Bitcoin (BTC) Realized Cap Hits New All-Time High, Miner Revenue On the Rise

Over the last week, Bitcoin (BTC) made a solid move surging past all the way to $47,000. Even now BTC is holding above its crucial support levels of $45,000. At press time, Bitcoin is trading at $46,392 and has a market cap of $370 billion.

This comes amid major improvements in Bitcoin’s on-chain metrics. The Bitcoin network continues to absorb new capital inflows. Bitcoin’s on-chain equivalent of market cap aka its realized cap has touched an all-time high.

As Glassnode reports: “It is calculated by valuing each coin at the price when it was last spent, representing an aggregate cost basis for the market”.

The uptrend in realized cap explains that the coins accumulated at cheaper prices have been spent and sold, and the market must absorb the sell-side pressure to trend higher. As Glassnode explains:

The Realised Cap started trending higher in late-July and has just reached a new all-time-high of $379B. Given spot prices have continued to rally, this indicates that new capital is flowing into Bitcoin, and the market is capable of absorbing that sell-side pressure.

Bitcoin Miner Revenu Per Hash On the Rise

The Bitcoin hashrate has resumed its north journey after a 50% collapse in May amid the China crackdown. Over the last two months, the hashrate has surged 25% from the bottom as the Bitcoin network is currently mining at 112 EH/s.

Over the last year since the Bitcoin halving of May 2020, the miner revenue was on a decline dropping from 9.5 BTC/EH to a low of 5.6 BTC/EH in May 2021. However, with the recent great miner migration, there’s also been a good adjustment with protocol difficulty.

All the miners who continued to remain online during the recent migration period have seen their Bitcoin miner revenue growing 57% by hash to around 8.8 BTC/EH.

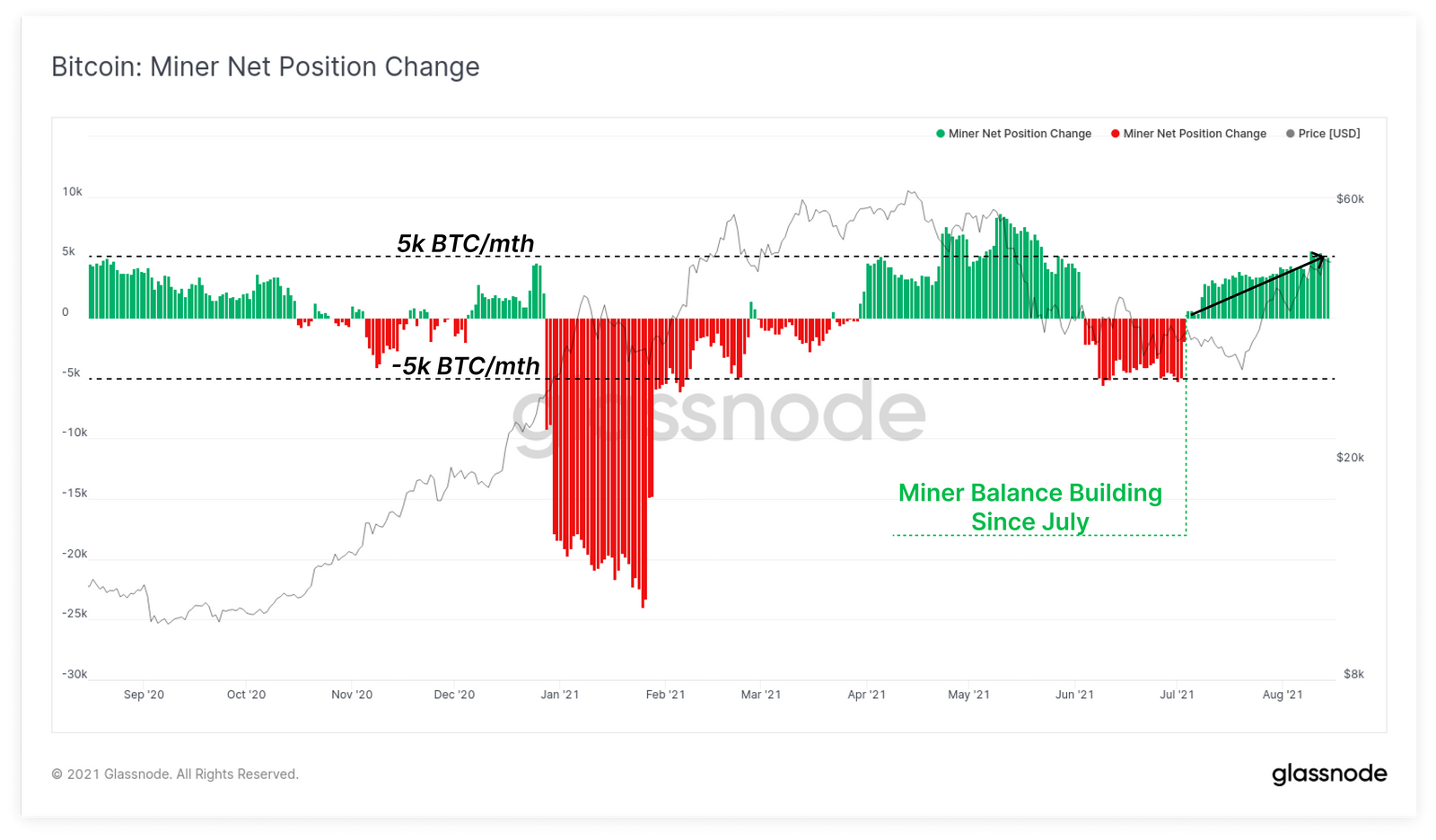

Thus, the net balance of Bitcoin miners has also surged over the last two months. The net growth of miner balances has crossed +5K/month thereby indicating a decreased selling pressure. Over the last month, the net position change for Bitcoin miners has turned positive.

- Cathie Wood’s Ark Invest Files for BTC, ETH, SOL, XRP, ADA Crypto Index ETF

- Crypto ETF Issuer Grayscale Files S-1 for Binance Coin (BNB) ETF With SEC

- Did GameStop (GME) Capitulate? Retailer Moves All Bitcoin Holdings to Coinbase in Potential Sell-Off

- Binance Applies For EU MiCA License In Greece

- Kansas Advances Bitcoin Reserve Proposal as States Explore Digital Asset Funds

- Bitcoin and Gold Outlook 2026: Warsh, Rieder Gain Traction in Trump’s Fed Pick

- PEPE Coin Price Eyes 45% Rebound as Buyers Regain Control on Spot Markets

- Pi Network Price Prediction: Will PI Coin Hold Steady at $0.18 Retrace Lower?

- Dogecoin Price Prediction as 21Shares Announces DOGE ETF

- GME Stock Price Outlook as CEO Ryan Cohen Buys Shares Amid Store Closures

- Bitcoin Price Outlook as US Senate Delays CLARITY Act Again