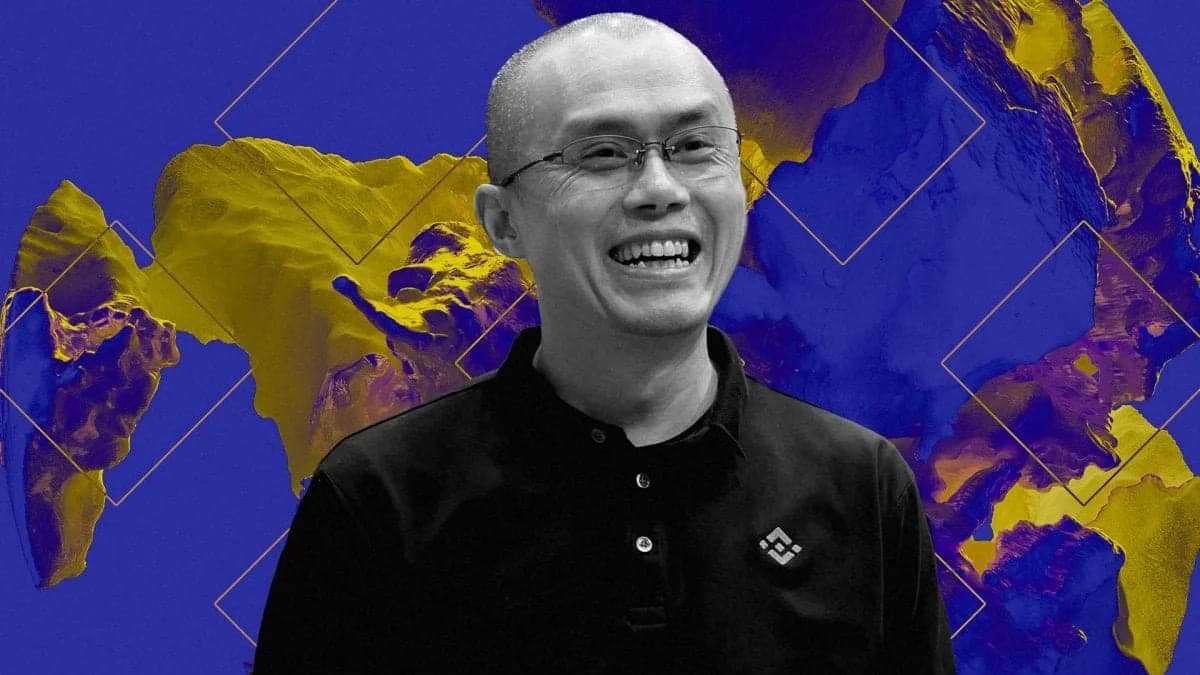

Breaking: Binance’s CZ Placing ‘Multiple Bets’ On Launching USDT Rival

Crypto News: Changpeng Zhao or ‘CZ’, the chief executive officer of crypto exchange Binance, on Monday announced plans to list more stablecoins on its platform. In addition to the recent listing of new stablecoin First Digital USD (FDUSD) on July 26, 2023 on the exchange, the platform is set to add another US Dollar based stablecoin, he said. CZ had criticized the lack of transparency when it comes to the financial records of USDT, the largest USD stablecoin.

Also Read: MakerDAO’s Bold Move Into Traditional Assets Fuels MKR Token Surge

Binance’s CZ Criticizes USDT Transparency

Speaking in a community session on Monday, the CEO said that USDT stablecoin, despite having a large market cap, did not provide an audit report yet. It is kind of like a black box due to the risk and uncertainty around it and yet, it is by far the largest stablecoin. He explained that the Paxos partnership was aimed at resolving the same issue. In February 2023, the New York Department of Financial Services had ordered Paxos to stop creating more of the dollar-pegged stablecoin BUSD.

“We are supporting multiple stablecoins given that the BUSD minting has been stopped in relation to the Paxos partnership. We are working with multiple other partners in different regions now to support the idea of further decentralization.”

Binance’s Own Algorithmic Stablecoin Project

CZ revealed that the crypto exchange was working on launching an algorithmic stablecoin. He explained plans to have as many bets as possible in stablecoins, considering the regulatory risks associated with them. The best thing to do is to diversify on the different types of stablecoins and see which ones survive the regulatory challenges, he added. The Binance CEO also warned that the stablecoins do continue to have different risk characteristics. It is very important to be transparent about financial records for stablecoin issuers.

Meanwhile, Tether in its latest quarterly report showed an increase in excess reserves by $850 million. It added that the consolidated assets exceed its consolidated liabilities.

Also Read: Terra Luna Classic Community Set To Burn 800 Million Tokens, LUNC And USTC To $1?

- WLFI Token Sees 19% Spike Ahead of World Liberty’s Mar-a-Lago Forum Today

- Veteran Trader Peter Brandt Predicts Bitcoin Price Rebound, Gold Fall to $4000

- Peter Thiel Exits ETHZilla as Stock Slides 3% Amid Token Launch

- Bitwise, Granitshares Eyes $63B Sector With New Prediction Markets ETF Filing

- Breaking: Grayscale Sui Staking ETF to Start Trading on NYSE Arca Today

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- How Long Will Pi Network Price Rally Continue?

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k