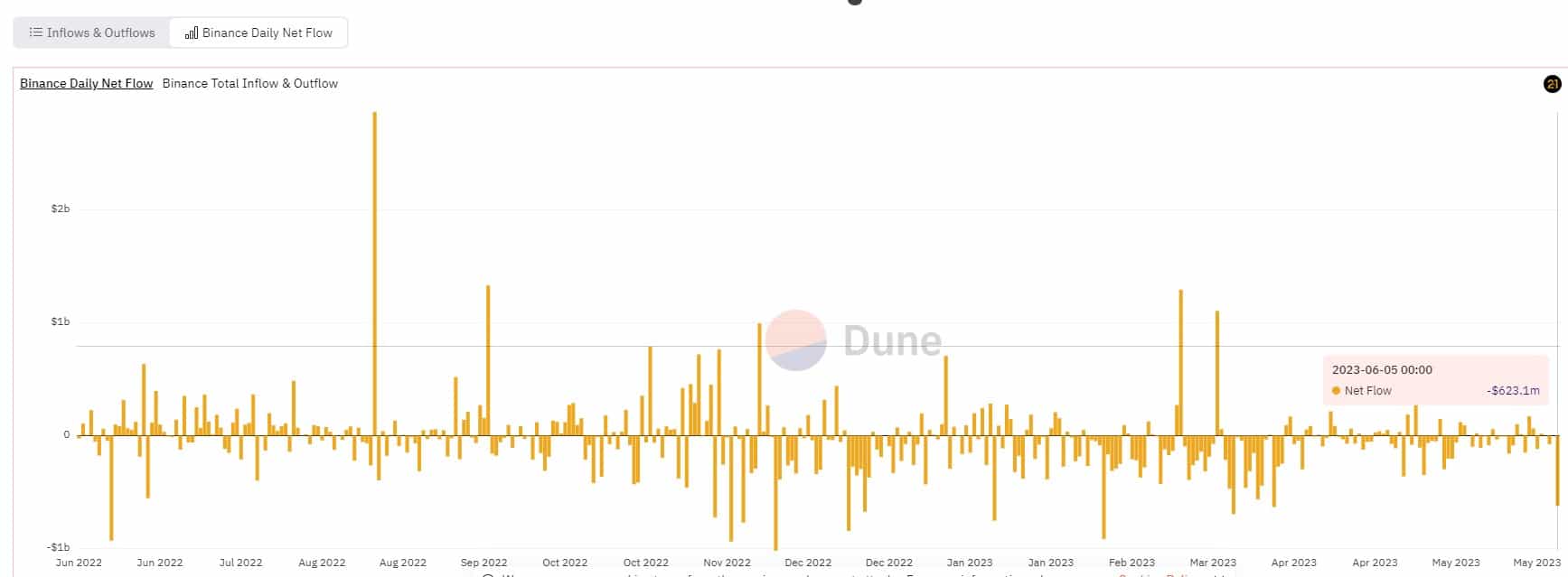

Binance Vs SEC: On-Chain Data Shows Withdrawals Worth $623 Million From Binance

The world’s largest cryptocurrency exchange Binance witnessed negative $623 million in netflow on 5th June after US SEC filed a fresh lawsuit, on-chain data revealed.

The crypto exchange saw withdrawal levels not seen since the banking crisis in March this year. However, these figures remain within historical normal levels. Binance has witnessed as much as $1 billion in negative netflows in the same period amid various FUDs and bank run rumors.

Blockchain analysis firm Nansen reported that netflow to Binance turned positive this morning on ethereum. As the exchange witnessed around $75 million positive netflow within a few hours.

BNB down 8% since SEC lawsuit

At the time of writing, Binance’s native token BNB is trading at $277, down nearly 8% in the last 24 hrs, as per CoinMarketCap data. Bitcoin and Ethereum are also down nearly 4% and 3%, respectively.

Binance’s crypto wallets currently hold $55 billion worth of cryptocurrencies in its reserve wallets. The world’s largest crypto exchange has been under heavy scrutiny from the US regulators recently. Along with this SEC lawsuit, Binance is also facing investigations from the US DoJ, US CFTC and even the IRS.

The SEC has filed 13 charges against the crypto exchange’s entities and their founder Changpeng Zhao for operating unregistered exchanges and misrepresenting trading controls and oversight on the Binance.US platform.

Binance exec secretly controlled Binance.US’s finances.

As reported earlier, a senior Binance executive operated five bank accounts that belonged to the exchange’s independent U.S. affiliate. One of the bank accounts even held American customers’ funds, bank records show, Reuters revealed yesterday. A day after the Reuter’s report, the SEC filed a lawsuit against the crypto exchange’s entities on the same charges. The investigation found that the now defunct Silvergate bank allowed Guangying Chen, a close associate of Changpeng Zhao, to control the accounts between 2019 and 2020, according to records from those years.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Breaking: Ethereum Treasury BitMine Adds 50,928 ETH as Tom Lee Predicts March Bottom For Crypto Prices

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

Buy $GGs

Buy $GGs