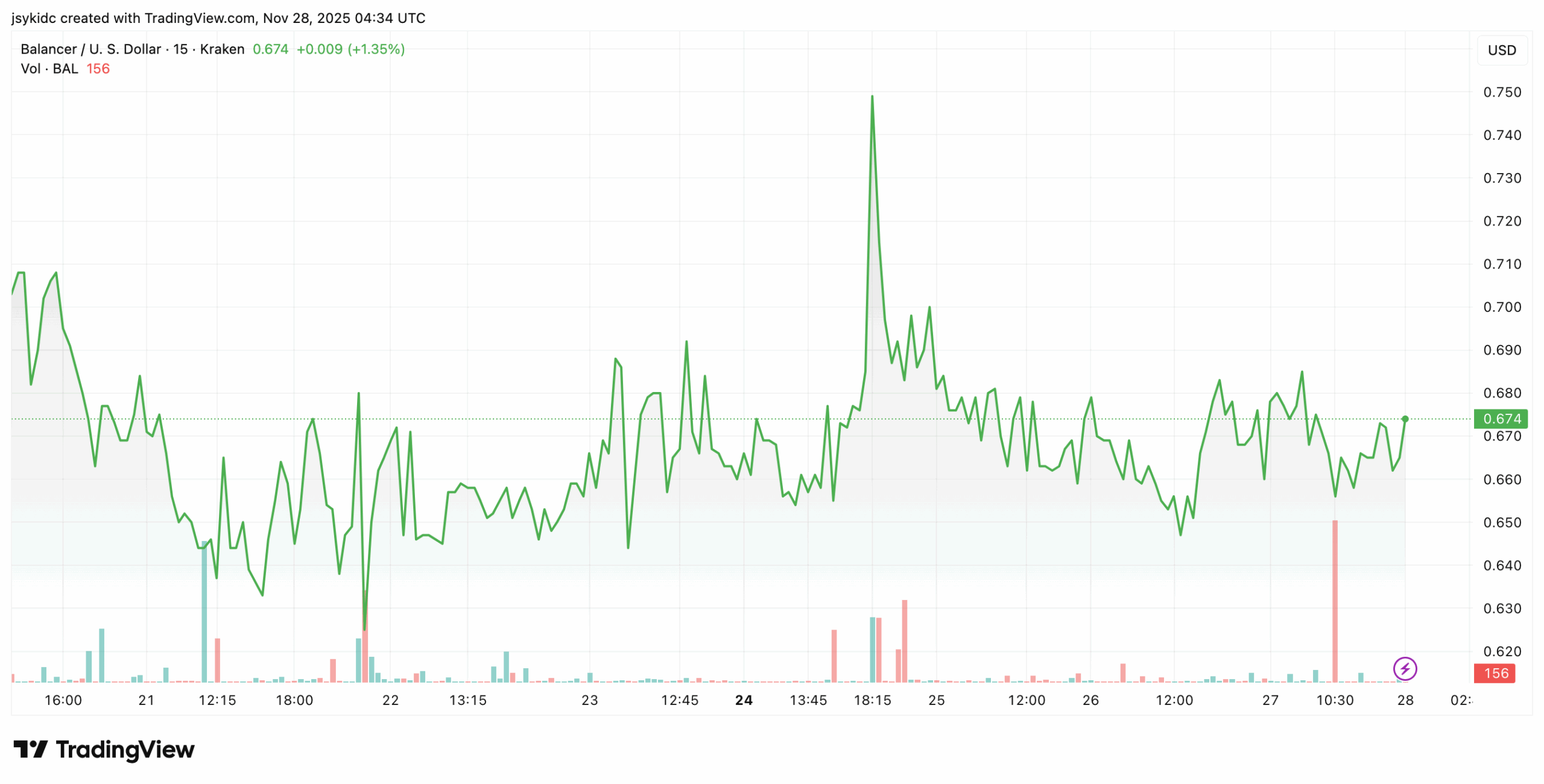

In light of this recovery, the price of BAL has risen by 2% over the last 24 hours.

On November 13, this hacker tampered with internal token balances in specific Balancer v2 pools. The attacker took advantage of small rounding errors in the protocol’s calculations. They tricked the pools into thinking they were very unbalanced which led to millions of funds drained.

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible