“Bitcoin Is 60% Below Stock-To-Flow Model Value”- PlanB

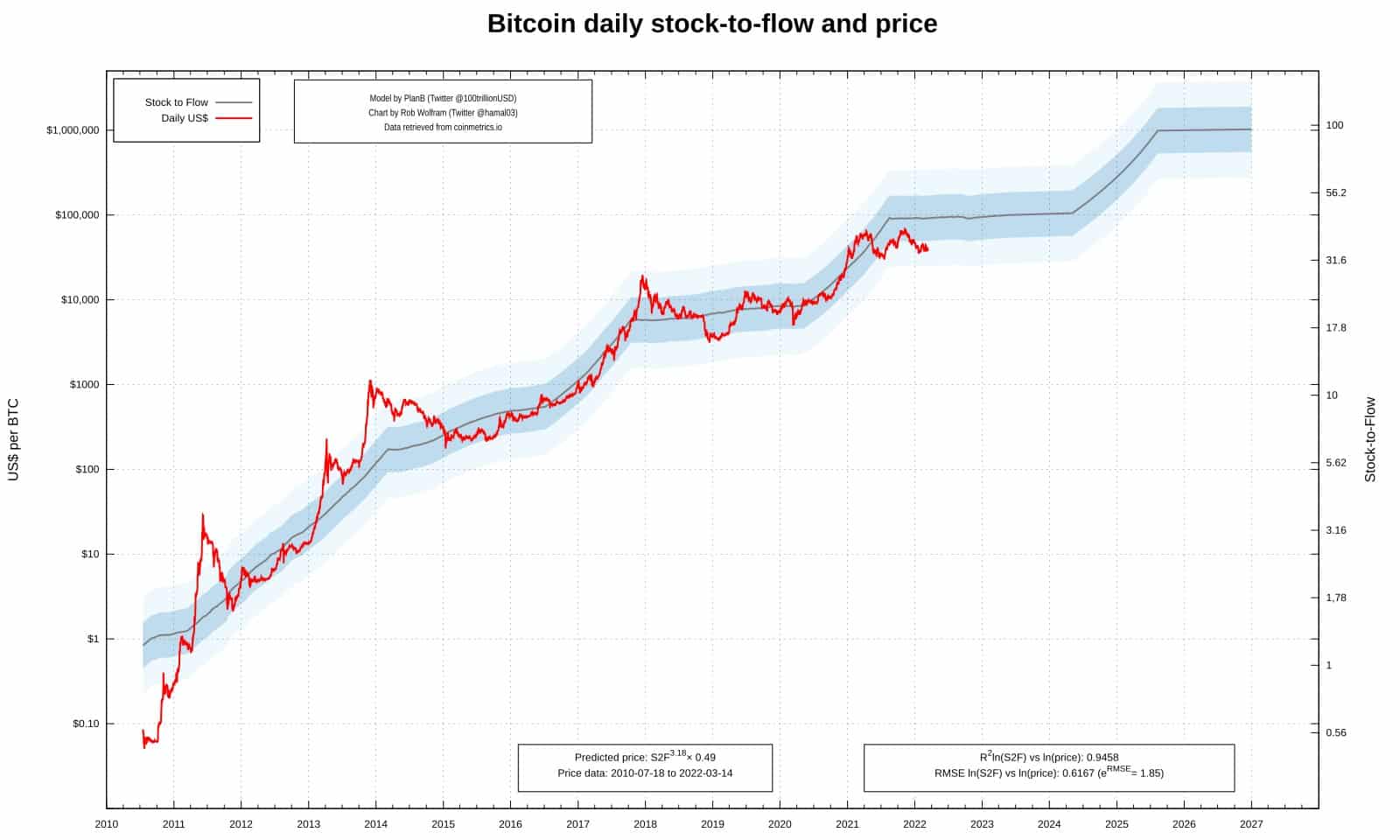

Stock-to-flow (S2F) model created by analyst PlanB had helped crypto investors make a more structured decision when betting on cryptocurrencies, considering the volatility in the crypto space. The model has historically correlated with the Bitcoin (BTC) price which makes it popular for predicting price based on its value in a period of time.

With some people thinking the S2F is dead, PlanB announced in a tweet on Wednesday that BTC price is currently 60% below the stock-to-flow model. Also, as per PlanB, the Bitcoin (BTC) will reach the $100k average price but will take two more years.

Bitcoin Will Hit $100K in Two Years

PlanB says he is confident that BTC price will reach $100,000. However, investors have to wait for at least two years to observe a massive rally. As per the chart, the next halving is scheduled to take place in mid-2024. Every Bitcoin halving had historically resulted in the BTC price to shoot massively.

#BTC is 60% below S2F model value. Some think S2F is dead. Others know we have 2 more years to reach the $100K average. Your choice. pic.twitter.com/xrYeeUN9hP

— PlanB (@100trillionUSD) March 16, 2022

He suggested BTC investors have their own opinion when making buying and selling decisions, and avoid getting into what others say. People need to look at the chart and see, how many times BTC price deviated from stock-to-flow model value to make an informed decision.

Previously, the S2F model predicted the $100k mark in December 2021. However, the model failed as the Bitcoin ended below $45k from its ATH price of $68k last November. This happened after the Chinese crackdown on crypto trading and mining, as well as questions raised on the efficiency of Bitcoin.

Moreover, amid the current escalating Russian-Ukraine tensions, rising inflation, and political pressure, the price dwindled even more. These all have possibly resulted in the diversion from the daily stock-to-flow model value, with the current price moving 60% below the model value.

Bitcoin’s Support From the Community

Bitcoin is currently trading at $40,516, up nearly 5% in the last 24 hours. Moreover, the trading volume is $34 billion in the last 24 hours, rising almost 43%.

This week, Bitcoin influencers including Michael Saylor, Elon Musk, and Mike Novogratz have shown trust in Bitcoin. Saylor explained why bitcoin is a better inflation hedge and a store of value than gold and real estate. While Musk, considering the worth of Bitcoin, tweeted that he will continue to hold it, mostly under the present circumstances.

Furthermore, Bitcoin whales have become active, pulling out almost 1.2 billion BTC from crypto exchanges in just a week. However, retail investors should wait until the price breaks the 45k barrier.

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k