Bitcoin [BTC] Miner Capitulation is Over, Buy Signal Awaits This Confirmation

Bitcoin [BTC] hashrate post halving has returned to its highs again, with positive reports on increasing additions. According to two popular indicators based on the mining statistic, the buy signal is almost here.

When miners capitulate, it signals one of the scariest trends in price. In the past, these have signalled bottoms in Bitcoin prices as with the exit of weak miners, selling pressure in the market also reduces considerably.

Hash Ribbons

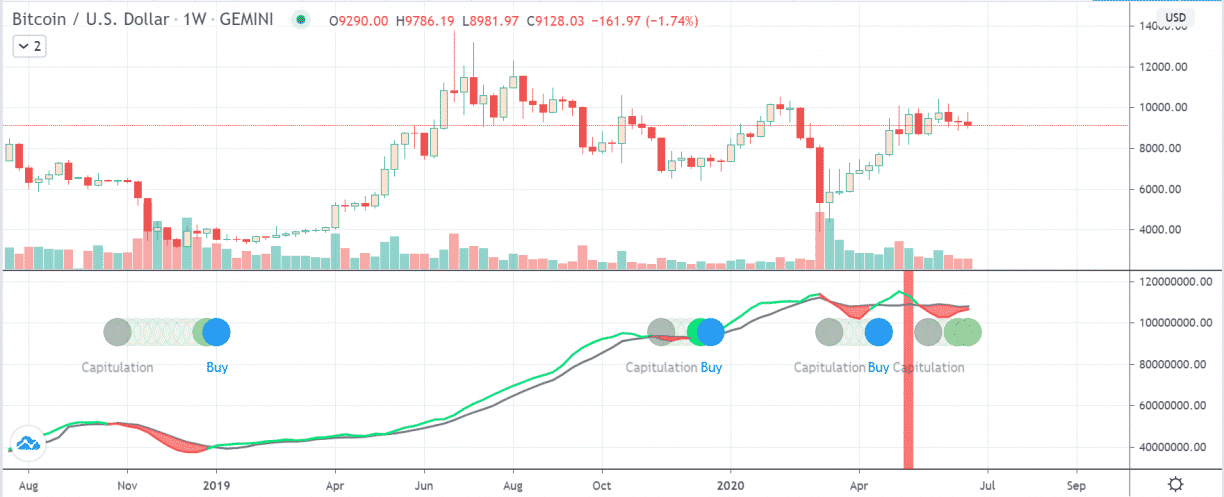

Charles Edwards, founder of Capriole Investments designed an indicator using the 30 and 60-day moving average of hash-rates. The cross over of these moving averages signal beginning and end of the miner capitulations.

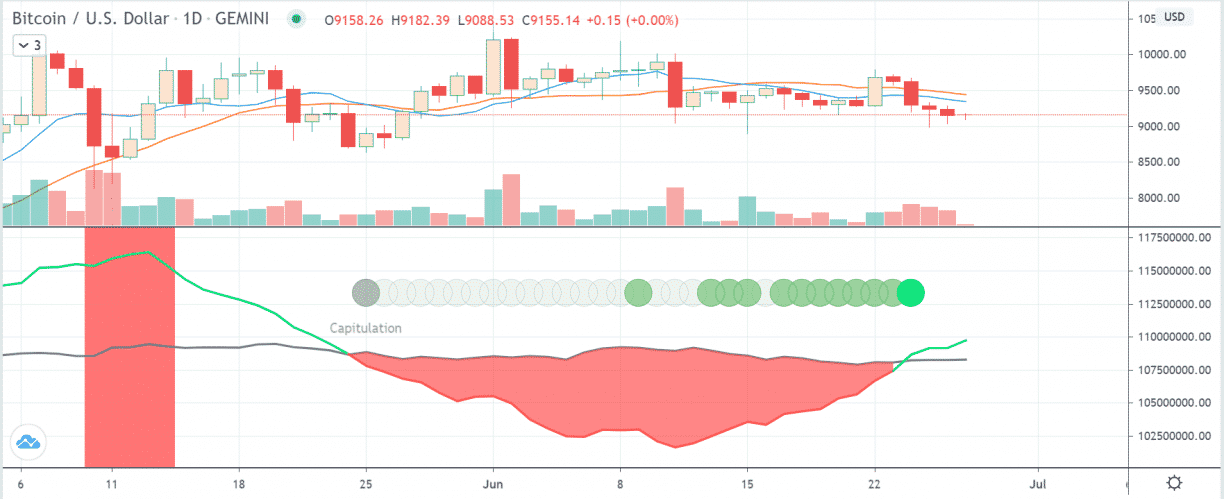

The Hash Ribbons, presently, signals a complete recovery of the hashrates which dropped 23.3% from highs post Bitcoin halving in May. With the correction in difficulty in the following weeks, the total hashrate swept the highs and is currently at 112 EH/s.

However, the buy signal hasn’t yet gone ‘blue.’ Apart from the recovery in hash-rate, Edwards has also factored momentum in the equation. This momentum factor is represented by a positive cross between the 10 and 20 Day SMA (Simple Moving Average). The chart below shows the close vicinity of the two lines (orange and blue). However, they are in a slight downtrend. Hence, traders following this signal might have to wait for a couple of weeks.

The drawdown of this indicator on an average is -11%, which is meagre compared to the growth percentage which is above 5000%.

Difficulties Ahead

Another popular indicator, Bitcoin Difficulty Band, only measures the moving averages of Bitcoin network difficulty. According to Willy Woo (the designer of the Difficulty Band Indicator) who often has a long-term stance, buying should begin with the capitulation itself. He tweeted in the past,

When the ribbon compresses, or flips negative, these are the best time to buy in and get exposure to Bitcoin.

However, with time the percentage of sell pressure from miners is not the only factor driving bears. The increasing volume of the derivatives market (futures and options), sell-off from exchanges, and other start-ups also contribute to the selling pressure.

Moreover, the frequency of ‘capitulations’ has increased in the last two years with three capitulations. The last time Bitcoin miners had such frequent declines and recoveries in hash rate was in 2015-2016. While the price was effectively in a bull market during that time, the duration period of consolidation was long as well.

Do you think that Bitcoin is primed for a bull run now or expect lows? Please share your views with us.

- Polymarket Sues Massachusetts Amid Prediction Market Crackdown

- CLARITY Act: Bessent Slams Coinbase CEO, Calls for Compromise in White House Meeting Today

- Crypto Traders Reduce Fed Rate Cut Expectations Even as Expert Calls Fed Chair Nominee Kevin Warsh ‘Dovish’

- Crypto, Banks Clash Over Fed’s Proposed ‘Skinny’ Accounts Ahead of White House Crypto Meeting

- XRP News: Ripple Expands Custody Services to Ethereum and Solana Staking

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?

- Bitcoin and XRP Price Prediction as China Calls on Banks to Sell US Treasuries

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting

- Cardano Price Prediction as Midnight Token Soars 15%