Binance’s Bitcoin, Ethereum, Stablecoins Netflow Reveals Stability Despite US CFTC Suit

The world’s largest crypto exchange Binance and CEO “CZ” was accused of violating crypto trading and derivatives rules in a lawsuit filed by the U.S. Commodity Futures Trading Commission (CFTC). This raised the levels of FUD regarding Binance amid heightened scrutiny and crypto regulatory crackdowns following the collapse of FTX.

On-chain data firm CryptoQuant in a report shared an analysis of Binance’s health after the U.S. CFTC lawsuit. A comparative analysis of Bitcoin, Ethereum, and stablecoin netflows and reserves during regulatory FUD after FTX collapse, BUSD crackdown, and the CFTC lawsuit was assessed.

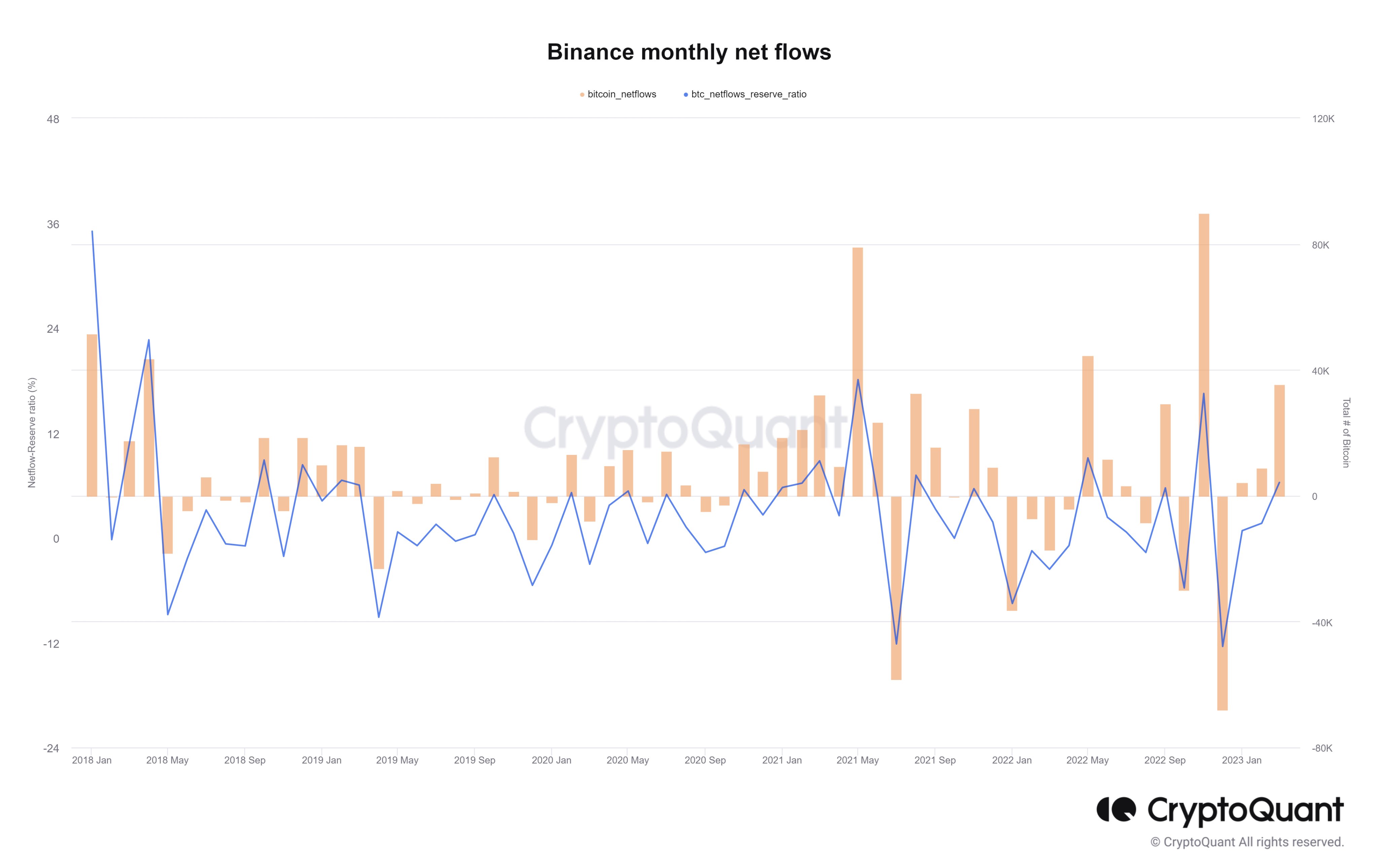

During the regulatory FUD after the FTX crisis in December, Binance recorded the highest net outflows of 40,353 BTC on December 12. Also, the exchange recorded a total net outflow of 78,744 BTC between December 10-16.

Meanwhile, Binance witnessed the largest daily net outflow of 5,027 BTC on February 12 during the BUSD FUD and a daily net outflow of 4,505 BTC after the CFTC lawsuit. Thus, the recent Bitcoin outflow is relatively low as compared to the earlier events.

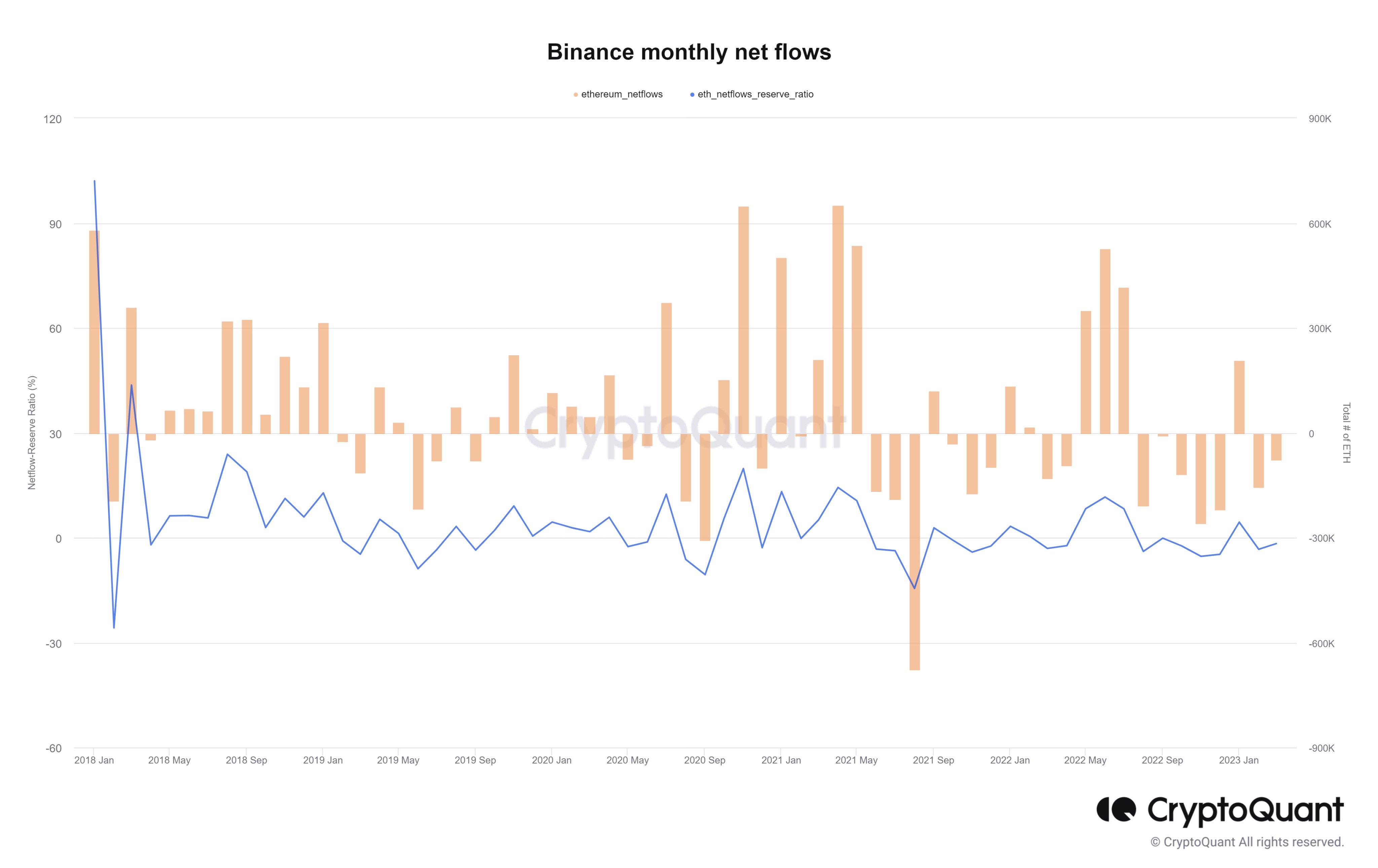

Ethereum net outflows data is similar to Bitcoin outflows, with the total net outflows continuing to decline. During the regulatory FUD, Binance recorded the highest daily net outflow of 278k ETH on December 12. The daily net outflow of 79,706 ETH and 76,146 ETH happened after BUSD FUD and the CFTC lawsuit, respectively. CryptoQuant noted Net Flow-Reserve Ratio metric indicates net flows have remained inside historical ranges.

In the case of stablecoins, on-chain data reveals net outflows of $871 million, a daily-high outflow of $671 million in February. However, Binance recorded total net outflows of $1 billion since the CFTC lawsuit.

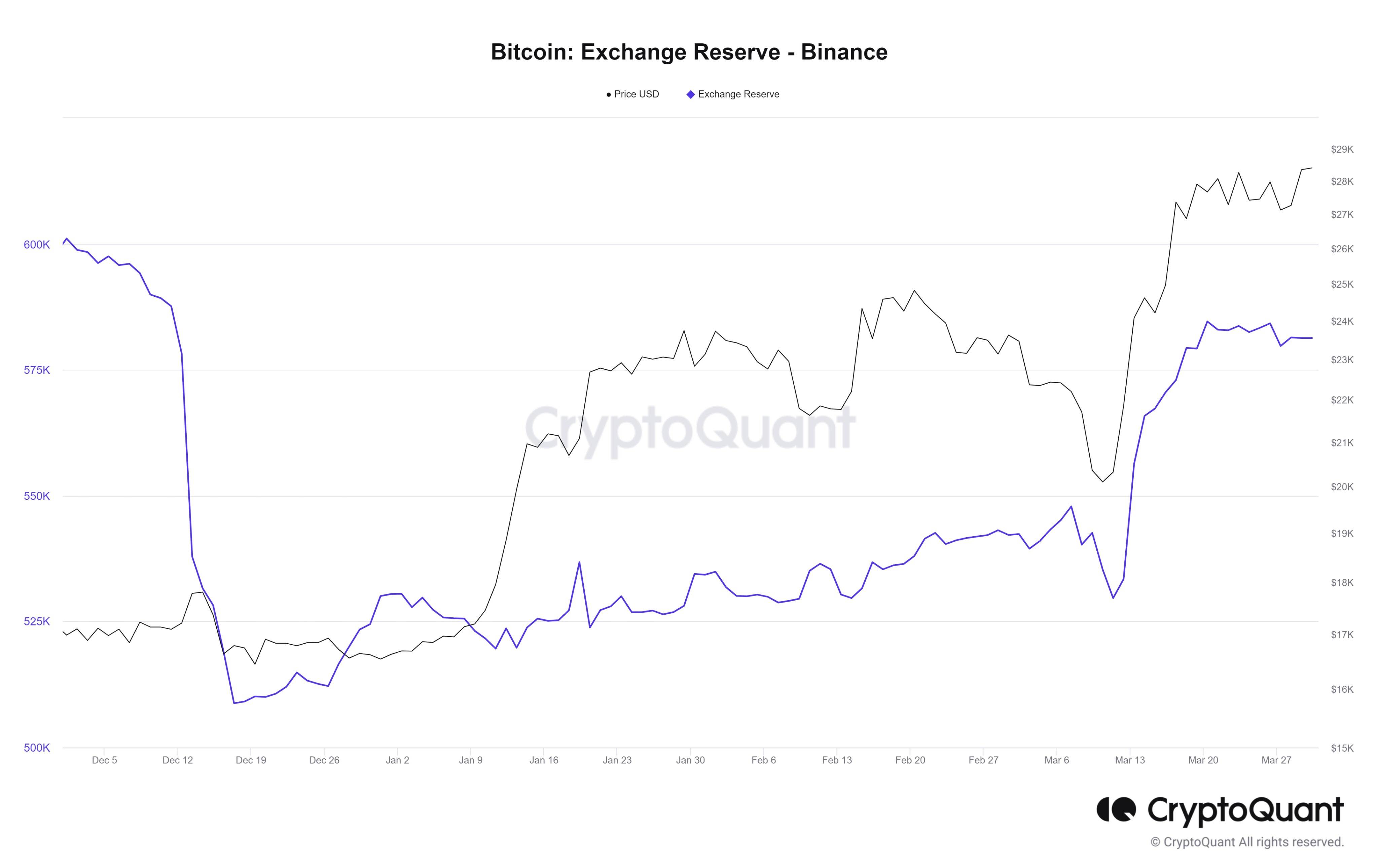

Binance’s Bitcoin (BTC) and Ethereum (ETH) reserves remained at “healthy” levels, with reserves rising from December levels. BTC reserves increased from 509k in December 2022 to 581k currently. ETH reserves increased to 4.487 million from 4.420 million in December. Moreover, Exchange to Exchange Flows data shows investors still consider Binance as a trustworthy and desirable exchange.

Also Read: Montenegro Court Rejects Do Kwon’s Appeal; Terra’s Daniel Shin Arrest Reviewed

Bitcoin Price Rises Above $29K Amid CFTC Suit Against Binance

Bitcoin price today jumped over $29K briefly to hit a high of $29,159. Currently, the BTC price trades at $28,570 amid positive sentiment in the market. Investors believe Bitcoin will rise above $30K to move swiftly to $35,000 soon.

Ethereum price is also trading above $1800 after the broader crypto market recovery on Wednesday.

Also Read: Bitcoin Price Jumps 4% Defying Consolidation, Key Support and Resistance Levels

- Bitcoin vs Gold Feb 2026: Which Asset Could Spike Next?

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible