Bitcoin (BTC) Gains for the Ninth Successive Day, Is $20,000 Coming?

The world’s largest cryptocurrency Bitcoin (BTC) made a strong move on Wednesday amid the broader market rally. At press time, BTC is trading 4.55% up at a price of $18,224 and a market cap of $350 billion.

This is the ninth-successive day of gains for Bitcoin registering its largest winning streak since 2020. It’s been a great start to the year 2023 with the BTC price up by more than 10$ in the first 12 days.

The recent momentum in the crypto space has been supported by optimism on Wall Street. Analysts are betting that the inflation will cool down and the Fed will slow down the rate of interest-rate hikes has built positive investor sentiment for risk-ON assets.

This is certainly a fresh start for Bitcoin and the rest of crypto after undergoing brutal corrections in 2022. Speaking to Bloomberg, Michael Purves, founder of Tallbacken Capital Advisors said:

“Risk assets have been rallying, I think, for the reason that the terminal rate is coming slowly but surely into the foreground and positioning has been bearish and transitioning, which means bullish near-term price action”.

The regulatory issues surrounding the crypto market still continue to be an overhang and institutions are likely to wait further until the market clears up. Noelle Acheson, author of the “Crypto Is Macro Now” newsletter said: “There is little doubt that large players will come back into the market when the outlook is less murky, pushing up transactions and also price”.

Will Bitcoin Climb to $20,000?

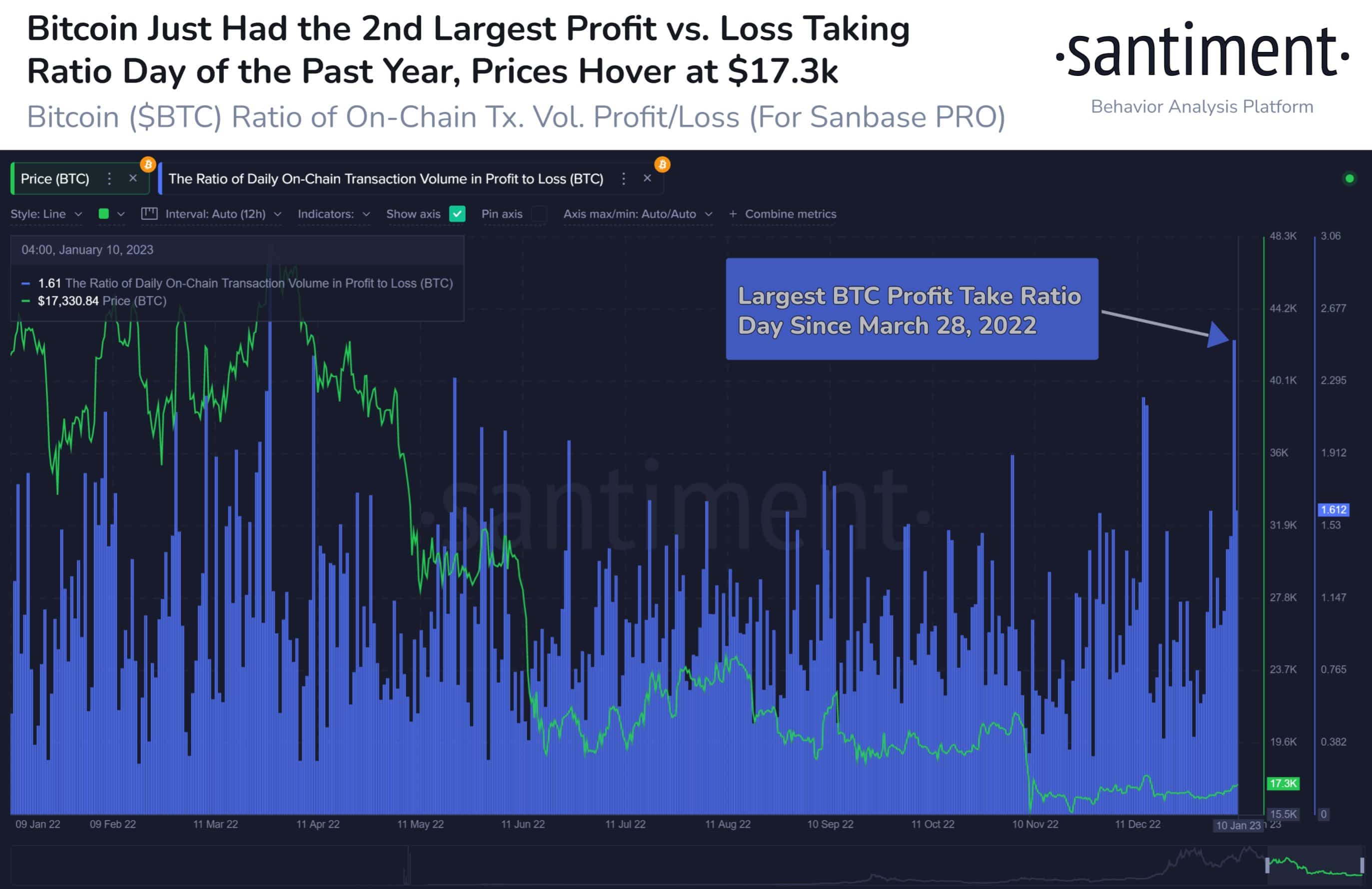

Amid the recent rally in the BTC price, market optimists believe that it will go to touch the $20,000 level once. However, on-chain data suggests that traders are seizing the profit opportunities here. Thus, it could be followed by a correction in the future. On-chain data provider Santiment reported:

The small profit opportunities for $BTC have been seized by traders, & yesterday was the 2nd largest profit vs. loss ratio of the past year. The top profit take spike resulted in a -18% the following month.

- $3.5T Banking Giant Goldman Sachs Discloses $2.3B Bitcoin, Ethereum, XRP, and Solana Exposure

- Why is XRP Price Dropping Today?

- Breaking: FTX’s Sam Bankman-Fried (SBF) Seeks New Trial Amid Push For Trump’s Pardon

- Fed’s Hammack Says Rate Cuts May Stay on Hold Ahead of Jobs, CPI Data Release

- $800B Interactive Brokers Launches Bitcoin, Ethereum Futures via Coinbase Derivatives

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?