Bitcoin (BTC) Back to $41,000, Here’s Why Retail Investors Should NOT Buy Yet

Just a day before the Federal Reserve plans to announce its first rate hike in four years, Bitcoin (BTC) makes a surprising move to the north. As of press time, Bitcoin is trading 5% up above $41,000. This is for the third time in three weeks that Bitcoin has made a move back above $40,000.

However, retail investors should still hold the guns and not fall for this renewed optimism. With today’s move, BTC makes a jump over its 20-day EMA and 50-day moving average. But make no mistake, the world’s largest crypto is still far away from its 200-day moving average (DMA) of $48,622. Only if Bitcoin crosses these levels, we can confirm some signs of the uptrend.

#bitcoin doing stuff pic.twitter.com/tEf25XtoQj

— Lark Davis (@TheCryptoLark) March 16, 2022

The current global macroeconomic situation looks to be quite fragile with the U.S. inflation numbers touching a four-decade high. On the other hand, the geopolitical uncertainty with the Russia-Ukraine war has added to the woes. A Twitter handle operated by Glassnode co-founders explains:

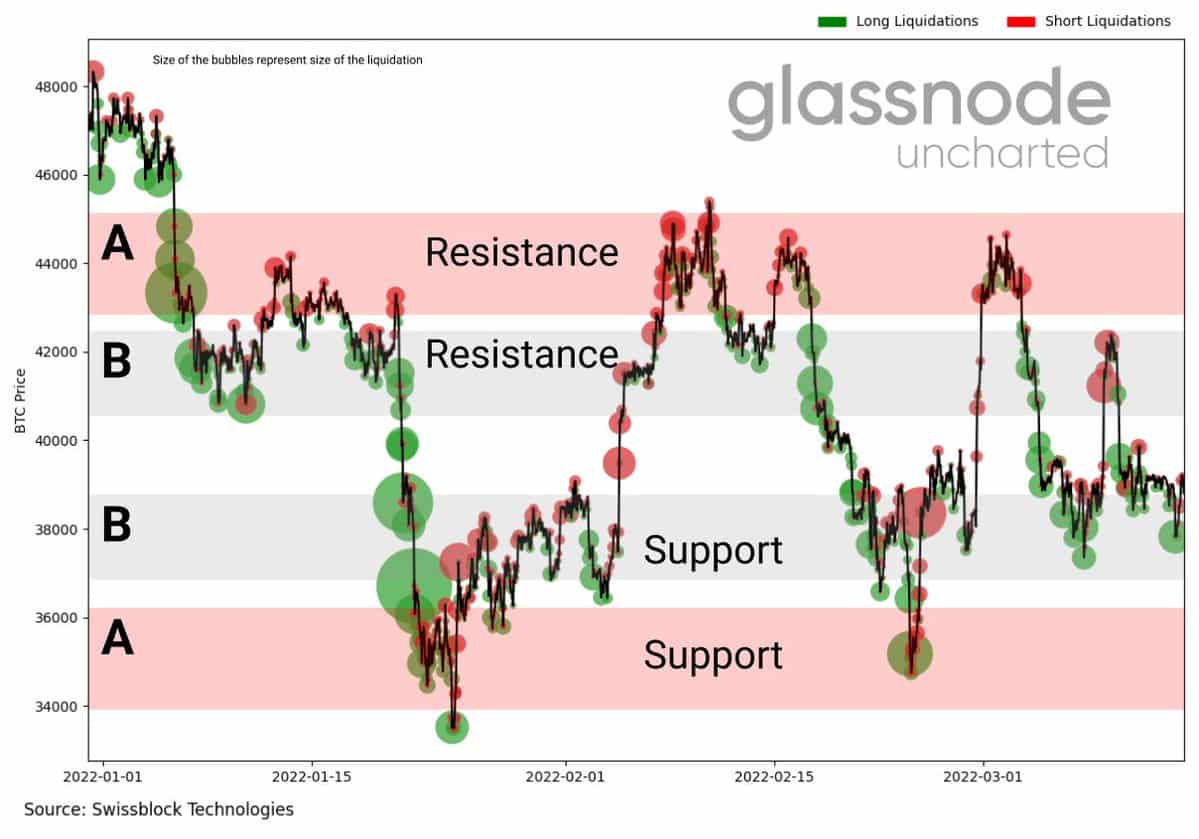

Liquidation sizes decrease as Bitcoin is squeezed into the $38-$42k price range (B). Long liquidations continue to dominate. The next big move is confirmed once we break the $36-$45k range (A).

Mike Novogratz: Don’t Expect Bitcoin to Rally ‘Aggressively’

Billionaire crypto investor and the founder of Galaxy Digital Mike Novogratz said that there are very few chances for Bitcoin to rally ‘aggressively’ knowing that the Fed is planning to rate interest rates and go ahead with strong quantitative tightening measures.

The Fed is reportedly planning for four minimum rate hikes this year which could go as high as 7-8 hikes in case the inflation doesn’t come under control quickly. Novogratz expects Bitcoin to stay in the $30,000 to $50,000 range this year. He further added:

“I don’t think Bitcoin can rally aggressively until we get a pause. Bitcoin is a narrative story, it’s bringing people into the community. It’s hard to bring in new people when their house is on fire.”

Novogratz also said that the New York State needs to get rid of BitLicense which is making it extremely difficult for other crypto firms to do business in the region.

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?