Bitcoin (BTC) Downside Looks Limited As Coinbase Premium Shoots Significantly High

After hitting its all-time high above $64,500 on the day of the Coinbase (NASDAQ: COIN) listing, Bitcoin (BTC) has retraced partially with a bit of downward pressure. On Friday, April 16, Bitcoin (BTC) took a dip below $61,000 levels after news broke out that one of the major BTC markets – Turkey – has issued a ban on crypto trading.

However, the Bitcoin (BTC) price has picked back quickly from the lows and has moved back to $62,000. At press time, Bitcoin (BTC) is trading at a price of $62,245 with a market cap of $1.163 trillion. Interestingly, all on-chain indicators suggest that Bitcoin’s downside from here is limited.

As per the CryptoQuant data, the Coinbase premium has turned significantly high suggesting a stronger spot buying pressure on the exchange.

Maybe the bottom is in. https://t.co/CiaZVZAr7H

— Ki Young Ju 주기영 (@ki_young_ju) April 16, 2021

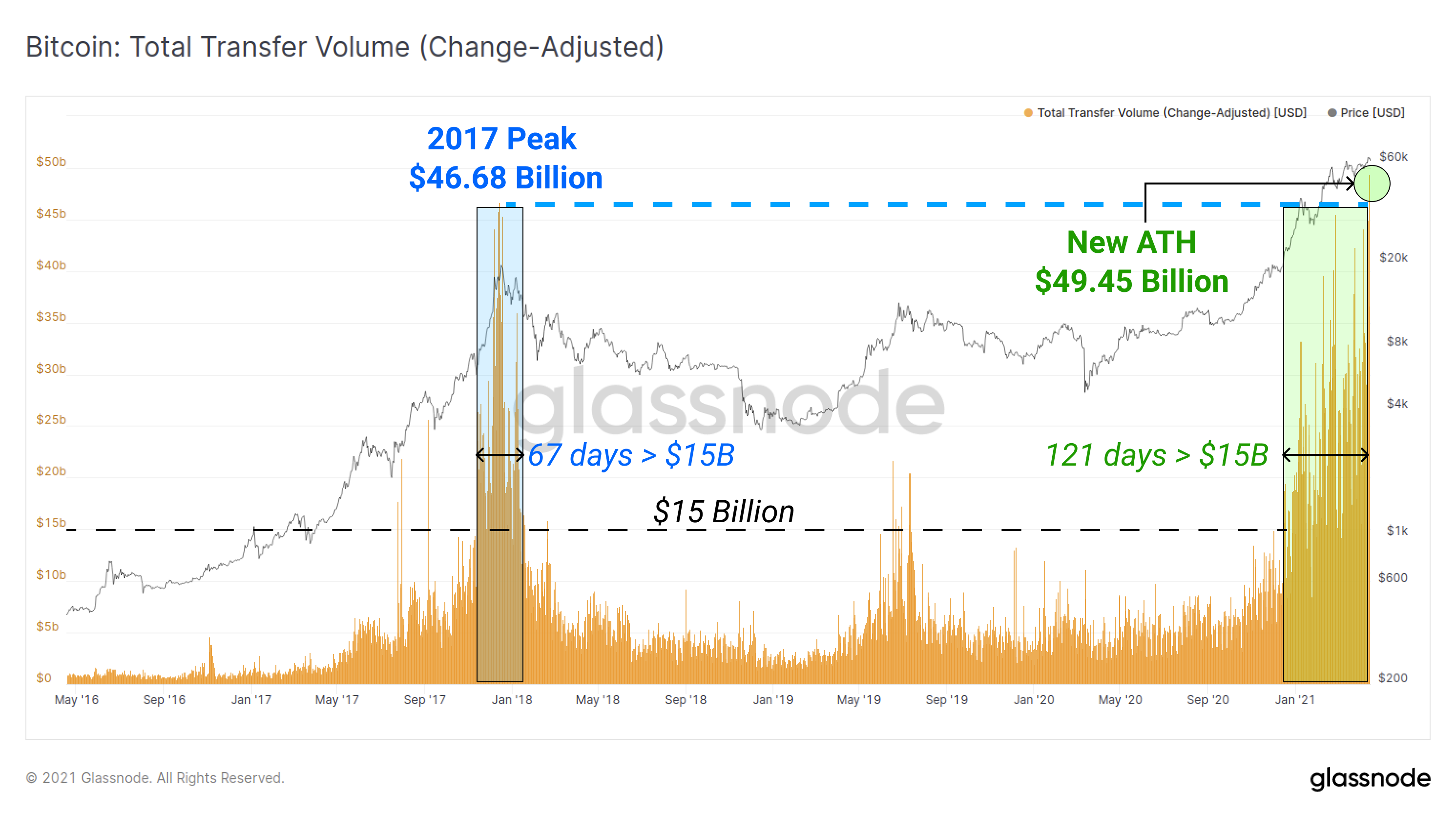

On the other hand, a Glassnode report suggests that the BTC bull run this year has lasted for a much higher period with consistently high trading volumes. The Glassnode report states:

“Bitcoin’s change-adjusted transaction volume has hit a new ATH of $49.45 Billion. The previous record $46.68B was set at 2017 peak during a 67-day stretch of high volume > $15B. This bull has sustained a much longer 121-days with high volume > $15B”.

On the other hand, the Bitcoin (BTC) number of addresses in profit has also reached an all-time high of over 37 million.

📈 #Bitcoin $BTC Number of Addresses in Profit (7d MA) just reached an ATH of 37,049,447.202

View metric:https://t.co/qLnvDYVzPt pic.twitter.com/7nuQp6X7oM

— glassnode alerts (@glassnodealerts) April 16, 2021

China’s Coal Mine Accidents Causes Dip In BTC Hash Rate

Earlier this week, the BTC hash rate was on a declining trend with some reported accidents in the Chinese coal mines of Shanxi, Guizhou and Xinjiang provinces. The security accidents happened due to flooding and gas explosions taking place in those regions.

As reported by Wu Blockchain, Chinese miner Jiang Zhuoer stated that the Xinjiang coal mine accident caused power outages across all mines due to safety inspections. This resulted in a drop in the BTC hashrate of the network by 21%. China contributes a total of 60% of the overall BTC hashrate of which Xinjiang accounts for at least 21%.

According to Chinese miner Jiang Zhuoer, the Xinjiang coal mine accident caused power outages in all mines for safety inspections, resulting in a decrease in the hashrate of the entire network by about 21.56% and 36EH. pic.twitter.com/Fc6xJXXlxD

— Wu Blockchain (@WuBlockchain) April 17, 2021

As per the recent BTC hashrate chart from Blockchain.com, there’s a drop in the total hash rate from April 12-April 15. However, it seems that the power supply has been resumed back as the hashrate spikes north on Friday, April 16.

- Bhutan Gov. Dumps More Bitcoin Amid $410M Institutional Sell-Off in BTC ETFs

- Crypto Market in Panic Mode Ahead of Bitcoin, ETH, XRP, SOL Options Expiry & US CPI Today

- Digital Assets Are Fixed In The Future Of Traditional Finance

- U.S. CFTC Committee Appoint Ripple, Coinbase, Robinhood CEOs to Boost Crypto Regulation

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter