Bitcoin Miner Capitulation of the New Gen. Will Begin at This Price: Analyst

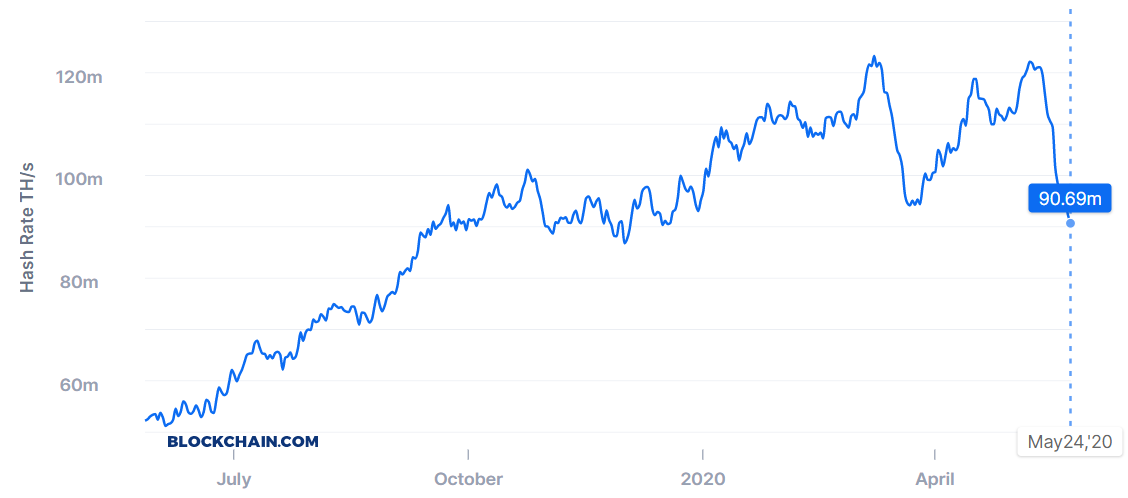

The total Bitcoin [BTC] hash-rate has fallen below COVID-19 crash levels, and this time around exit seems to be permanent for the older generation of miners. Nevertheless, there is a silver lining with the rainy season arriving in China.

The levels around 85-90 million TH/s marked the bottom in hash-rates during the bear market of 2019 when the prices fell to around $7,000. The miners continue to exit even after the recent difficulty adjustment of 6% on 19th May, pointing out the unprofitable price levels.

“The first drop of hashrate comes after 3/12 black Thursday, tho temporarily as price bounces back quickly in a month. Most miners can shut down for a month, but it’s like holding their breath.” she added, “the second drop comes after halving and this time will continue for a while if the price keeps ranging (last for a few more difficulty adjustments cycles)”

Electricity Cost and Revenue Ratio

According to previous estimates, the marginal break-even cost for the new gen. of miners was around $10,000. However, Wan points that it is a gross over-estimation. Assuming the cost of electricity to be around $0.04 per kWh, the marginal cost of “WhatsMiner M20s 65T is around $5,000, with its flagship M20S+ will be ~$4000 per BTC.” The cost of S17 and S17+ should be comparable as well.

Nevertheless, as stated before, the S9 systems are effectively being driven out. She introduced the cost to revenue ratio, an important metric which varies with price. For new gen, the ratio is still below 1, making them profitable. While in the future old generations find relevance during extreme bull markets, but at present capitulation is more likely. She said,

Before the halving S9’s E/R is <1, now, assuming $0.04/kwh is 1.19, so all S9 need to shut down after halving at current price

While the markets expects the exit of S9 and possibly S15 miners, a further drop in price could accelerate the selling pressures among newer models as well. The rainy season stands to improve the ratio by about 25% as the cost of electricity is decreased due to the availability of abundant hydro-power, which is bullish for the hash-rates in the short term. It could take around 6-8 weeks of times to find an equilibrium in the supply schedule of Bitcoin [BTC].

Do you think that the price can drop below the marginal break-even levels? Please share your views with us.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple’s Valuation Tops $50B As Firm Begins $750M Share Buyback

- FDIC Proposes No Insurance for Stablecoins Under GENIUS Act Amid Banks’ ‘Deposit Flight’ Fears

- Ripple Joins Mastercard Crypto Partner Program to Advance On-Chain Payments

- Breaking: Crypto Prices Jump As IEA Members Agree To Release Record 400M Barrels Of Oil

- Breaking: U.S. CPI Holds Steady at 2.4% as Iran War Raises Inflation Concerns

- Bitcoin Price At Risk of Losing $65k as Iran Warns of “Continuous Strikes” That May Push Oil to $200

- XRP Price Prediction as Goldman Sachs Becomes Biggest Holder of Ripple ETFs

- Circle (CRCL) Stock Price Prediction Ahead of CPI Data Release-Is 120 Next?

- Bitcoin Price Today: President Trump Signals Iran Conflict May End Soon As BTC Eyes $72k

- Top Analyst Explains Why Pi Network Price May Soar to $0.50 This Week

- Is MSTR Stock Going to Rally $150?