Bitcoin (BTC) Can Correct Up To 70% If Recession Hits the US This Year

Bitcoin (BTC) and the broader cryptocurrency market has a strong runup since the beginning of 2023 gaining by more than 40% so far. As of press time, Bitcoin (BTC) is trading at a price of $22,789 with a market cap of $439 billion.

Mike McGlone, the senior macro strategist at Bloomberg Intelligence said that cryptos could be facing their first real recession that could lead to lower asset prices and higher volatility.

It was during the last US financial session of 2008 that led to the birth of Bitcoin. While the very premise of Bitcoin’s existence is to serve as an alternative to the fiat system, it still remains a highly volatile asset class. As Bitcoin is likely to test its first major financial recession this year, the question is how much pain is still in the making before resuming the long-term gains.

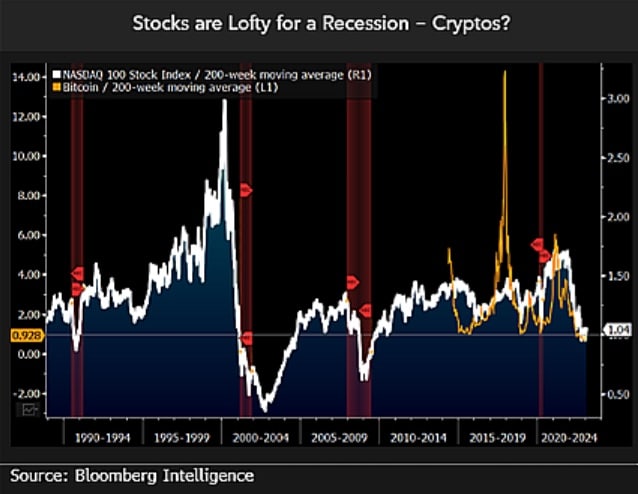

For this, Mike McGlone compares BTC to the Nasdaq 100 Index since both of them have in close correlation in the past. Bloomberg Intelligence compares Nasdaq 100 with its 200-week moving average and its performance over the last two recessions.

During the 2022 market crash, Nasdaq bottomed at 70% below the mean. Similarly, it was trading at a 40% discount below the mean during the 2009 recession. If the BTC price goes to show a similar resemblance, there’s a possibility that it can tank sub $10,000 levels.

A Bull Case Scenario for Bitcoin

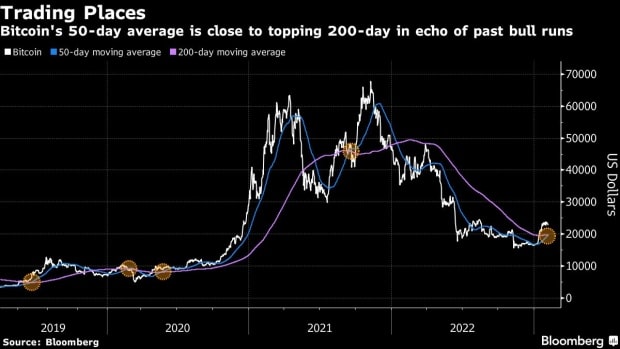

Bitcoin (BTC) has been currently facing psychological resistance at $23,000 levels. On the technical chart, a strong bullish scenario is emerging as the BTC price is on the cusp of a golden cross. This setup occurs when the 50-day moving average crossed the 200-day moving average.

Sean Farrell, Fundstrat Global Advisors’ digital-asset strategy head said: “Most instances of a golden cross have resulted in favorable returns for Bitcoin, and many have occurred at critical long-term inflection points”.

The recent blowout of US jobs increases the possibility that the Fed could continue to raise interest rates more aggressively going ahead. It will be interesting to see how the BTC price structure forms going ahead.

- Bitcoin Shows Greater Weakness Than Post-LUNA Crash; Is a Crash Below $60K Next?

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Bitcoin vs. Gold: Expert Predicts BTC’s Underperformance as Options Traders Price in $20K Gold Target

- CLARITY Act: White House to Hold Another Meeting as Crypto and Banks Stall on Stablecoin Yield Deal

- Bitcoin as ‘Neutral Global Collateral’? Expert Reveals How BTC Price Could Reach $50M

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?