Bitcoin (BTC) Rises Above $15,000 With Massive $300 Million Short Liquidations on BitMEX

Bitcoin has been on a wild rally today surging nearly 10% in the last 24 hours. Just hours after crossing the $14,500 levels, BTC price has moved past $15,000 to hits it news 2020-high of $15,250. At press time, Bitcoin (BTC) is trading at a high of $15,074 with a market cap of $279 billion.

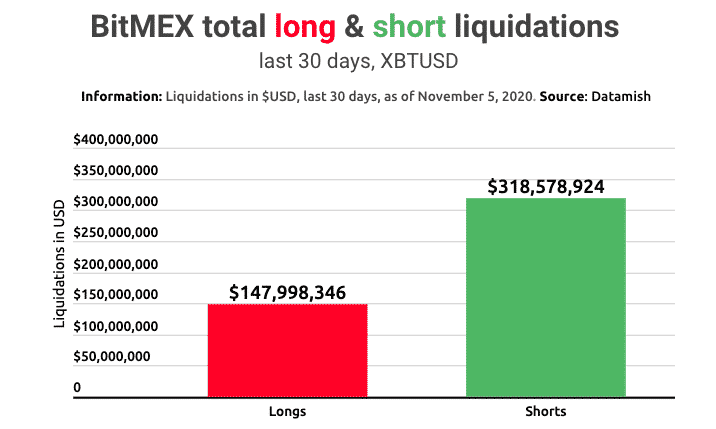

The recent price rally comes as over $318 million worth of BTC shorts has been liquidated on the BitMEX exchange alone over the last 30 days. It has been a tough time for shorter as Bitcoin has been on a constant and sustained surge over the last month. The BTC price has surged nearly 40 in the last 30 days as of November 5th, 2020.

The massive liquidation in the BTC short positions happened as the bulls raged in pushing BTC price higher consistently. However, during the same period, BitMEX has also liquidated $147 million worth of long positions.

Courtesy: FinBold

Bitcoin (BTC) Long and Short Positions

Bitcoin shorting involves the process of betting against Bitcoin price rise. Thus, if the BTC price falls as per predictions, traders usually make a profit for making the right predictions. However, the massive surge in Bitcoin throughout October has forced many traders to liquidate their short positions and take an exit.

But it seems that the BTC price volatility has also caused liquidations in the long positions as well! The sell-off triggered by Bitcoin miners earlier this week might have forced traders to liquidate their long positions.

Liquidations of short and longs is a very common scenario in the crypto trading space as traders usually have overleveraged positions. Also, with the kind of volatility that Bitcoin is known for, traders have to hedge/liquidate their positions on many occasions.

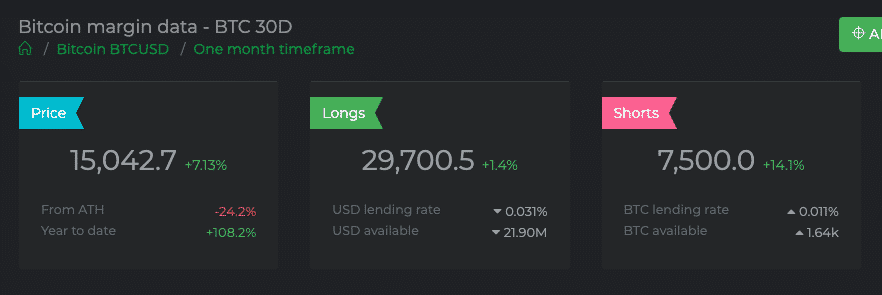

On a 30-day timeframe, another data from Datamish shows that the long positions have outgrown the short positions by a huge margin. However, with the recent surge in the BTC price, the percentage surge in short positions is 10 times that of the long positions.

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Bitget Targets 40% of Tokenized Stock Trading by 2030, Boosts TradFi with One-Click Access

- Trump-Linked World Liberty Targets $9T Forex Market With “World Swap” Launch

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown