Bitcoin (BTC) Ends Its Pandemic-Era Correlation With Nasdaq, Here Is What It Means

The world’s largest cryptocurrency Bitcoin (BTC) has moved so far moved in a greater correlation with the U.S stock markets. Besides, several institutional players have also been gaining exposure to BTC over the last few months.

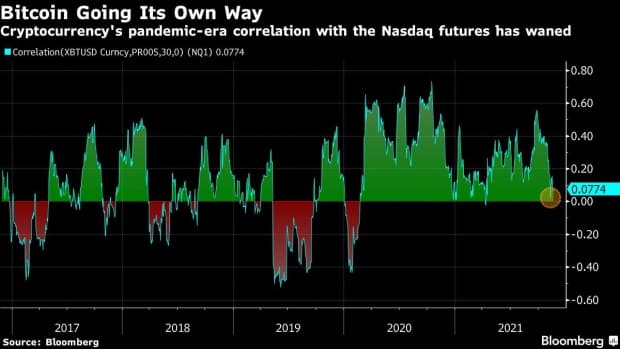

As per the recent report from Bloomberg, Bitcoin’s pandemic-era correlation with Nasdaq 100 has dropped to near zero in recent days. The correlation was at a peak ack in September 2021 which suggested that Bitcoin and tech stocks were moving parallel. The correlation between the two always remained positive since February 2020.

Since the end of September 2021, Nasdaq is up 11%. On the other hand, Bitcoin is up by 40%. This happens as the world’s largest cryptocurrency claims the role of an inflation hedge. Bitcoin’s recent price rally moving closer to $70,000 has been attributed to the rising price pressure in the global economy.

Bitcoin Volatility Raises Doubts Once Again

While many players claim Bitcoin to be a hedge asset, its recent volatility has raised doubts once again. The BTC price has corrected more than 10% from its all-time high and is currently trading under $60,000.

Speaking to Bloomberg, Carsten Menke, head of next-generation research with Bank Julius Baer in Zurich, said: “The lack of a consistent and negative correlation between Bitcoin and equities clearly suggests that Bitcoin is not yet a safe haven”. He further added that stressing in times of financial market stress, Bitcoin tends to suffer like other riskier assets.

Esme Pau, an analyst with China Tonghai Securities in Hong Kong, has a contrary view. Pau calls Bitcoin (BTC) a “sensible” way of buffering against inflation.

“I would urge investors to focus on the longer-term trend, and do not think short-term changes in correlation should be considered representative,” she said.

- XRP Community Day: Ripple CEO on XRP as the ‘North Star,’ CLARITY Act and Trillion-Dollar Crypto Company

- Denmark’s Danske Bank Reverses 8-Year Crypto Ban, Opens Doors to Bitcoin and Ethereum ETPs

- Breaking: $14T BlackRock To Venture Into DeFi On Uniswap, UNI Token Surges 28%

- U.S. Jobs Report: January Nonfarm Payrolls Rise To 130k, Bitcoin Falls

- Arkham Exchange Shut Down Rumors Denied as Bear Market Jitters Deepen

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates