Bitcoin Bloodbath: Miners Start Selling Most Aggressively In The Last 7 Years

The recent crash in the price of bitcoin has distressed bitcoin miners. They are compelled to sell in order to cover their expenses.

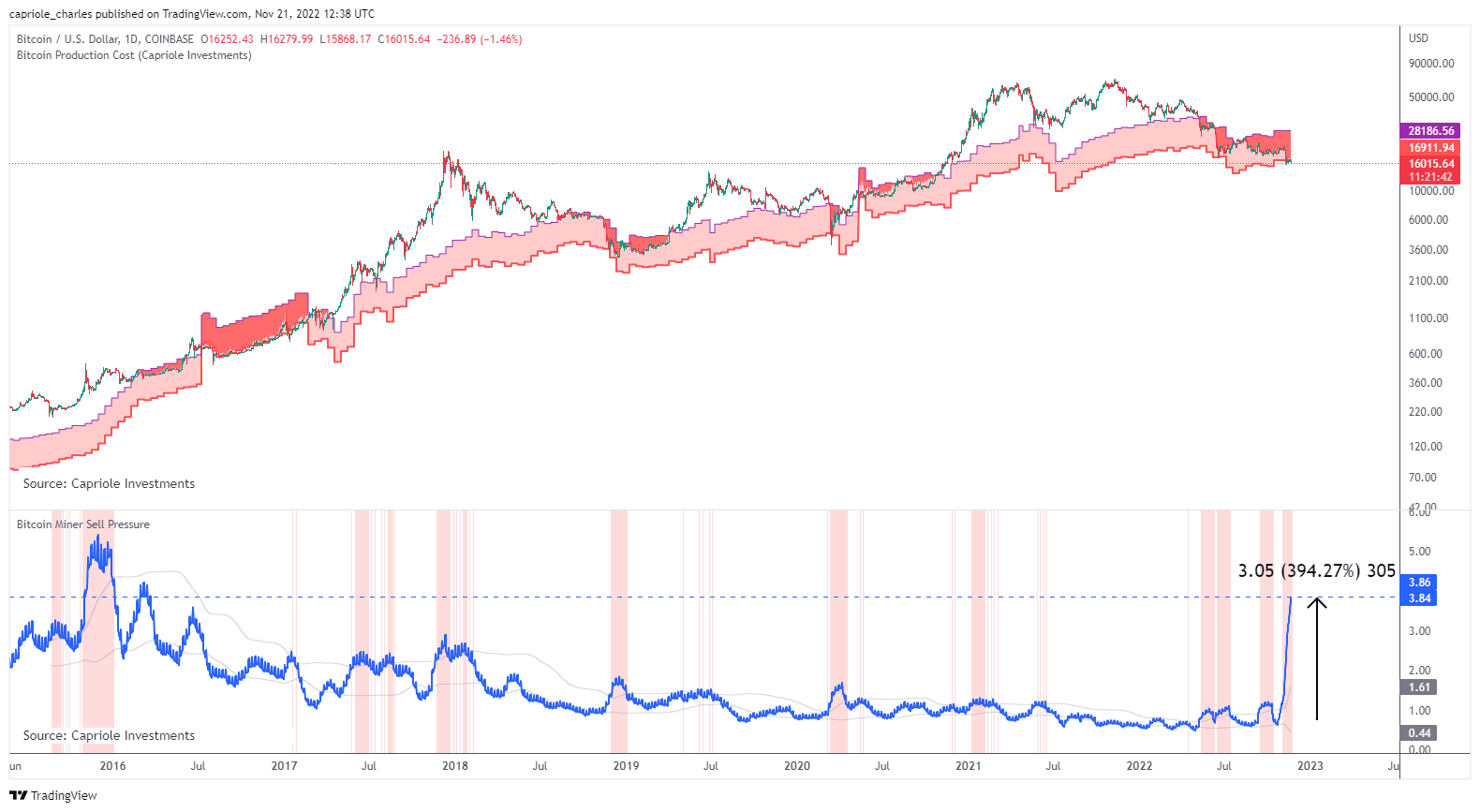

In the past three weeks, Bitcoin (BTC) miners have increased their selling pressure by 400%. This indicator reached new highs, not seen since the bottom of the 2015 cycle, nearly 7 years ago.

Charles Edwards, the founder of Capriole Investments, a quantitative Bitcoin and digital asset fund, took to Twitter to reveal the distress that the BTC mining fraternity is going through.

Edwards presented charts showing the Bitcoin (BTC) price, mining expenses (log scales), and the amount of Bitcoins (BTC) miners are selling. It appears that the entire segment is having a difficult time.

Miner’s Distress

According to him, if the price of Bitcoin does not improve in the coming weeks, many miners would be compelled to cease operations due to huge losses.

He argues that mine-and-hodl is not a sustainable strategy for Bitcoin miners. Edward holds the “never selling” attitude of miners responsible for the current situation.

“Miners are paying the consequences of the “never selling” arrogance widespread just 6 months ago. You need to manage (trade) your Bitcoin position constantly in this market” he adds.

What we are seeing is not sustainable. Mine-and-hodl is not a viable strategy as a Bitcoin miner. Miners are paying the consequences of the "never selling" arrogance widespread just 6 months ago.

You need to manage (trade) your Bitcoin position constantly in this market.

— Charles Edwards (@caprioleio) November 21, 2022

Also Read: Is FTX Crash An End Of Crypto? Here’s How A Multi Billion Dollar Scam Unfolded

Furthermore, this difficult period indicates that Bitcoin mining can no longer be deemed “passive income.” Miners should re-evaluate their strategies to avoid becoming bankrupt.

Charles Edwards reported earlier this month that Bitcoin (BTC) appeared to be severely oversold based on the Energy Value Model.

According to a report, an Australian mining firm, Iris Energy, had to unplug hardware as it defaulted on its loan due to insufficient cash flow. This makes the distress more evident, which can grapple the sector in coming weeks.

Also Read: Genesis Says It Has No Immediate Plans To Declare Bankruptcy, Seeks Consensual Resolution

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs