Is 10% Fall in Bitcoin[BTC] Prices Just A Pull Back Or A Signal For Downward Trend?

- Bitcoin dropped by 10% over the past 24 hours of trading as it reaches the $8,800 level.

- Block Halving just a little over a day away.

Bitcoin dropped by a total of 10% over the past 24 hours of trading as the cryptocurrency currently trades at the $8,800 level. The cryptocurrency had actually dropped around 15% to reach as low as $8,100 but it has since recovered to the $8,800 level.

With Block Halving just a little over a day away many are suggesting that this could be whales getting out of the market earlier than expected. Santiment data had actually shown that whales with large stashes above 1000 BTC had actually dropped this week which could suggest that they had already started moving their funds to exchanges.

Furthermore, additional data showed that dormant BTC addresses that had not been touched for long periods of time also started to shift coins around.

Many believe that the BTC halving is already priced in as investors have been buying the asset trying to front-run the event. Nevertheless, today’s price drop has still not stalled the bull run as it remains intact.

Bitcoin Price Analysis

BTC/USD – Daily CHART – SHORT TERM

Market Overview

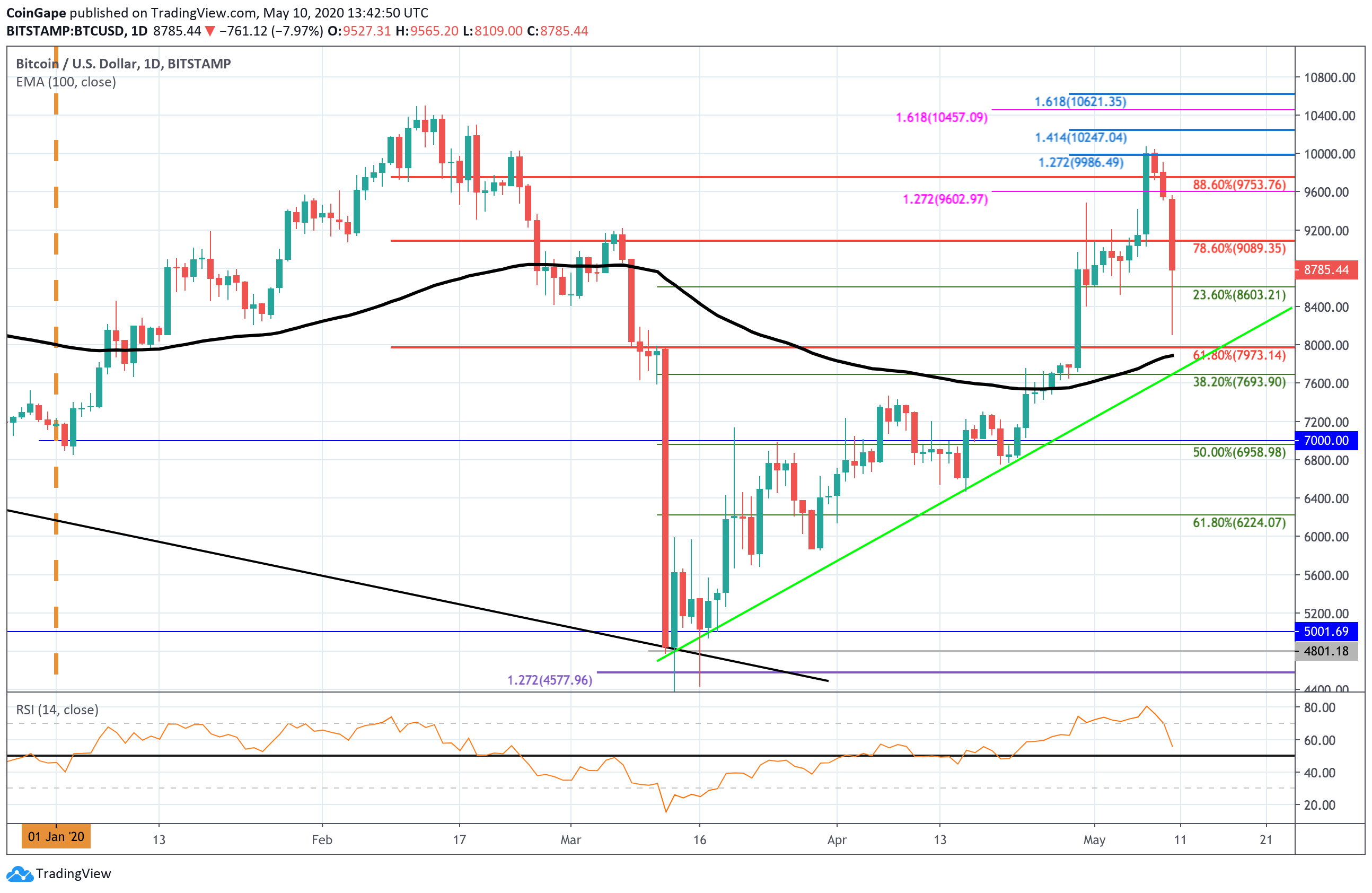

Taking a look at the daily chart above we can see that BTC rolled over from the $9,600 level as it tanked lower to reach a low price of $8,100. IT has since recovered to trade at around $8,800, at the time of writing.

If we were to drill down into the 5-minute chart, you would see that BTC actually found very strong support at the $8,600 support, provided by the .236 Fib Retracement level. During the epic sell-off, the market managed to recover quickly as it closed at this level.

Short term prediction: BULLISH

BTC would still need to close beneath $8,600 to turn neutral and would have to drop below $7,700 to turn bearish.

If the sellers push lower, the first level of support lies at $8,600 (.236 Fib Retracement). Beneath this, support lies at $8,400, $8,000, and $7,900 (100-days EMA). This is followed by support at $7,693 (.382 Fib Retracement), $7,500, and $7,000.

On the other side, the first level of resistance lies at $9,000. Above this, resistance lies at $9,200, $9,600, and $10,000.

Key Levels

Support: $8,600, $8,500, $8,200, $8,000, $7,690, $7,500.

Resistance: $9,000, $9,200, $9,600, $9,800, $10,000.

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Bitget Targets 40% of Tokenized Stock Trading by 2030, Boosts TradFi with One-Click Access

- Trump-Linked World Liberty Targets $9T Forex Market With “World Swap” Launch

- Analysts Warn BTC Price Crash to $10K as Glassnode Flags Structural Weakness

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown