Binance Surpasses CME to Become Top Bitcoin Futures Exchange, What it Means for BTC Price?

Highlights

- Binance flips CME to become largest futures exchange again

- Binance has notional BTC open interest of $4.52 billion against $4.35 billion on CME

- Spot Bitcoin ETFs recorded a net inflow of $68 million, continuing to decline amid lack of interest from institutional investors

- ETF expert Nate Geraci says spot Bitcoin ETF is crucial for liquidity

The world’s largest crypto exchange Binance has again topped world’s leading derivatives marketplace Chicago Mercantile Exchange (CME) in Bitcoin futures after months. The outflow from GBTC drops continuously, and so do other spot Bitcoin ETFs, including BlackRock and Fidelity.

Binance Surpasses CME in Bitcoin Futures Open Interest

Bitcoin Futures open interest (OI) on Binance has surpassed CME after four months. The spot Bitcoin ETF demand from institutional investors put CME on the top in derivatives trading for the last several months.

With a notional open interest (OI) of 105,130 BTC valued at $4.52 billion, Binance is now the largest Bitcoin futures exchange again. The Chicago Mercantile Exchange (CME) ranks second, with a notional open interest of 101,410 worth $4.35 billion.

BTC OI on Binance soared 2% in last 24 hours, whereas it plunged more than 3% on CME. This indicates demand from institutional investors for spot Bitcoin ETF continues to drop.

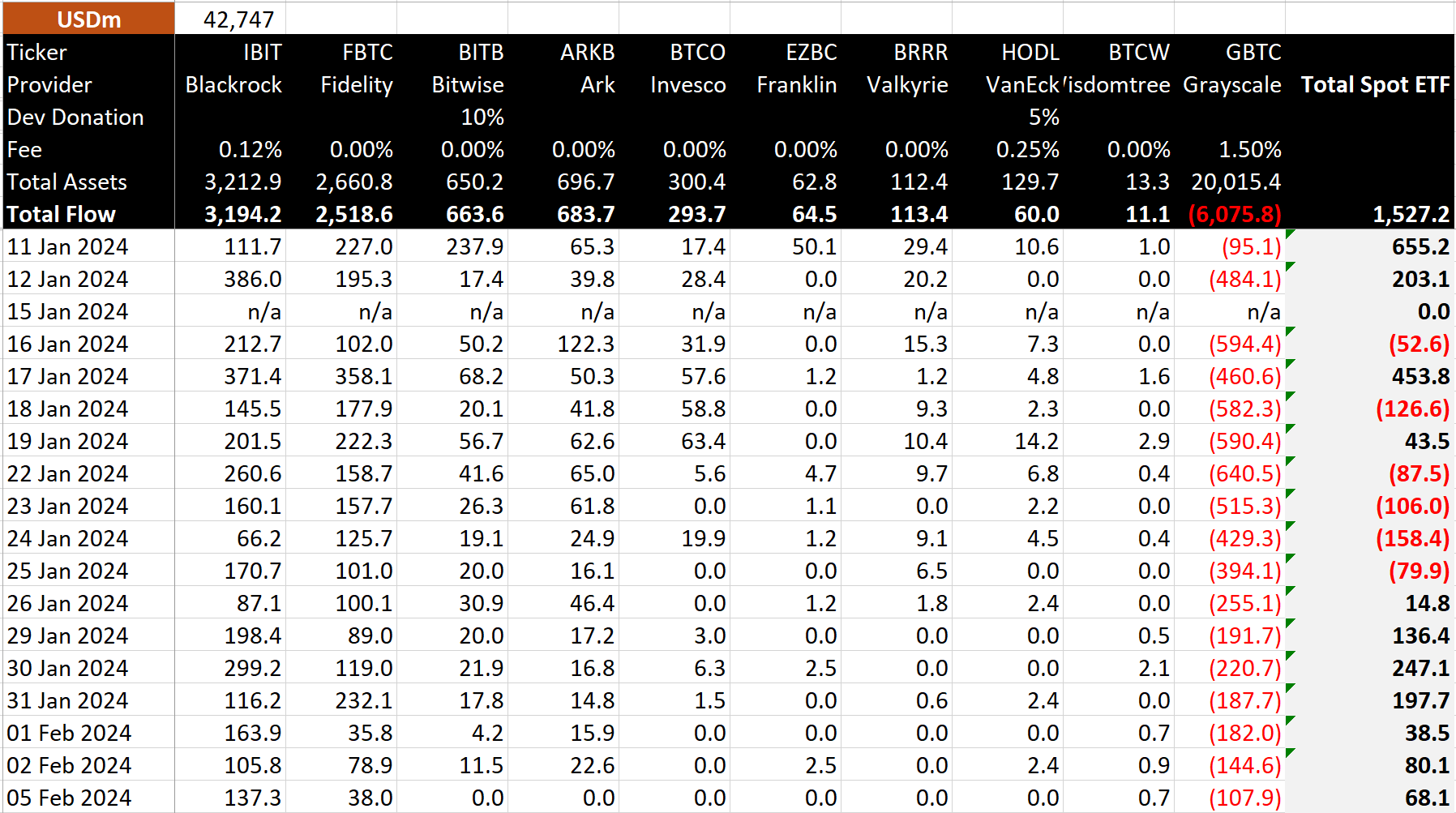

According to Bitcoin ETF flow data up to February 5, spot Bitcoin ETFs recorded a net inflow of $68 million. Notably, GBTC saw a 108 million outflow. It clearly shows a massive drop in demand for spot Bitcoin ETF.

BlackRock’s spot Bitcoin ETF (IBIT) saw more than $137 million inflow on Monday, rising in comparison to the inflow last Friday.

Read More: Bitcoin Options Block Trade Hints Strong Price Volatility In Feb

Bitcoin ETF Options Key

Nate Geraci, president of ETF Store, said approval of spot bitcoin ETF options is crucial for the market. Also, the timing plays an important role as a liquidity leader in ETF category has historically charged higher fees. Grayscale will need a robust derivatives ecosystem developed around underlying ETF if they wants to remain a leader and charge high fees. Currently, GBTC charges 1.5% management fees for its spot Bitcoin ETF.

Geraci added that the longer approval on spot bitcoin ETF options takes, it will be worse for current liquidity leader GBTC. He thinks “options should be approved w/out delay.”

BTC price trading at $42,9211 in the past 24 hours. The 24-hour low and high are $42,298 and $43,494, respectively. Furthermore, the trading volume has increased by nearly 15% in the last 24 hours, indicating a rise in interest among traders.

Also Read: MicroStrategy Earnings — Michael Saylor Hints At Revealing MSTR’s Bitcoin Strategy

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Will Bitcoin Crash To $58k or Rally to $75k After Hot PCE Inflation Data?

- Ripple’s RLUSD Gets Institutional Boost as SEC Eases Stablecoin Rules for Broker-Dealers

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise