New High in Bitcoin [BTC] Options Demand Raises Bullish Exceptions

The trend in the price of Bitcoin lately can be described as a ‘chopping action’ at best. Since halving on 11th May, the price has fluctuated between $10,200 and $8,600 with a lot of uncertainty. In the last 30 days, over $900 million in liquidations (<60% in longs) have occurred on BitMEX alone.

The volatility in the price has been considerably high. Moreover, the implied volatility index of Bitcoin is suggesting that traders expect more volatility in the prices.

Crypto options analytics website, GenesisVolatilty tweeted,

Last year 30 day BTC IV was ~71% and VIX was ~15%, today BTC IV is about ~62% and VIX is ~36%… Interesting

Since last year and particularly post COVID-19 crisis, the irrationality in the price of the stock market has come as a surprise to many. Despite the global slowdown, stock markets led by technology companies is making new highs with a lot of uncertainty in general. This adds expectation of high volatility in the market.

Bitcoin Options Market

Moreover, the rising demand for the options market and the implied volatility likely has a direct correlation here. Su Zhu, partner at Three Arrows Capital tweeted,

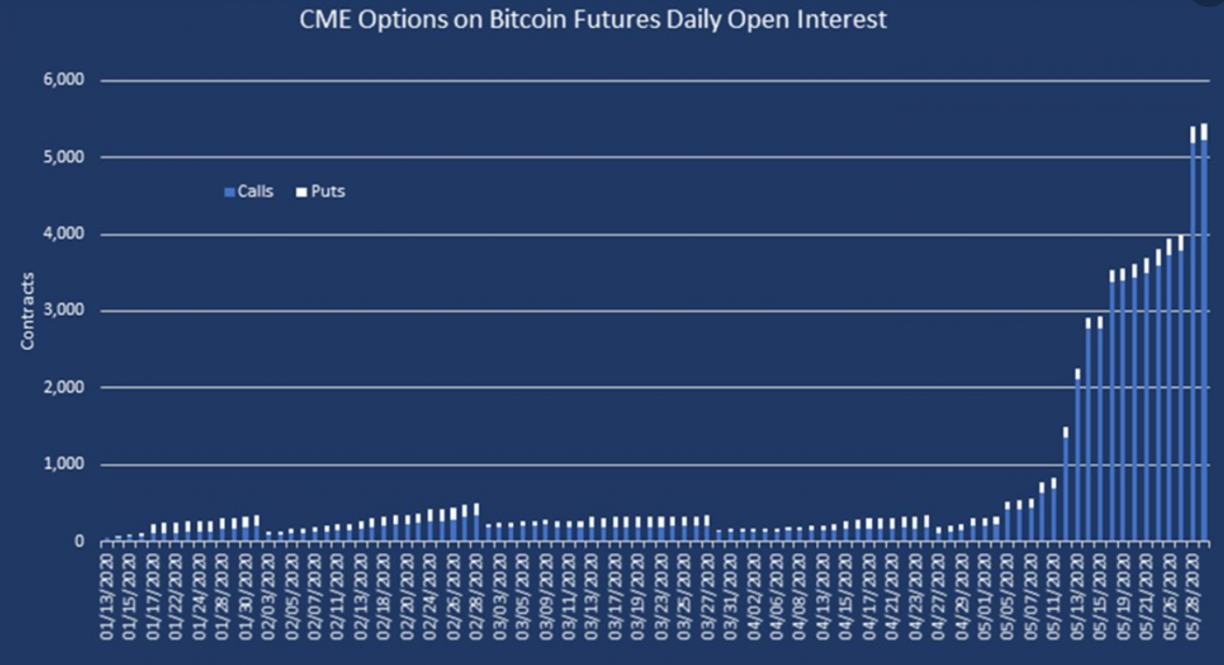

CME $BTC options open interest is nearly entirely in calls (upside moves)

On CME, the rise in the Open Interest can be particularly witnessed in the week following Bitcoin halving in May signalling institutional interest with halving.

The volume on Deribit is nearly 4 times that of CME. The Open Interest (OI) of Bitcoin options on Deribit surpassed $1 billion for the first time last month.

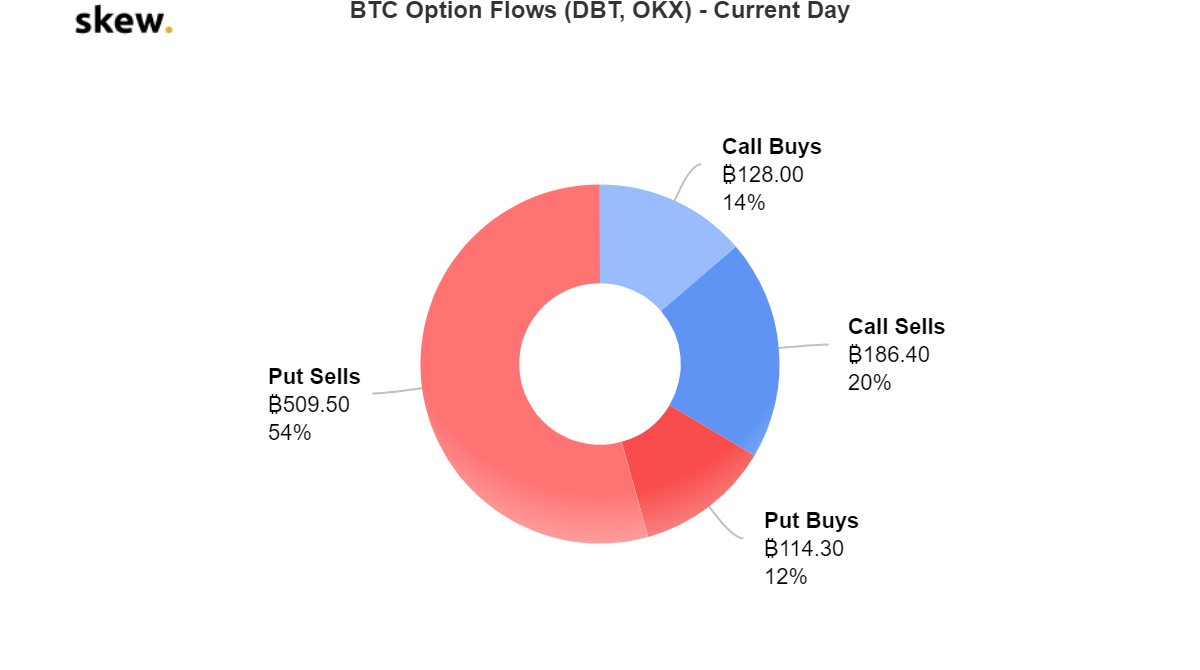

Due to the high implied volatility and volume, the options might seem overpriced to some traders. While CME is seeing a rise in call options, traders on Deribit are taking a different approach by selling put options to capture the premium on contracts.

Overall, the options traders are long on the price at the moment. Including the call buys and put sells, about 68% of the market is positioned long on Deribit and Okex.

How do you think the traders are covering/hedging these trades? Please share your views with us.

- New $2M Funding Reveals Ethereum Foundation’s New Threat

- U.S. Shutdown Odds Hit 78% as CLARITY Act Faces Fresh Uncertainty

- Bitcoin Sentiment Weakens BTC ETFs Lose $103M- Is A Crash Imminent?

- Trump Backed Rick Rieder Now Leads the Odds for New Fed Chair

- Trump Threatens 100% Canada Tariffs as Bitcoin Holds $89K

- Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73%

- PEPE vs PENGUIN: Can Pengu Price Outperform Pepe Coin in 2026?

- Binance Coin Price Outlook As Grayscale Files S-1 for BNB

- Solana Price Prediction as SOL ETF Inflows Outpace BTC and ETH Together

- Bitcoin and Gold Outlook 2026: Warsh, Rieder Gain Traction in Trump’s Fed Pick

- PEPE Coin Price Eyes 45% Rebound as Buyers Regain Control on Spot Markets