Breaking: SEC Takes Aim At Binance’s Ex-CCO For Willful Violation Of US Regulations

In a civil suit filed in Washington D.C.’s federal court, the Securities and Exchange Commission (SEC) has accused Binance, the world’s largest cryptocurrency exchange, of operating as a thinly-veiled shell game. The lawsuit alleges that Binance’s founder, Changpeng Zhao, and its then Chief Compliance Officer (CCO) used customer accounts for personal gain while evading U.S. regulations and sidestepping American regulatory oversight.

SEC Quotes Binance’s CCO As Evidence

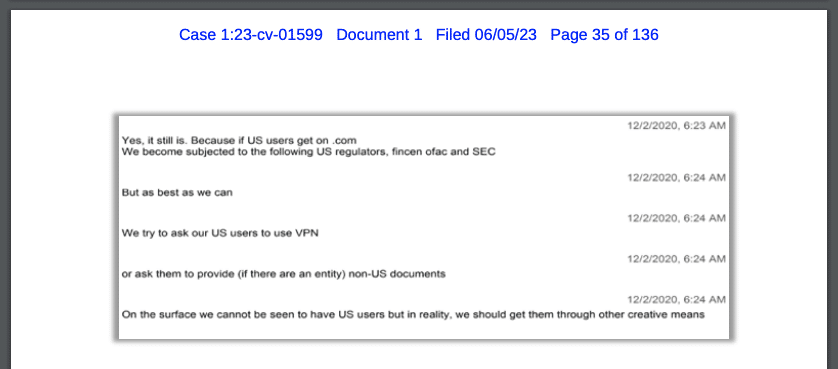

According to the lawsuit, Binance’s CCO back in 2018 held significant authority within the company, effectively operating the billion-dollar exchange with current CEO Changpeng Zhao, to avoid any form of regulatory scrutiny. The lawsuit paints a gloomy picture of the crypto exchange that allegedly prioritized evading regulations over compliance. The SEC’s lawsuit cites incriminating conversations within Binance, revealing the knowledge of operating in violation of numerous U.S. laws, including federal securities laws.

Binance’s CCO was allegedly recorded stating in December 2018, “we are operating as a fking unlicensed securities exchange in the USA bro.” The suit further claims that Binance’s top compliance officer admitted to intentionally avoiding regulation, stating, “we do not want [Binance].com to be regulated ever.”

Today we charged Binance Holdings Ltd. (Binance); U.S.-based affiliate, BAM Trading Services Inc., which, together with Binance, operates https://t.co/swcxioZKVP; and their founder, Changpeng Zhao, with a variety of securities law violations.https://t.co/H1wgGgR5ir pic.twitter.com/IWTb7Et86H

— U.S. Securities and Exchange Commission (@SECGov) June 5, 2023

Binance Accused Of Evading Regulations

The SEC’s allegations primarily focus on Binance’s creation of a separate U.S. trading operation, purportedly meant to cater exclusively to American customers and comply with U.S. regulations. However, the suit claims that this move was merely a facade, as the Binance exchange continued to allow U.S. customers to trade on loosely regulated overseas exchanges, thus circumventing American regulatory requirements.

In a written statement released by the financial watchdog, SEC Chief Gary Gensler, was quoted as saying:

[Zhao and Binance] engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law.

Binance, a Cayman Islands limited liability company founded by Zhao, now faces charges that are reminiscent of the practices exposed after the collapse of the second-largest cryptocurrency exchange, FTX, last year. The SEC’s lawsuit contends that Binance and its founder were well aware of the legal violations they were committing, acknowledging the existential risks posed to their business.

As reported earlier on CoinGape, Binance has formally responded to the allegations stating that the firm had been cooperating with the SEC’s investigation but the federal agency “chose to act unilaterally and litigate.”

Also Read: BNB Price Tumbles 8% On SEC Lawsuit Against Binance, Market Fears Further Impact

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs