Bitcoin (BTC) Approaches $30,000 But Accumulation Addresses Increasing

Bitcoin (BTC) continues to trade under pressure a day after its month and quarterly expiry! At press time, Bitcoin is more than 8% down and moving under $31,000. This has also pulled down the overall cryptocurrency market by 7% to now at $1.26 trillion.

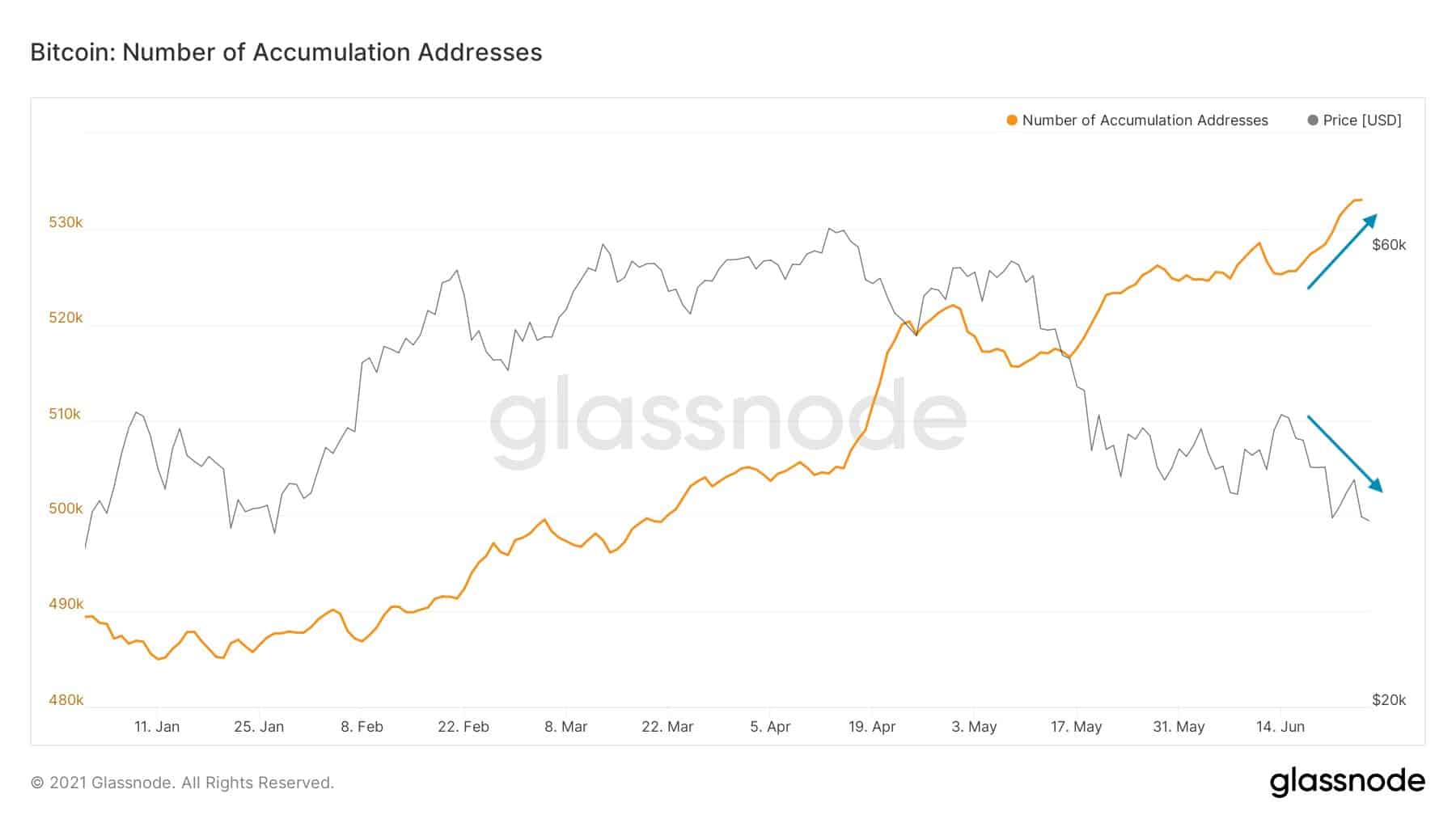

With Bitcoin facing a continuous downward pressure in the last 10 days, the number of accumulation addresses is on the rise. The BTC price and the accumulation addresses are showing opposite moves as we can see in the below chart from Glassnode.

This is clearly a bullish sign! Moreover, as CoinGape reported other bullish indicators, the BTC supply at exchanges has also started falling once again while whales have started buying once again around $30K after heavy dumping at around $40K levels.

Bitcoin Short Term Speculators Booking Major Losses

While long-term players have continued to buy the dips, the Bitcoin short-term speculators have realized major losses in recent times. The Friday, June 25 expiry was a brutal one for short-term players. On Friday, the net realized profit/loss was the largest even larger than the March 2020 crackdown. There were a total of $3.45 billion in net realized losses booked.

There is every possibility that Bitcoin can fall further under $30,000 levels from here onwards. Speaking to CNBC, Guggenheim’s Scott Minerd said that the Bitcoin price can correct 50% further from here at around $15,000.

Minerd said that the bottom has still not been formed and adds that investors should not be “anxious in putting money in bitcoin now. The real bottom, when you look at the technicals, $10,000 would be the real bottom, you know, that’s probably a little extreme, so I would say $15,000,” explained Minerd.

Citing historical patterns, Minerd believes that Bitcoin will likely consolidate for a couple of years. Minerd noted that BTC’s exceptional performance over the last year has been due to the major influx of money by central banks. He believes that as the governments start rolling back in liquidity programs, Bitcoin demand will continue to drop.

- U.S. Government Shutdown Odds Hit 84%, Will Bitcoin Crash Again?

- Wall Street Giant Citi Shifts Fed Rate Cut Forecast To April After Strong U.S. Jobs Report

- XRP Community Day: Ripple CEO on XRP as the ‘North Star,’ CLARITY Act and Trillion-Dollar Crypto Company

- Denmark’s Danske Bank Reverses 8-Year Crypto Ban, Opens Doors to Bitcoin and Ethereum ETPs

- Breaking: $14T BlackRock To Venture Into DeFi On Uniswap, UNI Token Surges 28%

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates